Answered step by step

Verified Expert Solution

Question

1 Approved Answer

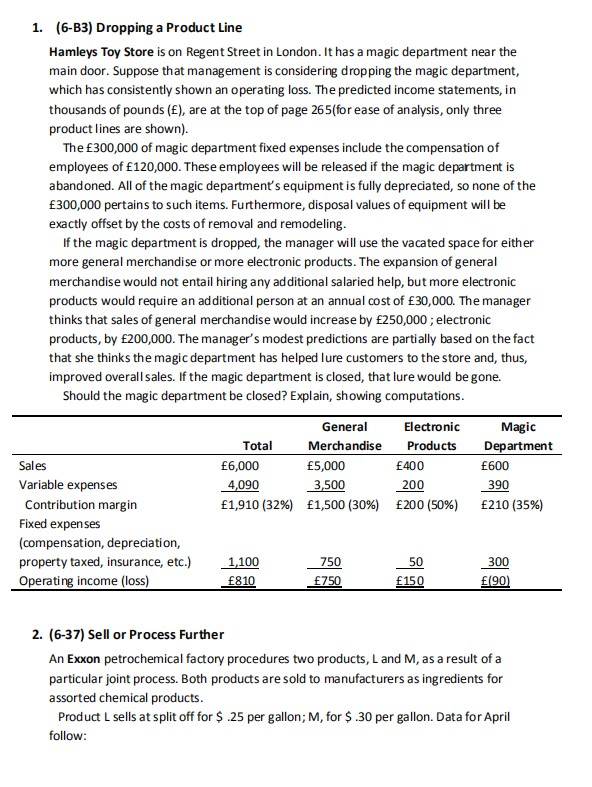

1. (6-B3) Dropping a Product Line Hamleys Toy Store is on Regent Street in London. It has a magic department near the main door. Suppose

