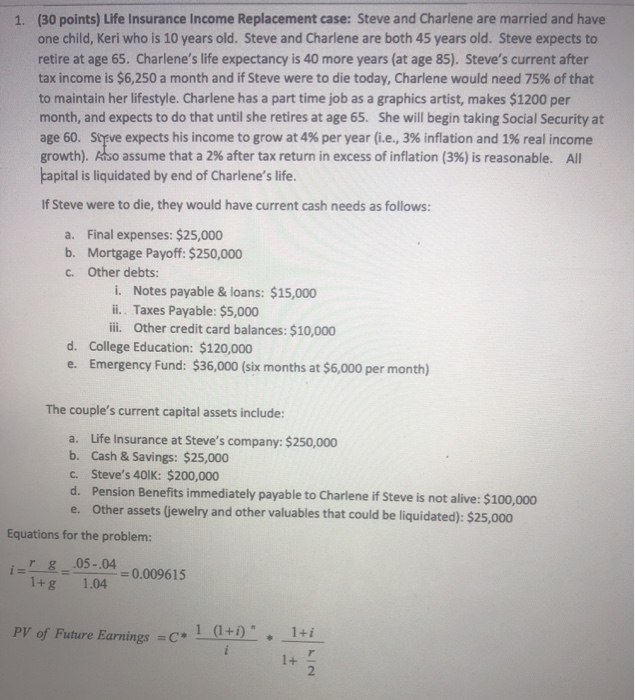

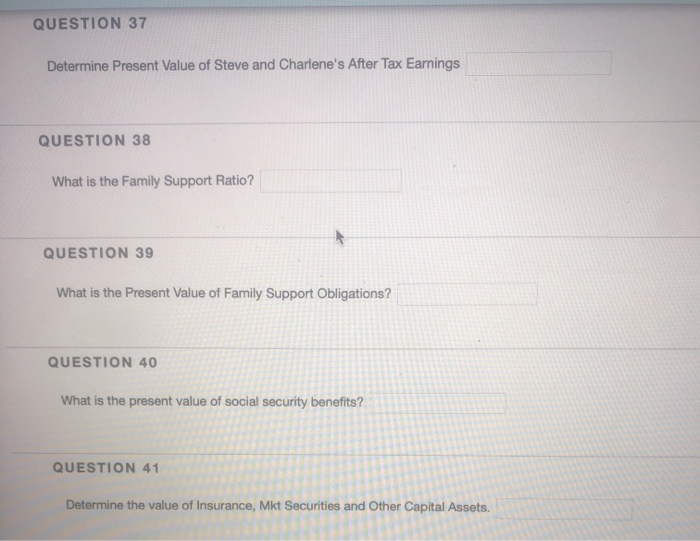

1. (30 points) Life Insurance Income Replacement case: Steve and Charlene are married and have one child, Keri who is 10 years old. Steve and Charlene are both 45 years old. Steve expects to retire at age 65. Charlene's life expectancy is 40 more years (at age 85). Steve's current after tax income is $6,250 a month and if Steve were to die today, Charlene would need 75% of that to maintain her lifestyle. Charlene has a part time job as a graphics artist, makes $1200 per month, and expects to do that until she retires at age 65. She will begin taking Social Security at age 60. Styve expects his income to grow at 4% per year (i.e., 3% inflation and 1% real income growth). Riso assume that a 2% after tax return in excess of inflation (3%) is reasonable. All capital is liquidated by end of Charlene's life. If Steve were to die, they would have current cash needs as follows: a. Final expenses: $25,000 b. Mortgage Payoff: $250,000 C. Other debts: i. Notes payable & loans: $15,000 ii. Taxes Payable: $5,000 iii. Other credit card balances: $10,000 d. College Education: $120,000 e. Emergency Fund: $36,000 (six months at $6,000 per month) The couple's current capital assets include: a. Life Insurance at Steve's company: $250,000 b. Cash & Savings: $25,000 C. Steve's 401K: $200,000 d. Pension Benefits immediately payable to Charlene if Steve is not alive: $100,000 e. Other assets (jewelry and other valuables that could be liquidated): $25,000 Equations for the problem: iz' g .05-.04 1+ g 1.04 -= 0.009615 PV of Future Earnings =C# 1 (1+i)". 1+i QUESTION 37 Determine Present Value of Steve and Charlene's After Tax Earnings QUESTION 38 What is the Family Support Ratio? QUESTION 39 What is the Present Value of Family Support Obligations? QUESTION 40 What is the present value of social security benefits QUESTION 41 Determine the value of Insurance, Mkt Securities and Other Capital Assets. 1. (30 points) Life Insurance Income Replacement case: Steve and Charlene are married and have one child, Keri who is 10 years old. Steve and Charlene are both 45 years old. Steve expects to retire at age 65. Charlene's life expectancy is 40 more years (at age 85). Steve's current after tax income is $6,250 a month and if Steve were to die today, Charlene would need 75% of that to maintain her lifestyle. Charlene has a part time job as a graphics artist, makes $1200 per month, and expects to do that until she retires at age 65. She will begin taking Social Security at age 60. Styve expects his income to grow at 4% per year (i.e., 3% inflation and 1% real income growth). Riso assume that a 2% after tax return in excess of inflation (3%) is reasonable. All capital is liquidated by end of Charlene's life. If Steve were to die, they would have current cash needs as follows: a. Final expenses: $25,000 b. Mortgage Payoff: $250,000 C. Other debts: i. Notes payable & loans: $15,000 ii. Taxes Payable: $5,000 iii. Other credit card balances: $10,000 d. College Education: $120,000 e. Emergency Fund: $36,000 (six months at $6,000 per month) The couple's current capital assets include: a. Life Insurance at Steve's company: $250,000 b. Cash & Savings: $25,000 C. Steve's 401K: $200,000 d. Pension Benefits immediately payable to Charlene if Steve is not alive: $100,000 e. Other assets (jewelry and other valuables that could be liquidated): $25,000 Equations for the problem: iz' g .05-.04 1+ g 1.04 -= 0.009615 PV of Future Earnings =C# 1 (1+i)". 1+i QUESTION 37 Determine Present Value of Steve and Charlene's After Tax Earnings QUESTION 38 What is the Family Support Ratio? QUESTION 39 What is the Present Value of Family Support Obligations? QUESTION 40 What is the present value of social security benefits QUESTION 41 Determine the value of Insurance, Mkt Securities and Other Capital Assets