Question

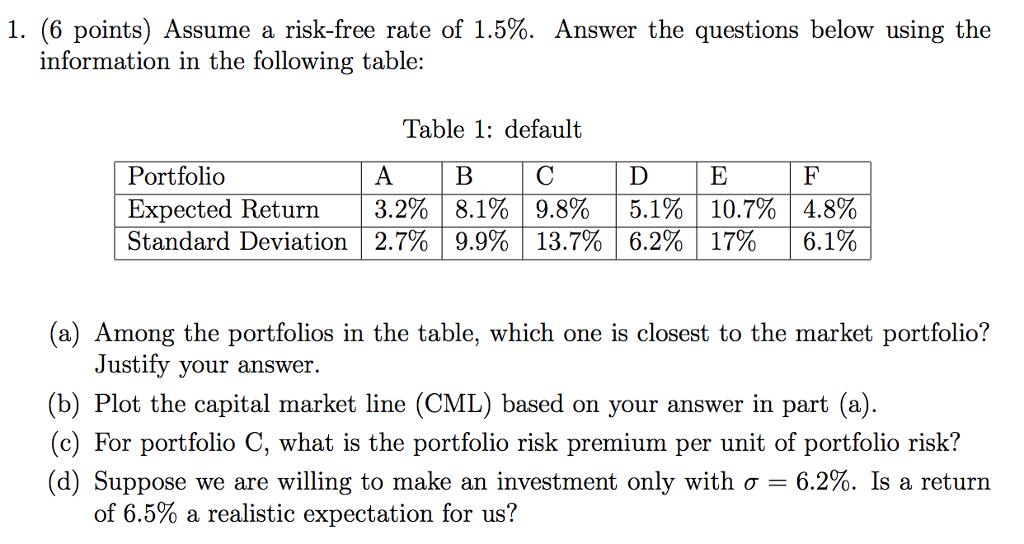

1. (6 points) Assume a risk-free rate of 1.5%. Answer the questions below using the information in the following table: Table 1: default Portfolio

1. (6 points) Assume a risk-free rate of 1.5%. Answer the questions below using the information in the following table: Table 1: default Portfolio A B C D E F Expected Return 3.2% 8.1% 9.8% 5.1% 10.7% 4.8% Standard Deviation 2.7% 9.9% 13.7% 6.2% 17% 6.1% (a) Among the portfolios in the table, which one is closest to the market portfolio? Justify your answer. (b) Plot the capital market line (CML) based on your answer in part (a). (c) For portfolio C, what is the portfolio risk premium per unit of portfolio risk? (d) Suppose we are willing to make an investment only with = 6.2%. Is a return of 6.5% a realistic expectation for us?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Computer Organization And Architecture

Authors: Linda Null, Julia Labur

6th Edition

1284259439, 9781284259438

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App