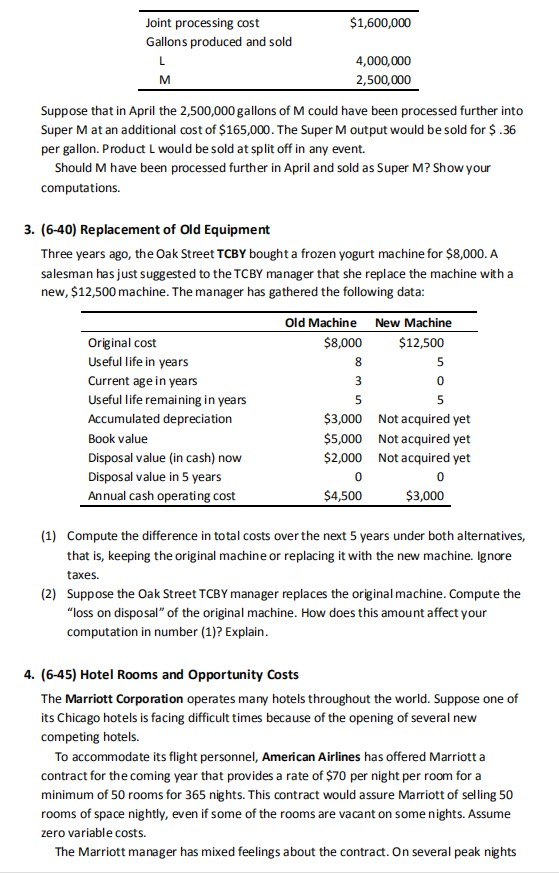

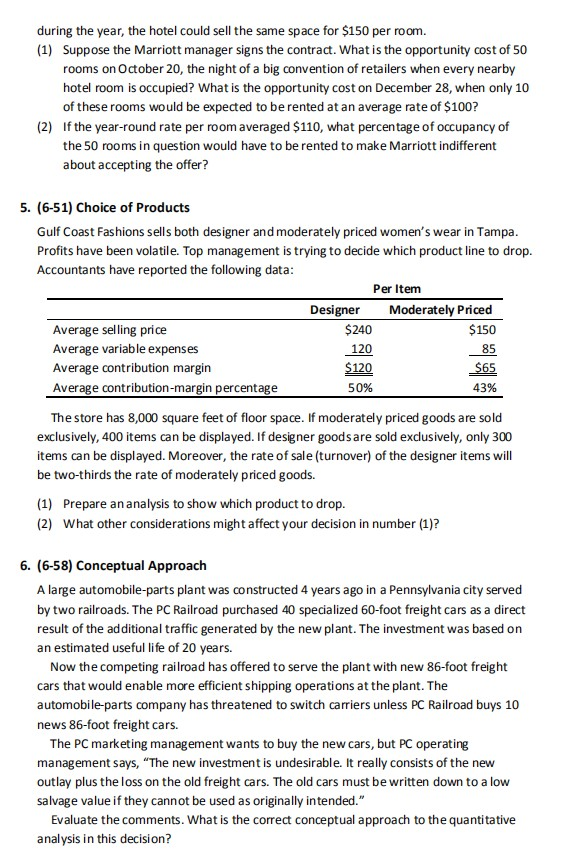

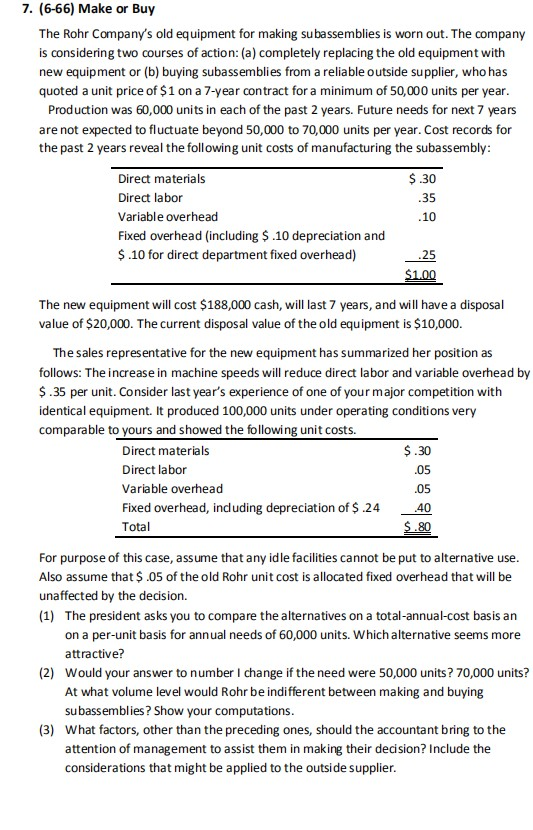

1. (6-B3) Dropping a Product Line Hamleys Toy Store is on Regent Street in London. It has a magic department near the main door. Suppose that management is considering dropping the magic department, which has consistently shown an operating loss. The predicted income statements, in thousands of pounds (), are at the top of page 265(for ease of analysis, only three product lines are shown). The 300,000 of magic department fixed expenses include the compensation of employees of 120,000. These employees will be released if the magic department is abandoned. All of the magic department's equipment is fully depreciated, so none of the 300,000 pertains to such items. Furthermore, disposal values of equipment will be exactly offset by the costs of removal and remodeling. If the magic department is dropped, the manager will use the vacated space for either more general merchandise or more electronic products. The expansion of general merchandise would not entail hiring any additional salaried help, but more electronic products would require an additional person at an annual cost of 30,000. The manager thinks that sales of general merchandise would increase by 250,000; electronic products, by 200,000. The manager's modest predictions are partially based on the fact that she thinks the magic department has helped lure customers to the store and, thus, improved overall sales. If the magic department is closed, that lure would be gone. Should the magic department be closed? Explain, showing computations. General Total Merchandise 6,000 5,000 4,090 3,500 1,910 (32%) 1,500 (30%) Electronic Products 400 200 200 (50%) Magic Department 600 390 210 (35%) Sales Variable expenses Contribution margin Fixed expenses (compensation, depreciation, property taxed, insurance, etc.) Operating income (loss) 1,100 810 750 750 50 150 300 190) 2. (6-37) Sell or Process Further An Exxon petrochemical factory procedures two products, Land M, as a result of a particular joint process. Both products are sold to manufacturers as ingredients for assorted chemical products. Product L sells at split off for $.25 per gallon; M, for $.30 per gallon. Data for April follow: $1,600,000 Joint processing cost Gallons produced and sold 4,000,000 2,500,000 Suppose that in April the 2,500,000 gallons of M could have been processed further into Super Mat an additional cost of $165,000. The Super M output would be sold for $.36 per gallon. Product L would be sold at split off in any event. Should M have been processed further in April and sold as Super M? Show your computations. 3. (6-40) Replacement of Old Equipment Three years ago, the Oak Street TCBY bought a frozen yogurt machine for $8,000. A salesman has just suggested to the TCBY manager that she replace the machine with a new, $12,500 machine. The manager has gathered the following data: Old Machine New Machine $8,000 $12,500 Original cost Useful life in years Current age in years Useful life remaining in years Accumulated depreciation Book value Disposal value (in cash) now Disposal value in 5 years Annual cash operating cost $3,000 $5,000 $2,000 0 $4,500 Not acquired yet Not acquired yet Not acquired yet $3,000 (1) Compute the difference in total costs over the next 5 years under both alternatives, that is, keeping the original machine or replacing it with the new machine. Ignore taxes. (2) Suppose the Oak Street TCBY manager replaces the original machine. Compute the "loss on disposal of the original machine. How does this amount affect your computation in number (1)? Explain. 4. (6-45) Hotel Rooms and Opportunity Costs The Marriott Corporation operates many hotels throughout the world. Suppose one of its Chicago hotels is facing difficult times because of the opening of several new competing hotels. To accommodate its flight personnel, American Airlines has offered Marriott a contract for the coming year that provides a rate of $70 per night per room for a minimum of 50 rooms for 365 nights. This contract would assure Marriott of selling 50 rooms of space nightly, even if some of the rooms are vacant on some nights. Assume zero variable costs. The Marriott manager has mixed feelings about the contract. On several peak nights during the year, the hotel could sell the same space for $150 per room. (1) Suppose the Marriott manager signs the contract. What is the opportunity cost of 50 rooms on October 20, the night of a big convention of retailers when every nearby hotel room is occupied? What is the opportunity cost on December 28, when only 10 of these rooms would be expected to be rented at an average rate of $100? (2) If the year-round rate per room averaged $110, what percentage of occupancy of the 50 rooms in question would have to be rented to make Marriott indifferent about accepting the offer? 