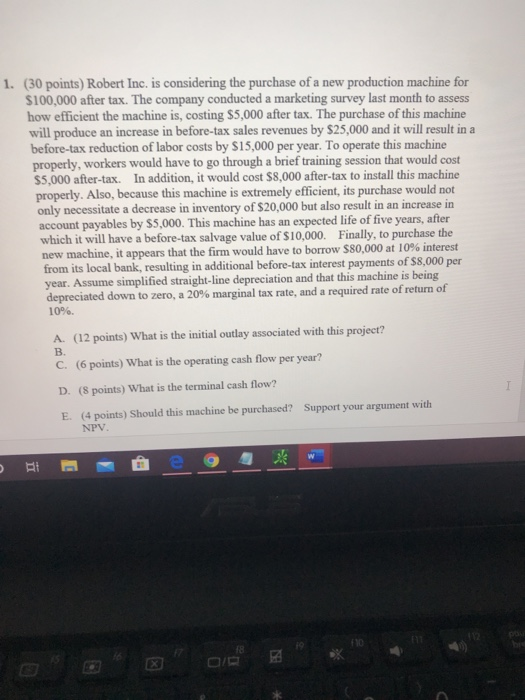

1. (30 points) Robert Inc. is considering the purchase of a new production machine for $100,000 after tax. The company conducted a marketing survey last month to assess how efficient the machine is, costing $5,000 after tax. The purchase of this machine will produce an increase in before-tax sales revenues by $25,000 and it will result in a before-tax reduction of labor costs by $15,000 per year. To operate this machine properly, workers would have to go through a brief training session that would cost $5,000 after-tax. In addition, it would cost $8,000 after-tax to install this machine properly. Also, because this machine is extremely efficient, its purchase would not only necessitate a decrease in inventory of $20,000 but also result in an increase in account payables by $5,000. This machine has an expected life of five years, after which it will have a before-tax salvage value of $10,000. Finally, to purchase the new machine, it appears that the firm would have to borrow $80,000 at 10% interest from its local bank, resulting in additional before-tax interest payments of $8,000 per year. Assume simplified straight-line depreciation and that this machine is being depreciated down to zero, a 20% marginal tax rate, and a required rate of return of 10%. A. (12 points) What is the initial outlay associated with this project? C. (6 points) What is the operating cash flow per year? D. (8 points) What is the terminal cash flow? E (4 points) Should this machine be purchased? Support your argument with NPV. 1. (30 points) Robert Inc. is considering the purchase of a new production machine for $100,000 after tax. The company conducted a marketing survey last month to assess how efficient the machine is, costing $5,000 after tax. The purchase of this machine will produce an increase in before-tax sales revenues by $25,000 and it will result in a before-tax reduction of labor costs by $15,000 per year. To operate this machine properly, workers would have to go through a brief training session that would cost $5,000 after-tax. In addition, it would cost $8,000 after-tax to install this machine properly. Also, because this machine is extremely efficient, its purchase would not only necessitate a decrease in inventory of $20,000 but also result in an increase in account payables by $5,000. This machine has an expected life of five years, after which it will have a before-tax salvage value of $10,000. Finally, to purchase the new machine, it appears that the firm would have to borrow $80,000 at 10% interest from its local bank, resulting in additional before-tax interest payments of $8,000 per year. Assume simplified straight-line depreciation and that this machine is being depreciated down to zero, a 20% marginal tax rate, and a required rate of return of 10%. A. (12 points) What is the initial outlay associated with this project? C. (6 points) What is the operating cash flow per year? D. (8 points) What is the terminal cash flow? E (4 points) Should this machine be purchased? Support your argument with NPV