Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 3 Question 4 IBH manufactures personal computer laptops. Its operations are separated into two majors divisions: ProC, which produces processors, and ComP, which manufactures

Question

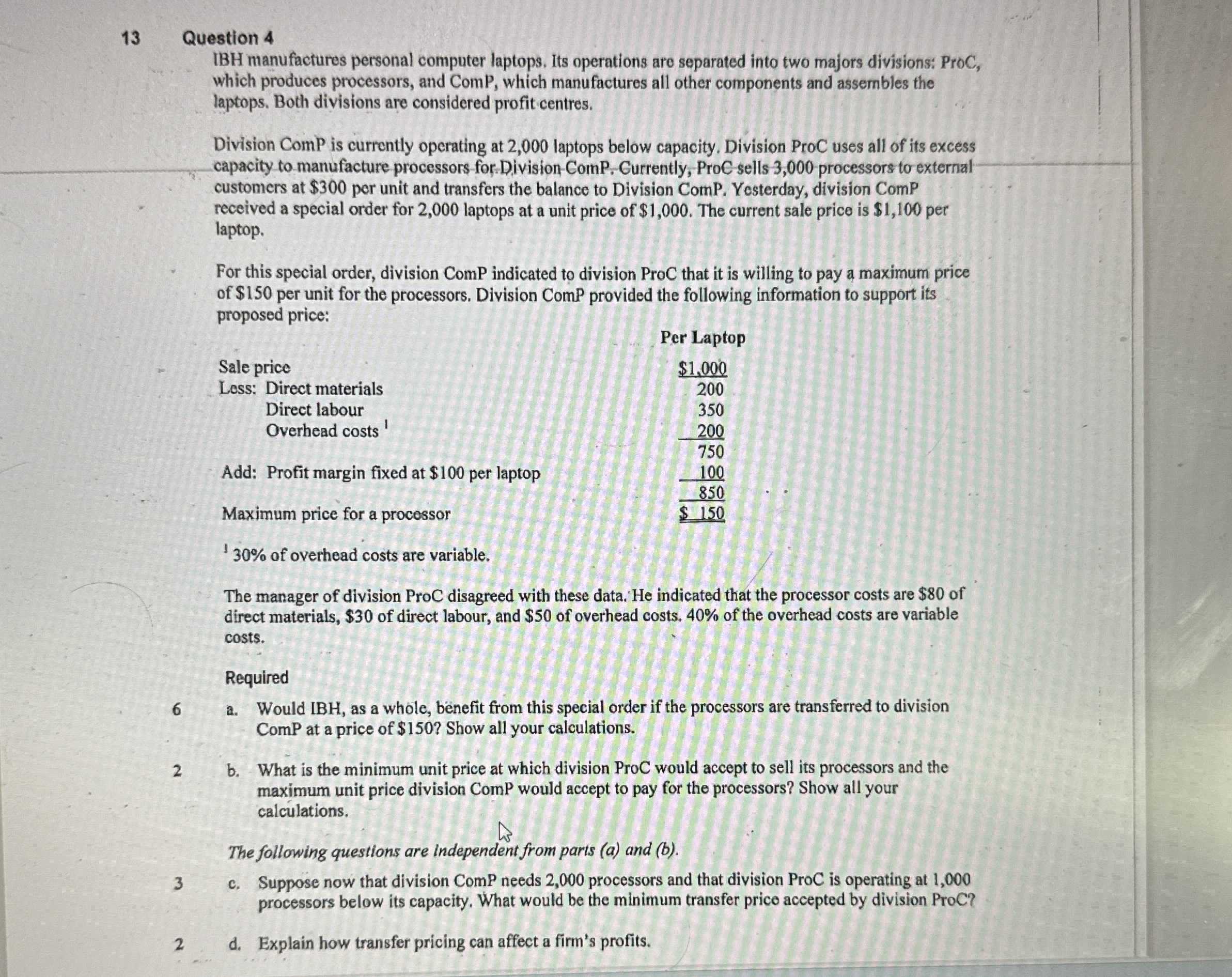

IBH manufactures personal computer laptops. Its operations are separated into two majors divisions: ProC, which produces processors, and ComP, which manufactures all other components and assembles the laptops. Both divisions are considered profit centres.

Division ComP is currently operating at laptops below capacity. Division ProC uses all of its excess capacity to manufacture processors forDivisionComP. Currently, ProC sells processors to external customers at $ per unit and transfers the balance to Division ComP. Yesterday, division ComP received a special order for laptops at a unit price of $ The current sale price is $ per laptop.

For this special order, division ComP indicated to division ProC that it is willing to pay a maximum price of $ per unit for the processors. Division ComP provided the following information to support its proposed price:

Sale price

Loss: Direct materials

Direct labour

Overhead costs

Add: Profit margin fixed at $ per laptop

Maximum price for a processor

Per Laptop

Sale price Less: Direct materials

Direct labour

Overhead costs Add: Profit margin fixed at $ per laptop

$$

of overhead costs are variable.

The manager of division ProC disagreed with these data. He indicated that the processor costs are $ of direct materials, $ of direct labour, and $ of overhead costs. of the overhead costs are variable costs.

Required

a Would IBH, as a whole, benefit from this special order if the processors are transferred to division ComP at a price of $ Show all your calculations.

b What is the minimum unit price at which division ProC would accept to sell its processors and the maximum unit price division ComP would accept to pay for the processors? Show all your calculations.

The following questions are independent from parts a and b

c Suppose now that division ComP needs processors and that division ProC is operating at processors below its capacity. What would be the minimum transfer price accepted by division ProC?

d Explain how transfer pricing can affect a firm's profits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started