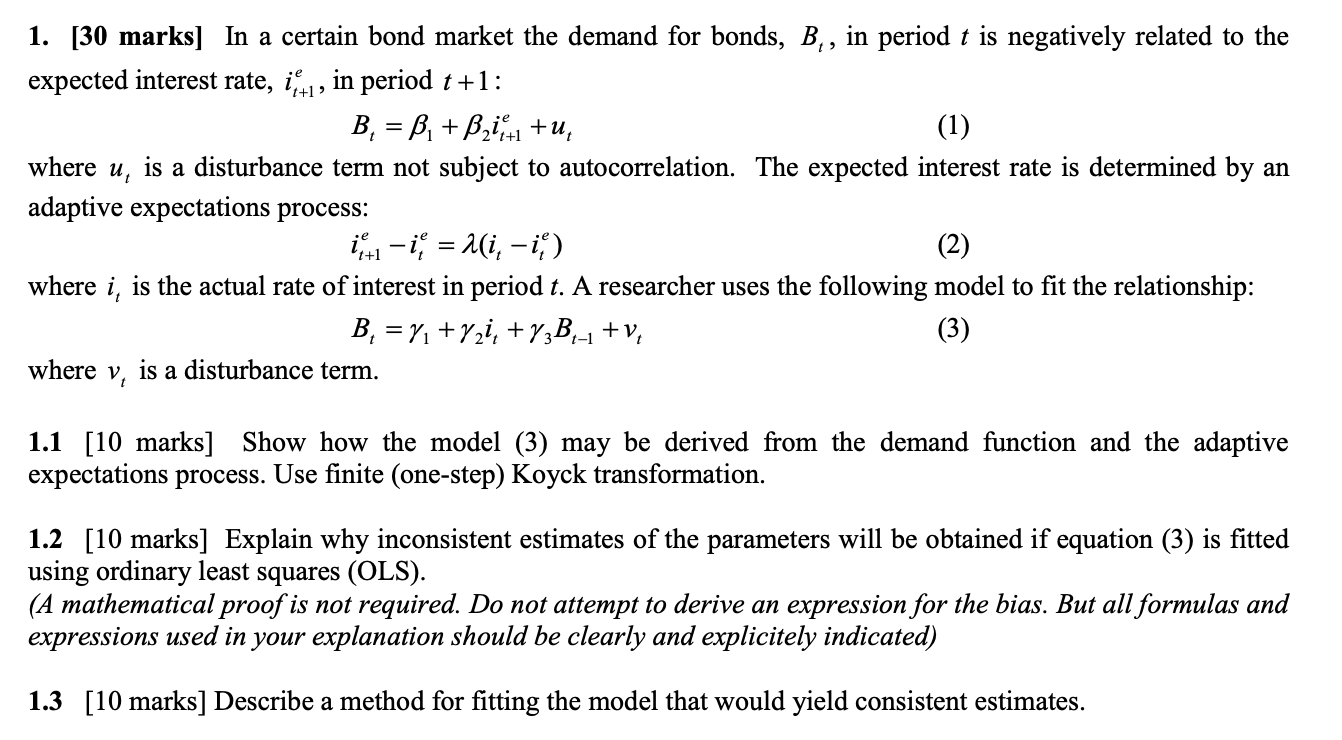

1. [30 marks] In a certain bond market the demand for bonds, B,, in period t is negatively related to the expected interest rate, 1+1, in period t+1: B, = B. + B21+1 +u, (1) where u is a disturbance term not subject to autocorrelation. The expected interest rate is determined by an adaptive expectations process: 1-1-1, = ai, -1) (2) where i, is the actual rate of interest in period t. A researcher uses the following model to fit the relationship: B, = 7 + Yzi, + Y3B,- + v, (3) where v, is a disturbance term. 1.1 [10 marks] Show how the model (3) may be derived from the demand function and the adaptive expectations process. Use finite (one-step) Koyck transformation. 1.2 [10 marks] Explain why inconsistent estimates of the parameters will be obtained if equation (3) is fitted using ordinary least squares (OLS). (A mathematical proof is not required. Do not attempt to derive an expression for the bias. But all formulas and expressions used in your explanation should be clearly and explicitely indicated) 1.3 [10 marks] Describe a method for fitting the model that would yield consistent estimates. 1. [30 marks] In a certain bond market the demand for bonds, B,, in period t is negatively related to the expected interest rate, 1+1, in period t+1: B, = B. + B21+1 +u, (1) where u is a disturbance term not subject to autocorrelation. The expected interest rate is determined by an adaptive expectations process: 1-1-1, = ai, -1) (2) where i, is the actual rate of interest in period t. A researcher uses the following model to fit the relationship: B, = 7 + Yzi, + Y3B,- + v, (3) where v, is a disturbance term. 1.1 [10 marks] Show how the model (3) may be derived from the demand function and the adaptive expectations process. Use finite (one-step) Koyck transformation. 1.2 [10 marks] Explain why inconsistent estimates of the parameters will be obtained if equation (3) is fitted using ordinary least squares (OLS). (A mathematical proof is not required. Do not attempt to derive an expression for the bias. But all formulas and expressions used in your explanation should be clearly and explicitely indicated) 1.3 [10 marks] Describe a method for fitting the model that would yield consistent estimates