Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 5 Eric is 2 5 years old and wishes to receive $ 6 0 , 0 0 0 after tax, in today's dollars, at

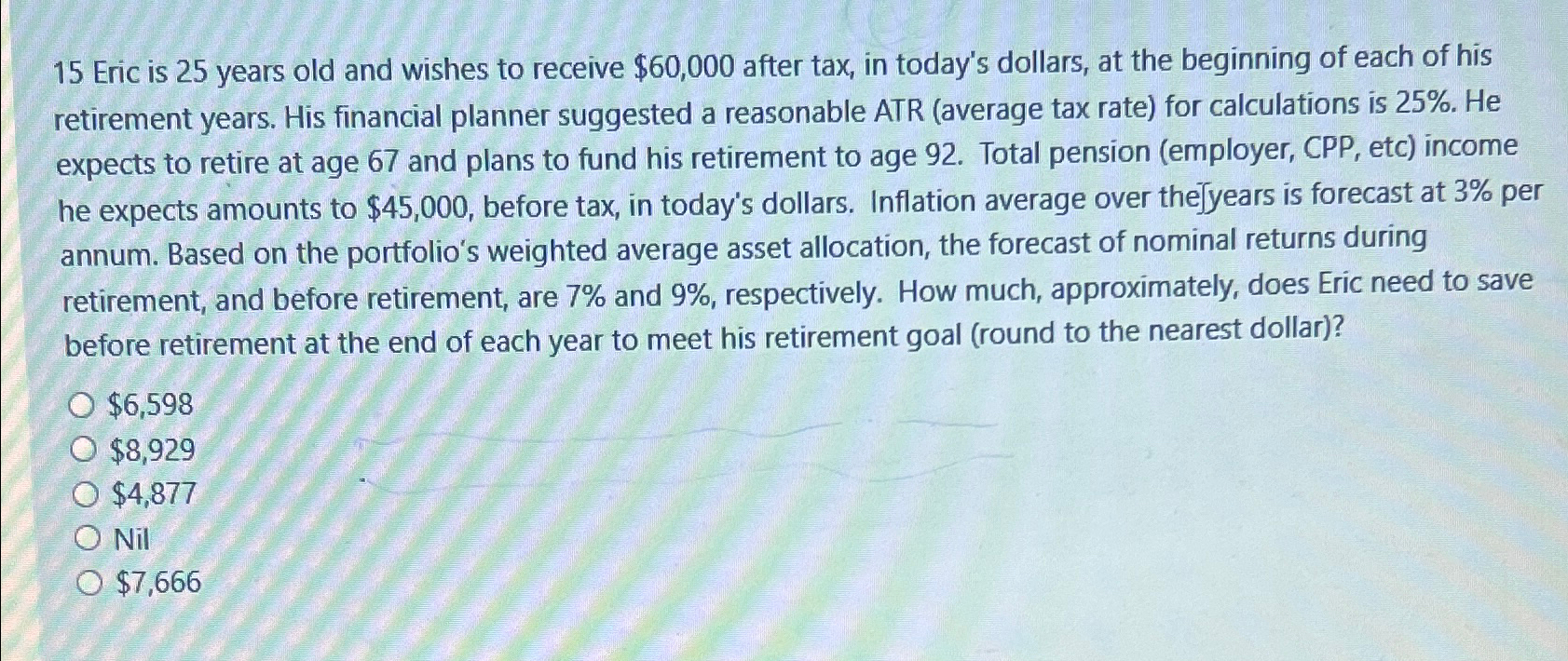

Eric is years old and wishes to receive $ after tax, in today's dollars, at the beginning of each of his retirement years. His financial planner suggested a reasonable ATR average tax rate for calculations is He expects to retire at age and plans to fund his retirement to age Total pension employer CPP etc income he expects amounts to $ before tax, in today's dollars. Inflation average over theyears is forecast at per annum. Based on the portfolio's weighted average asset allocation, the forecast of nominal returns during retirement, and before retirement, are and respectively. How much, approximately, does Eric need to save before retirement at the end of each year to meet his retirement goal round to the nearest dollar

$

$

$

Nil

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started