Answered step by step

Verified Expert Solution

Question

1 Approved Answer

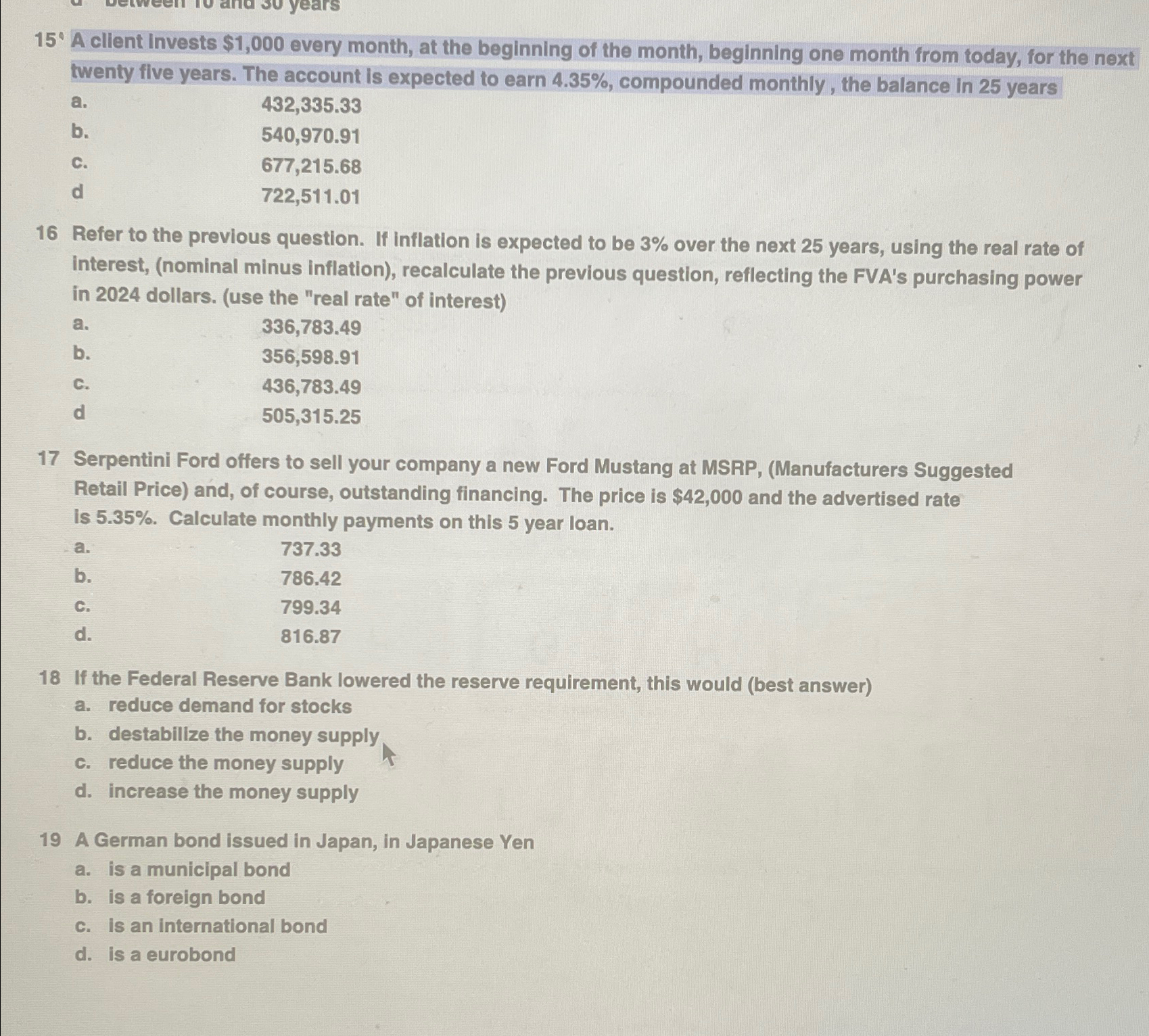

1 5 A client invests $ 1 , 0 0 0 every month, at the beginning of the month, beginning one month from foday, for

A client invests $ every month, at the beginning of the month, beginning one month from foday, for the next twenty five years. The account is expected to earn compounded monthly, the balance in years a b c d Refer to the previous question. If inflation is expected to be over the next years, using the real rate of interest, nominal minus inflation recalculate the previous question, reflecting the FVA's purchasing power in dollars. use the "real rate" of interest a b c d Serpentini Ford offers to sell your company a new Ford Mustang at MSRPManufacturers Suggested Retail Price and, of course, outstanding financing. The price is $ and the advertised rate is Calculate monthly payments on this year loan. a b c d If the Federal Reserve Bank lowered the reserve requirement, this would best answer a reduce demand for stocks b destabilize the money supply c reduce the money supply d increase the money supply A German bond Issued in Japan, in Japanese Yen a is a municipal bond b is a foreign bond c is an international bond d is a eurobond

A client invests $ every month, at the beginning of the month, beginning one month from foday, for the next twenty five years. The account is expected to earn compounded monthly, the balance in years

a

b

c

d

Refer to the previous question. If inflation is expected to be over the next years, using the real rate of interest, nominal minus inflation recalculate the previous question, reflecting the FVA's purchasing power in dollars. use the "real rate" of interest

a

b

c

d

Serpentini Ford offers to sell your company a new Ford Mustang at MSRPManufacturers Suggested Retail Price and, of course, outstanding financing. The price is $ and the advertised rate is Calculate monthly payments on this year loan.

a

b

c

d

If the Federal Reserve Bank lowered the reserve requirement, this would best answer

a reduce demand for stocks

b destabilize the money supply

c reduce the money supply

d increase the money supply

A German bond Issued in Japan, in Japanese Yen

a is a municipal bond

b is a foreign bond

c is an international bond

d is a eurobond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started