5. (6-51) Choice of Products Gulf Coast Fashions sells both designer and moderately priced women's wear in Tampa. Profits have been volatile. Top management is trying to decide which product line to drop. Accountants have reported the following data: Per Item Designer Moderately Priced Average selling price $240 $150 Average variable expenses 120 Average contribution margin $120 $65 Average contribution-margin percentage 50% 43% The store has 8,000 square feet of floor space. If moderately priced goods are sold exclusively, 400 items can be displayed. If designer goods are sold exclusively, only 300 items can be displayed. Moreover, the rate of sale (turnover) of the designer items will be two-thirds the rate of moderately priced goods. (1) Prepare an analysis to show which product to drop. (2) What other considerations might affect your decision in number (1)? 6. (6-58) Conceptual Approach A large automobile-parts plant was constructed 4 years ago in a Pennsylvania city served by two railroads. The PC Railroad purchased 40 specialized 60-foot freight cars as a direct result of the additional traffic generated by the new plant. The investment was based on an estimated useful life of 20 years. Now the competing railroad has offered to serve the plant with new 86-foot freight cars that would enable more efficient shipping operations at the plant. The automobile-parts company has threatened to switch carriers unless PC Railroad buys 10 news 86-foot freight cars. The PC marketing management wants to buy the new cars, but PC operating management says, "The new investment is undesirable. It really consists of the new outlay plus the loss on the old freight cars. The old cars must be written down to a low salvage value if they cannot be used as originally intended." Evaluate the comments. What is the correct conceptual approach to the quantitative analysis in this decision? 7. (6-66) Make or Buy The Rohr Company's old equipment for making subassemblies is worn out. The company is considering two courses of action: (a) completely replacing the old equipment with new equipment or (b) buying subassemblies from a reliable outside supplier, who has quoted a unit price of $1 on a 7-year contract for a minimum of 50,000 units per year. Production was 60,000 units in each of the past 2 years. Future needs for next 7 years are not expected to fluctuate beyond 50,000 to 70,000 units per year. Cost records for the past 2 years reveal the following unit costs of manufacturing the subassembly: Direct materials Direct labor Variable overhead Fixed overhead (including $.10 depreciation and $.10 for direct department fixed overhead) $.30 .35 .10 $1.00 The new equipment will cost $188,000 cash, will last 7 years, and will have a disposal value of $20,000. The current disposal value of the old equipment is $10,000. The sales representative for the new equipment has summarized her position as follows: The increase in machine speeds will reduce direct labor and variable overhead by $.35 per unit. Consider last year's experience of one of your major competition with identical equipment. It produced 100,000 units under operating conditions very comparable to yours and showed the following unit costs. Direct materials $.30 Direct labor Variable overhead .05 Fixed overhead, including depreciation of $.24 .40 Total $.80 05 For purpose of this case, assume that any idle facilities cannot be put to alternative use. Also assume that $.05 of the old Rohr unit cost is allocated fixed overhead that will be unaffected by the decision. (1) The president asks you to compare the alternatives on a total-annual-cost basis an on a per-unit basis for annual needs of 60,000 units. Which alternative seems more attractive? (2) Would your answer to number I change if the need were 50,000 units? 70,000 units? At what volume level would Rohr be indifferent between making and buying subassemblies? Show your computations. (3) What factors, other than the preceding ones, should the accountant bring to the attention of management to assist them in making their decision? Include the considerations that might be applied to the outside supplier. 