Answered step by step

Verified Expert Solution

Question

1 Approved Answer

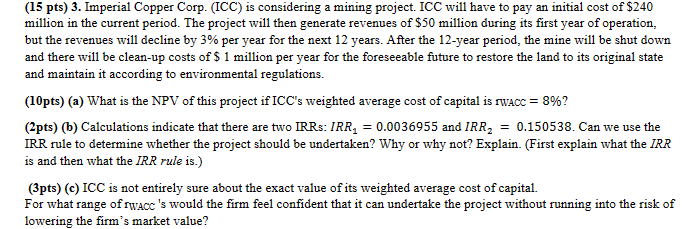

( 1 5 pts ) 3 . Imperial Copper Corp. ( ICC ) is considering a mining project. ICC will have to pay an initial

pts Imperial Copper Corp. ICC is considering a mining project. ICC will have to pay an initial cost of $

million in the current period. The project will then generate revenues of $ million during its first year of operation,

but the revenues will decline by per year for the next years. After the year period, the mine will be shut down

and there will be cleanup costs of $ million per year for the foreseeable future to restore the land to its original state

and maintain it according to environmental regulations.

ptsa What is the NPV of this project if ICC's weighted average cost of capital is rwacc

ptsb Calculations indicate that there are two IRRs: and Can we use the

IRR rule to determine whether the project should be undertaken? Why or why not? Explain. First explain what the IRR

is and then what the IRR rule is

ptsc ICC is not entirely sure about the exact value of its weighted average cost of capital.

For what range of rwacc's would the firm feel confident that it can undertake the project without running into the risk of

lowering the firm's market value?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started