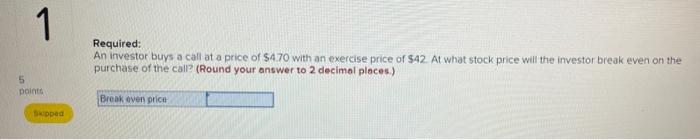

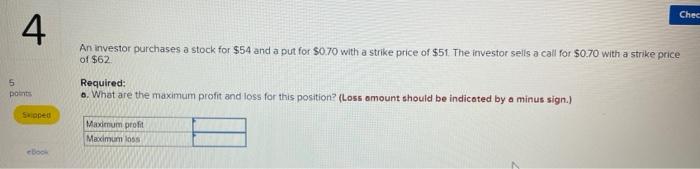

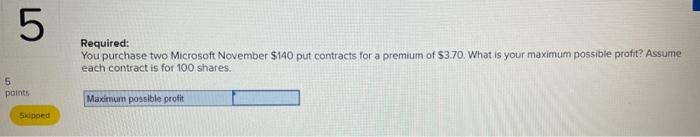

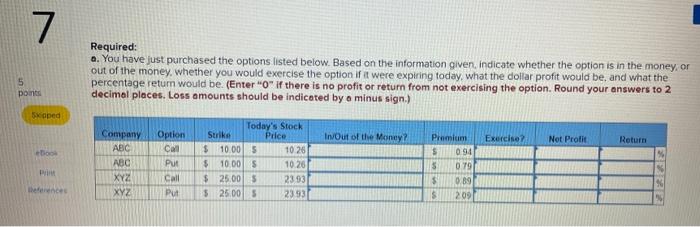

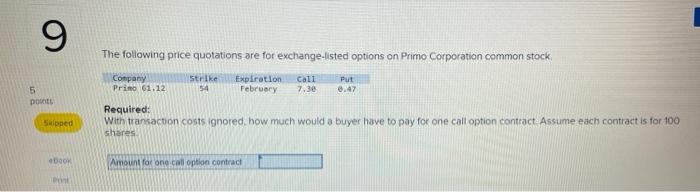

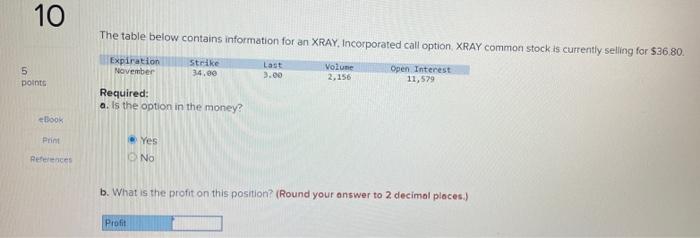

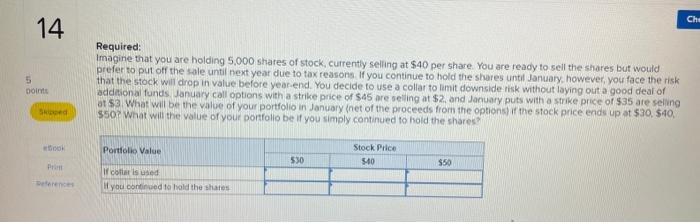

1 5 points Skipped Required: An investor buys a call at a price of $4.70 with an exercise price of $42. At what stock price will the investor break even on the purchase of the call? (Round your answer to 2 decimal places.) Break even price TE 4 An investor purchases a stock for $54 and a put for $0.70 with a strike price of $51. The investor sells a call for $0.70 with a strike price of $62 5 points Skipped ebook Required: a. What are the maximum profit and loss for this position? (Loss amount should be indicated by a minus sign.) Chec Maximum profit Maximum loss 5 5 points Skipped Required: You purchase two Microsoft November $140 put contracts for a premium of $3.70. What is your maximum possible profit? Assume each contract is for 100 shares. Maximum possible profit 7 points Skipped eBook Prim heferences Required: a. You have just purchased the options listed below. Based on the information given, indicate whether the option is in the money, or out of the money, whether you would exercise the option if it were expiring today, what the dollar profit would be, and what the percentage return would be. (Enter "0" if there is no profit or return from not exercising the option. Round your answers to 2 decimal places. Loss amounts should be indicated by a minus sign.) Company Option ABC Call ABC Put XYZ XYZ Call Put Today's Stock Price Strike $10.00 S $10.00 S $25.00 $ $25.00 $ 10.26 10.26 23.93 23.93 In/Out of the Money? Premium $ on S $ $ 0.94 0.79 0.89 209 Exercise? Not Profit. Return EXER ER FR 9 5 points Skipped ebook Pont The following price quotations are for exchange-listed options on Primo Corporation common stock. Strike Expiration Call 54 February 7.30 Company Primo 61.12 Put 0.47 Required: With transaction costs ignored, how much would a buyer have to pay for one call option contract. Assume each contract is for 100 shares. Amount for one call option contract 10 5 points eBook Print References The table below contains information for an XRAY, Incorporated call option, XRAY common stock is currently selling for $36.80. Expiration November Strike 34.00 Required: a. Is the option in the money? Yes No Profit Last 3.00 Volume 2,156 Open Interest 11,579 b. What is the profit on this position? (Round your answer to 2 decimal places.) 14 5 points Skipped ebook Prim Required: Imagine that you are holding 5,000 shares of stock, currently selling at $40 per share. You are ready to sell the shares but would prefer to put off the sale until next year due to tax reasons. If you continue to hold the shares until January, however, you face the risk that the stock will drop in value before year-end. You decide to use a collar to limit downside risk without laying out a good deal of additional funds. January call options with a strike price of $45 are selling at $2, and January puts with a strike price of $35 are selling at $3. What will be the value of your portfolio in January (net of the proceeds from the options) if the stock price ends up at $30, $40, $50? What will the value of your portfolio be if you simply continued to hold the shares? Portfolio Value If coller is used If you continued to hold the shares $30 Stock Price $40 $50 Che