Answered step by step

Verified Expert Solution

Question

1 Approved Answer

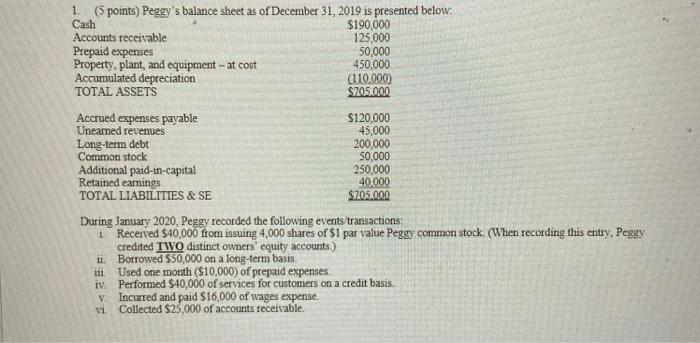

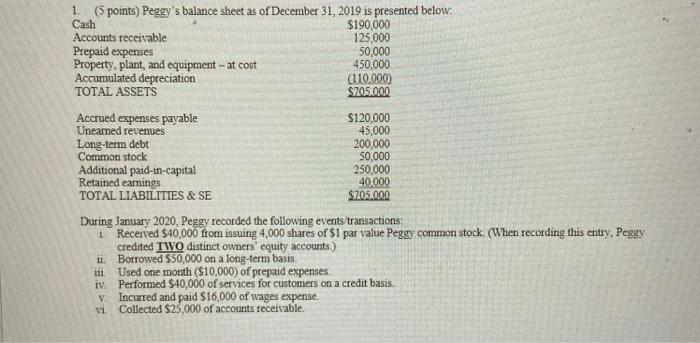

1 (5 points) Peggy's balance sheet as of December 31, 2019 is presented below. Cash $190,000 Accounts receivable 125,000 Prepaid expenses 50,000 Property, plant, and

1 (5 points) Peggy's balance sheet as of December 31, 2019 is presented below. Cash $190,000 Accounts receivable 125,000 Prepaid expenses 50,000 Property, plant, and equipment - at cost 450,000 Accumulated depreciation (110,000) TOTAL ASSETS $705.000 Accrued expenses payable $120.000 Unearned revenues 45,000 Long-term debt 200,000 Common stock 50.000 Additional paid-in-capital 250.000 Retained earnings 40.000 TOTAL LIABILITIES & SE S705.000 During January 2020, Peggy recorded the following events transactions 1 Received $40.000 from issuing 4,000 shares of $1 par value Peggy common stock. (When recording this entry. Peggy credited TWO distinct owners' equity accounts) ii. Borrowed $50,000 on a long-term basis Used one month ($10,000) of prepaid expenses iv. Performed $40,000 of services for customers on a credit basis. V. Incurred and paid $16,000 of wages expense. vi Collected $25,000 of accounts receivable. Prepare Peggy's balance sheet as of January 31, 2020. Hunt - you might consider (l) making the entries for the seven events transactions, (2) coding the debits and credits, and then (3) updating the balance sheet accounts Remember the coding of debits and credits is explained in the traditional homework general instructions

1 (5 points) Peggy's balance sheet as of December 31, 2019 is presented below. Cash $190,000 Accounts receivable 125,000 Prepaid expenses 50,000 Property, plant, and equipment - at cost 450,000 Accumulated depreciation (110,000) TOTAL ASSETS $705.000 Accrued expenses payable $120.000 Unearned revenues 45,000 Long-term debt 200,000 Common stock 50.000 Additional paid-in-capital 250.000 Retained earnings 40.000 TOTAL LIABILITIES & SE S705.000 During January 2020, Peggy recorded the following events transactions 1 Received $40.000 from issuing 4,000 shares of $1 par value Peggy common stock. (When recording this entry. Peggy credited TWO distinct owners' equity accounts) ii. Borrowed $50,000 on a long-term basis Used one month ($10,000) of prepaid expenses iv. Performed $40,000 of services for customers on a credit basis. V. Incurred and paid $16,000 of wages expense. vi Collected $25,000 of accounts receivable. Prepare Peggy's balance sheet as of January 31, 2020. Hunt - you might consider (l) making the entries for the seven events transactions, (2) coding the debits and credits, and then (3) updating the balance sheet accounts Remember the coding of debits and credits is explained in the traditional homework general instructions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started