1. (6-B3) Dropping a Product Line Hamleys Toy Store is on Regent Street in London. It has a magic department near the main door. Suppose that management is considering dropping the magic department, which has consistently shown an operating loss. The predicted income statements, in thousands of pounds (), are at the top of page 265(for ease of analysis, only three product lines are shown). The 300,000 of magic department fixed expenses include the compensation of employees of 120,000. These employees will be released if the magic department is abandoned. All of the magic department's equipment is fully depreciated, so none of the 300,000 pertains to such items. Furthermore, disposal values of equipment will be exactly offset by the costs of removal and remodeling. If the magic department is dropped, the manager will use the vacated space for either more general merchandise or more electronic products. The expansion of general merchandise would not entail hiring any additional salaried help, but more electronic products would require an additional person at an annual cost of 30,000. The manager thinks that sales of general merchandise would increase by 250,000; electronic products, by 200,000. The manager's modest predictions are partially based on the fact that she thinks the magic department has helped lure customers to the store and, thus, improved overall sales. If the magic department is closed, that lure would be gone. Should the magic department be closed? Explain, showing computations. General Total Merchandise 6,000 5,000 4,090 3,500 1,910 (32%) 1,500 (30%) Electronic Products 400 200 200 (50%) Magic Department 600 390 210 (35%) Sales Variable expenses Contribution margin Fixed expenses (compensation, depreciation, property taxed, insurance, etc.) Operating income (loss) 1,100 810 750 750 50 150 300 190) 2. (6-37) Sell or Process Further An Exxon petrochemical factory procedures two products, Land M, as a result of a particular joint process. Both products are sold to manufacturers as ingredients for assorted chemical products. Product L sells at split off for $.25 per gallon; M, for $.30 per gallon. Data for April follow: $1,600,000 Joint processing cost Gallons produced and sold 4,000,000 2,500,000 Suppose that in April the 2,500,000 gallons of M could have been processed further into Super Mat an additional cost of $165,000. The Super M output would be sold for $.36 per gallon. Product L would be sold at split off in any event. Should M have been processed further in April and sold as Super M? Show your computations. 3. (6-40) Replacement of Old Equipment Three years ago, the Oak Street TCBY bought a frozen yogurt machine for $8,000. A salesman has just suggested to the TCBY manager that she replace the machine with a new, $12,500 machine. The manager has gathered the following data: Old Machine New Machine $8,000 $12,500 Original cost Useful life in years Current age in years Useful life remaining in years Accumulated depreciation Book value Disposal value (in cash) now Disposal value in 5 years Annual cash operating cost $3,000 $5,000 $2,000 0 $4,500 Not acquired yet Not acquired yet Not acquired yet $3,000 (1) Compute the difference in total costs over the next 5 years under both alternatives, that is, keeping the original machine or replacing it with the new machine. Ignore taxes. (2) Suppose the Oak Street TCBY manager replaces the original machine. Compute the "loss on disposal of the original machine. How does this amount affect your computation in number (1)? Explain. 4. (6-45) Hotel Rooms and Opportunity Costs The Marriott Corporation operates many hotels throughout the world. Suppose one of its Chicago hotels is facing difficult times because of the opening of several new competing hotels. To accommodate its flight personnel, American Airlines has offered Marriott a contract for the coming year that provides a rate of $70 per night per room for a minimum of 50 rooms for 365 nights. This contract would assure Marriott of selling 50 rooms of space nightly, even if some of the rooms are vacant on some nights. Assume zero variable costs. The Marriott manager has mixed feelings about the contract. On several peak nights during the year, the hotel could sell the same space for $150 per room. (1) Suppose the Marriott manager signs the contract. What is the opportunity cost of 50 rooms on October 20, the night of a big convention of retailers when every nearby hotel room is occupied? What is the opportunity cost on December 28, when only 10 of these rooms would be expected to be rented at an average rate of $100? (2) If the year-round rate per room averaged $110, what percentage of occupancy of the 50 rooms in question would have to be rented to make Marriott indifferent about accepting the offer? 