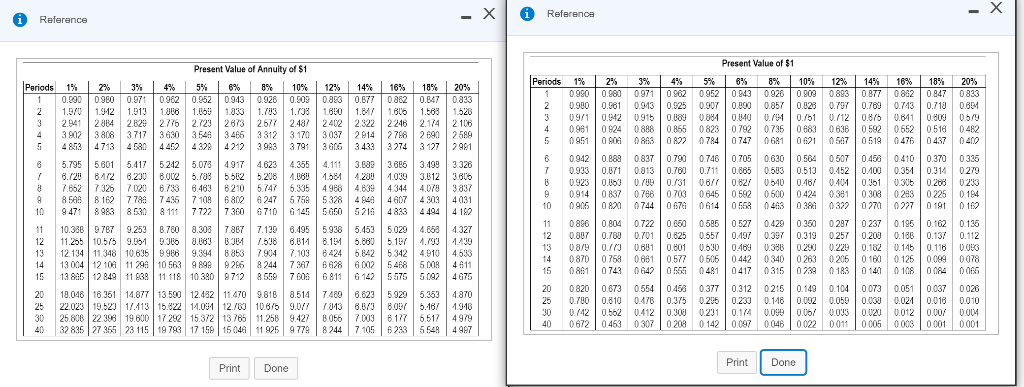

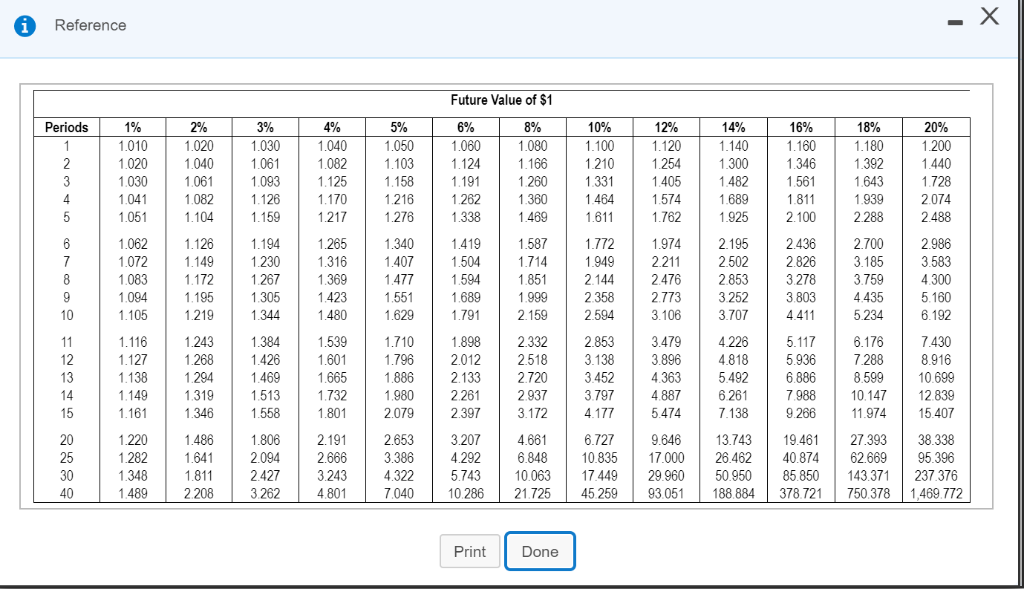

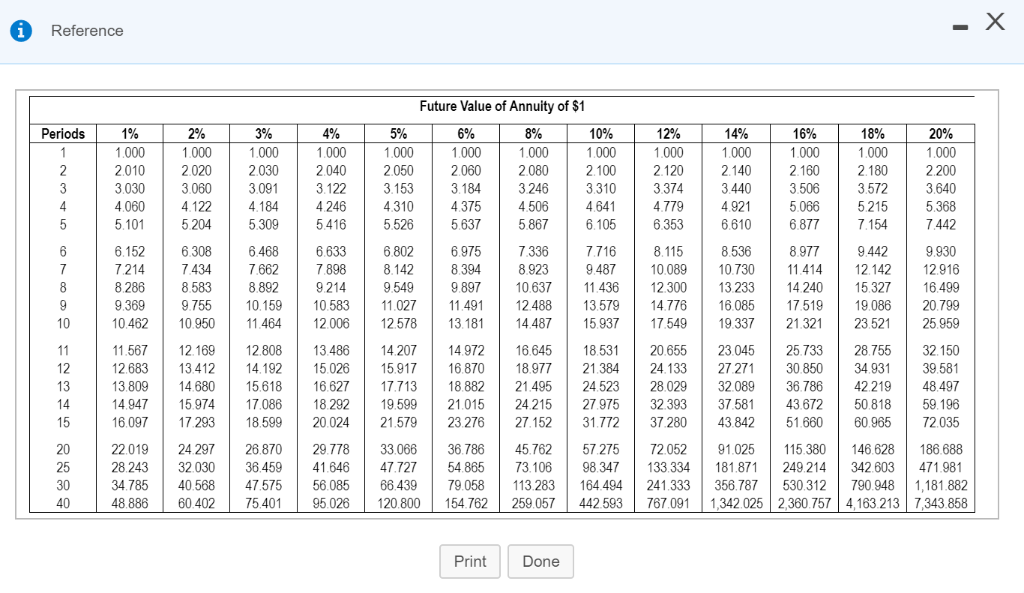

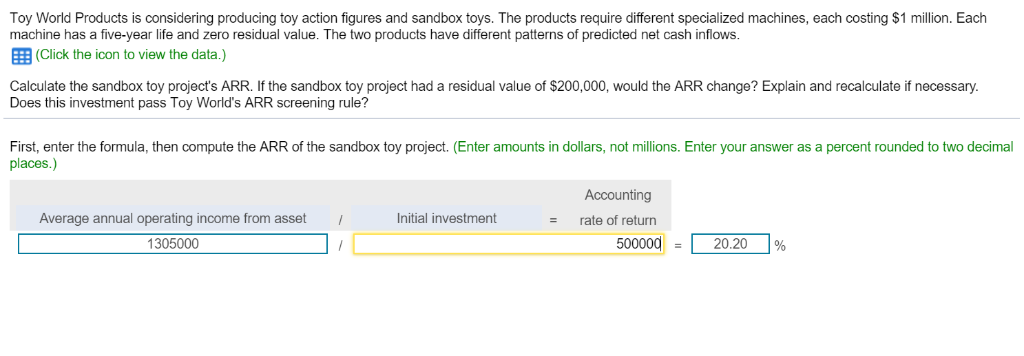

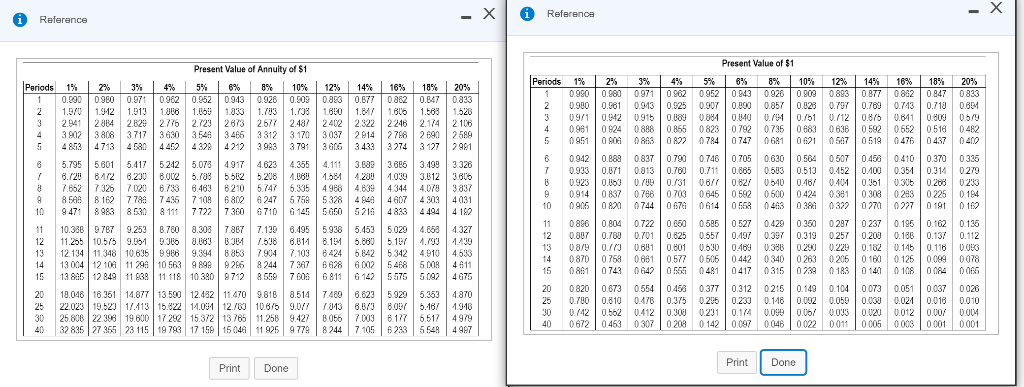

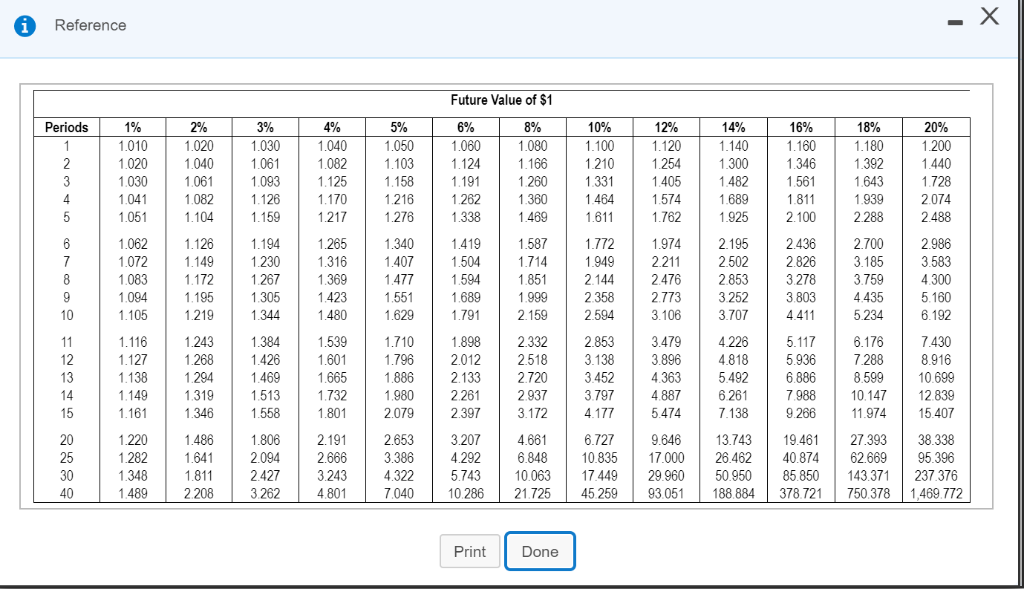

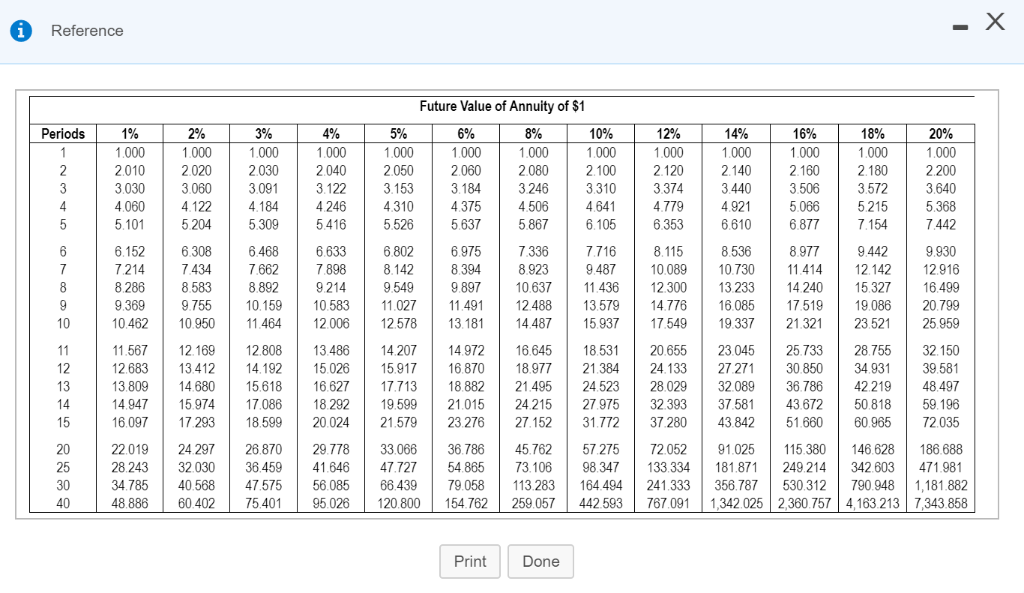

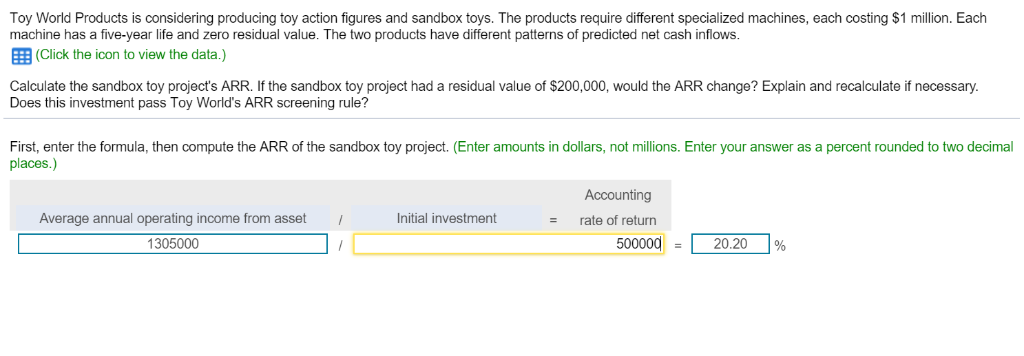

1 8% | 10% 12%| 14% 16%| 18% 20% 1 0.990 0.880 0971 0.962 0952 0.843 0926 0.809 0893 0877 0882 0.847 0833 2 0.90 0.561 0.9130.25 0.90T 0.800 0857 0.828 