Answered step by step

Verified Expert Solution

Question

1 Approved Answer

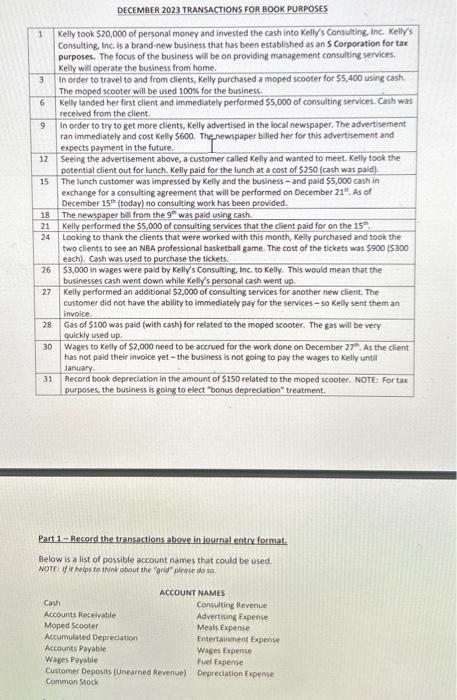

1 3 6 9 12 15 18 21 24 26 27 28 30 31 DECEMBER 2023 TRANSACTIONS FOR BOOK PURPOSES Kelly took $20,000 of personal

1 3 6 9 12 15 18 21 24 26 27 28 30 31 DECEMBER 2023 TRANSACTIONS FOR BOOK PURPOSES Kelly took $20,000 of personal money and invested the cash into Kelly's Consulting, Inc. Kelly's Consulting, Inc. is a brand-new business that has been established as an S Corporation for tax purposes. The focus of the business will be on providing management consulting services. Kelly will operate the business from home. In order to travel to and from clients, Kelly purchased a moped scooter for $5,400 using cash. The moped scooter will be used 100% for the business. Kelly landed her first client and immediately performed $5,000 of consulting services. Cash was received from the client. In order to try to get more clients, Kelly advertised in the local newspaper. The advertisement ran immediately and cost Kelly $600. The newspaper billed her for this advertisement and expects payment in the future. Seeing the advertisement above, a customer called Kelly and wanted to meet. Kelly took the potential client out for lunch. Kelly paid for the lunch at a cost of $250 (cash was paid). The lunch customer was impressed by Kelly and the business - and paid $5,000 cash in exchange for a consulting agreement that will be performed on December 21st. As of December 15th (today) no consulting work has been provided. The newspaper bill from the 9th was paid using cash. Kelly performed the $5,000 of consulting services that the client paid for on the 15th. Looking to thank the clients that were worked with this month, Kelly purchased and took the two clients to see an NBA professional basketball game. The cost of the tickets was $900 ($300 each). Cash was used to purchase the tickets. $3,000 in wages were paid by Kelly's Consulting, Inc. to Kelly. This would mean that the businesses cash went down while Kelly's personal cash went up. Kelly performed an additional $2,000 of consulting services for another new client. The customer did not have the ability to immediately pay for the services - so Kelly sent them an invoice. Gas of $100 was paid (with cash) for related to the moped scooter. The gas will be very quickly used up. Wages to Kelly of $2,000 need to be accrued for the work done on December 27th. As the client has not paid their invoice yet - the business is not going to pay the wages to Kelly until January. Record book depreciation in the amount of $150 related to the moped scooter. NOTE: For tax purposes, the business is going to elect "bonus depreciation" treatment. Part 1-Record the transactions above in journal entry format. Below is a list of possible account names that could be used. NOTE: If it helps to think about the "grid" please do so. Cash Accounts Receivable Moped Scooter ACCOUNT NAMES Accumulated Depreciation Accounts Payable Wages Payable Customer Deposits (Unearned Revenue) Common Stock Consulting Revenue Advertising Expense Meals Expense Entertainment Expense Wages Expense Fuel Expense Depreciation Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started