5. (6-51) Choice of Products Gulf Coast Fashions sells both designer and moderately priced women's wear in Tampa. Profits have been volatile. Top management is trying to decide which product line to drop. Accountants have reported the following data: Per Item Designer Moderately Priced Average selling price $240 $150 Average variable expenses 120 Average contribution margin $120 $65 Average contribution-margin percentage 50% 43% The store has 8,000 square feet of floor space. If moderately priced goods are sold exclusively, 400 items can be displayed. If designer goods are sold exclusively, only 300 items can be displayed. Moreover, the rate of sale (turnover) of the designer items will be two-thirds the rate of moderately priced goods. (1) Prepare an analysis to show which product to drop. (2) What other considerations might affect your decision in number (1)? 6. (6-58) Conceptual Approach A large automobile-parts plant was constructed 4 years ago in a Pennsylvania city served by two railroads. The PC Railroad purchased 40 specialized 60-foot freight cars as a direct result of the additional traffic generated by the new plant. The investment was based on an estimated useful life of 20 years. Now the competing railroad has offered to serve the plant with new 86-foot freight cars that would enable more efficient shipping operations at the plant. The automobile-parts company has threatened to switch carriers unless PC Railroad buys 10 news 86-foot freight cars. The PC marketing management wants to buy the new cars, but PC operating management says, "The new investment is undesirable. It really consists of the new outlay plus the loss on the old freight cars. The old cars must be written down to a low salvage value if they cannot be used as originally intended." Evaluate the comments. What is the correct conceptual approach to the quantitative analysis in this decision? 7. (6-66) Make or Buy The Rohr Company's old equipment for making subassemblies is worn out. The company is considering two courses of action: (a) completely replacing the old equipment with new equipment or (b) buying subassemblies from a reliable outside supplier, who has quoted a unit price of $1 on a 7-year contract for a minimum of 50,000 units per year. Production was 60,000 units in each of the past 2 years. Future needs for next 7 years are not expected to fluctuate beyond 50,000 to 70,000 units per year. Cost records for the past 2 years reveal the following unit costs of manufacturing the subassembly: Direct materials Direct labor Variable overhead Fixed overhead (including $.10 depreciation and $.10 for direct department fixed overhead) $.30 .35 .10 $1.00 The new equipment will cost $188,000 cash, will last 7 years, and will have a disposal value of $20,000. The current disposal value of the old equipment is $10,000. The sales representative for the new equipment has summarized her position as follows: The increase in machine speeds will reduce direct labor and variable overhead by $.35 per unit. Consider last year's experience of one of your major competition with identical equipment. It produced 100,000 units under operating conditions very comparable to yours and showed the following unit costs. Direct materials $.30 Direct labor Variable overhead .05 Fixed overhead, including depreciation of $.24 .40 Total $.80 05 For purpose of this case, assume that any idle facilities cannot be put to alternative use. Also assume that $.05 of the old Rohr unit cost is allocated fixed overhead that will be unaffected by the decision. (1) The president asks you to compare the alternatives on a total-annual-cost basis an on a per-unit basis for annual needs of 60,000 units. Which alternative seems more attractive? (2) Would your answer to number I change if the need were 50,000 units? 70,000 units? At what volume level would Rohr be indifferent between making and buying subassemblies? Show your computations. (3) What factors, other than the preceding ones, should the accountant bring to the attention of management to assist them in making their decision? Include the considerations that might be applied to the outside supplier

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started