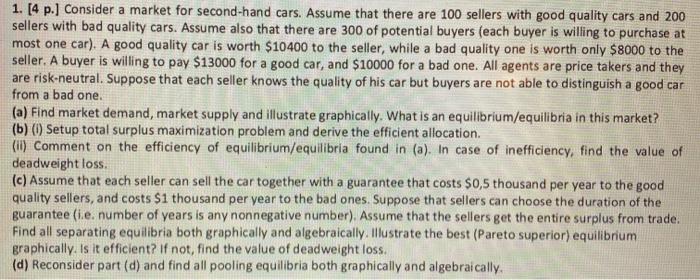

1. [4 p.) Consider a market for second-hand cars. Assume that there are 100 sellers with good quality cars and 200 sellers with bad quality cars. Assume also that there are 300 of potential buyers (each buyer is willing to purchase at most one car). A good quality car is worth $10400 to the seller, while a bad quality one is worth only $8000 to the seller. A buyer is willing to pay $13000 for a good car, and $10000 for a bad one. All agents are price takers and they are risk-neutral. Suppose that each seller knows the quality of his car but buyers are not able to distinguish a good car from a bad one. (a) Find market demand, market supply and illustrate graphically. What is an equilibrium/equilibria in this market? (b) () Setup total surplus maximization problem and derive the efficient allocation. (l) Comment on the efficiency of equilibrium/equilibria found in (a). In case of inefficiency, find the value of deadweight loss. (c) Assume that each seller can sell the car together with a guarantee that costs $0,5 thousand per year to the good quality sellers, and costs $1 thousand per year to the bad ones. Suppose that sellers can choose the duration of the guarantee (ie number of years is any nonnegative number). Assume that the sellers get the entire surplus from trade. Find all separating equilibria both graphically and algebraically. Illustrate the best (Pareto superior) equilibrium graphically. Is it efficient? If not, find the value of deadweight loss. (d) Reconsider part (d) and find all pooling equilibria both graphically and algebraically, 1. [4 p.) Consider a market for second-hand cars. Assume that there are 100 sellers with good quality cars and 200 sellers with bad quality cars. Assume also that there are 300 of potential buyers (each buyer is willing to purchase at most one car). A good quality car is worth $10400 to the seller, while a bad quality one is worth only $8000 to the seller. A buyer is willing to pay $13000 for a good car, and $10000 for a bad one. All agents are price takers and they are risk-neutral. Suppose that each seller knows the quality of his car but buyers are not able to distinguish a good car from a bad one. (a) Find market demand, market supply and illustrate graphically. What is an equilibrium/equilibria in this market? (b) () Setup total surplus maximization problem and derive the efficient allocation. (l) Comment on the efficiency of equilibrium/equilibria found in (a). In case of inefficiency, find the value of deadweight loss. (c) Assume that each seller can sell the car together with a guarantee that costs $0,5 thousand per year to the good quality sellers, and costs $1 thousand per year to the bad ones. Suppose that sellers can choose the duration of the guarantee (ie number of years is any nonnegative number). Assume that the sellers get the entire surplus from trade. Find all separating equilibria both graphically and algebraically. Illustrate the best (Pareto superior) equilibrium graphically. Is it efficient? If not, find the value of deadweight loss. (d) Reconsider part (d) and find all pooling equilibria both graphically and algebraically