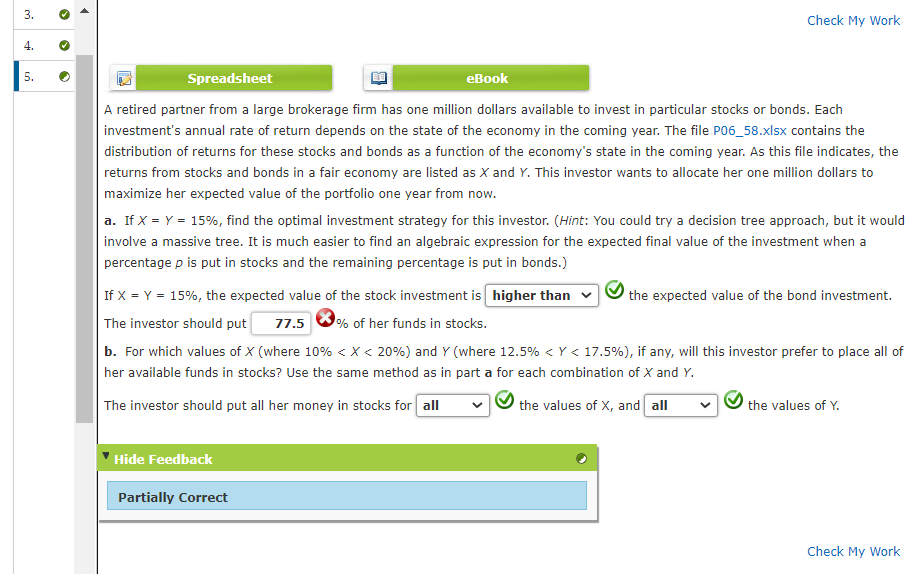

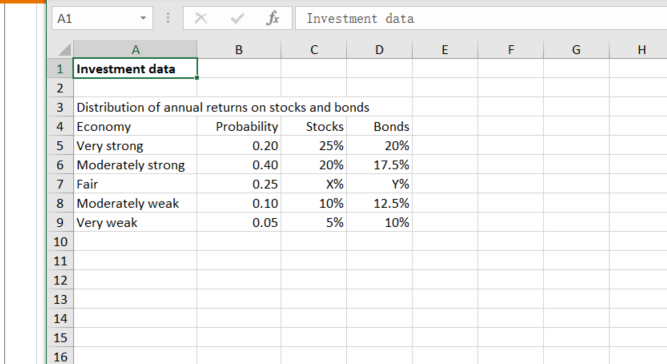

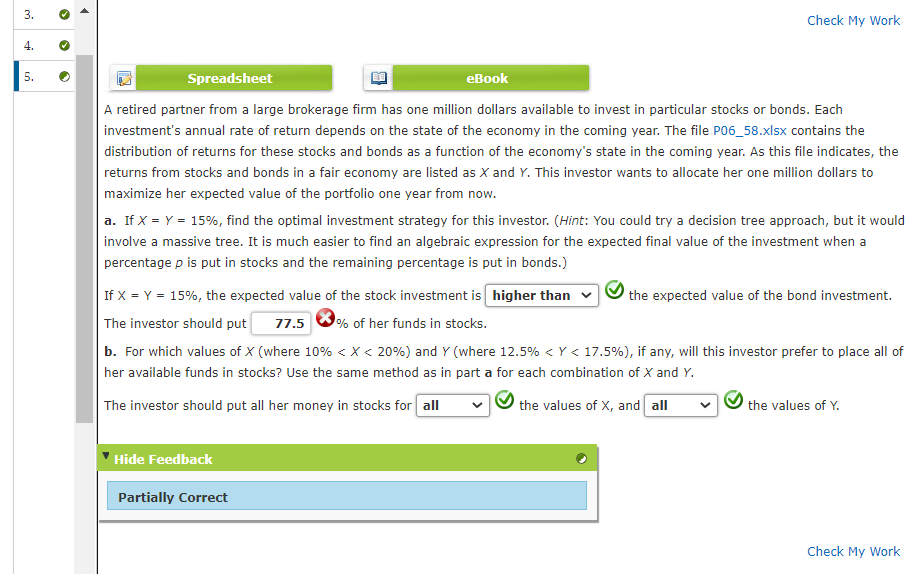

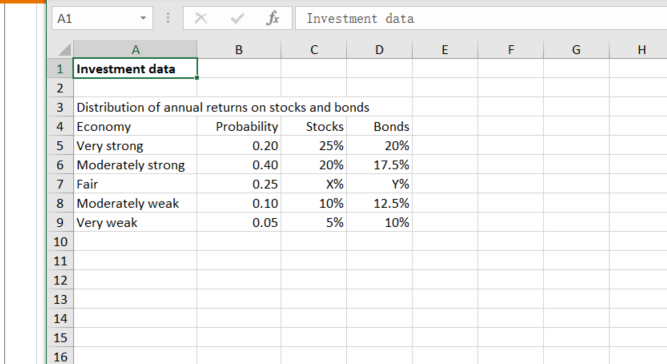

1 3. Check My Work 4. > 5. B Spreadsheet eBook A retired partner from a large brokerage firm has one million dollars available to invest in particular stocks or bonds. Each investment's annual rate of return depends on the state of the economy in the coming year. The file P06_58.xlsx contains the distribution of returns for these stocks and bonds as a function of the economy's state in the coming year. As this file indicates, the returns from stocks and bonds in a fair economy are listed as X and Y. This investor wants to allocate her one million dollars to maximize her expected value of the portfolio one year from now. a. If X = Y = 15%, find the optimal investment strategy for this investor. (Hint: You could try a decision tree approach, but it would involve a massive tree. It is much easier to find an algebraic expression for the expected final value of the investment when a percentage p is put in stocks and the remaining percentage is put in bonds.) If X = Y = 15%, the expected value of the stock investment is higher than the expected value of the bond investment. The investor should put 77.5 % of her funds in stocks. b. For which values of X (where 10%

5. B Spreadsheet eBook A retired partner from a large brokerage firm has one million dollars available to invest in particular stocks or bonds. Each investment's annual rate of return depends on the state of the economy in the coming year. The file P06_58.xlsx contains the distribution of returns for these stocks and bonds as a function of the economy's state in the coming year. As this file indicates, the returns from stocks and bonds in a fair economy are listed as X and Y. This investor wants to allocate her one million dollars to maximize her expected value of the portfolio one year from now. a. If X = Y = 15%, find the optimal investment strategy for this investor. (Hint: You could try a decision tree approach, but it would involve a massive tree. It is much easier to find an algebraic expression for the expected final value of the investment when a percentage p is put in stocks and the remaining percentage is put in bonds.) If X = Y = 15%, the expected value of the stock investment is higher than the expected value of the bond investment. The investor should put 77.5 % of her funds in stocks. b. For which values of X (where 10%