0TS 07800.7430.718 0851 Periods 1% | 2% 3% | 4% 5% | 6% 8% | 10% | 12% | 14% | 16% | 18% | 20% 0.50 0900 0.9 092 0.952 0943 0.928 0.509 0853 0.877 0862 0.847 0833 2 1.91912 1.13138 1333 1U3 1.3180 106 1.503 1520 2.941 2884 2829 2776 2.23 23 2677 2482402 2322 2246 2.14 2106 3902 | 3808 | 3717 | 3630 | 3548 | 3466 | 3312 | 3170 | 3037 | 2014 | 2706 | 2690 | 2589 4853 4713454452432 4212 3933791 3603433 3274 312791 4 0981024 0888 0865 0823 0792073 0683 0636 0520652 0516 0482 0951 | 00 08A3 | 0822 | 0784 0747 | 0681 | 0 1 | ()567 519 | 0476 | 0437 | 0407 6 0942 0.888 0837 0.790 0746 0.705 0.630 0564 0.5070453 0.4100.370 0335 0.933 0.B71 0813078 071 0.885 0.5830.5130452 0.400 0350.314 02T9 0.923 0.63 UrU0300.62 U54 40.361 3 0288 233 90914 0837 07660703 06450592 0600 0424 0381 0308 02630225 014 0906 | 080 0744 | 067a | 0614 | 0.558 | 04A3 | 038A | 0322 | 0270 | 0227 | 0191 | 016? 5.795 5801 5.417 52425.07 4917 4.623 4.355 4.1113.88 3885 3.499 3326 6.720 72 | 6.230 | 6002 | 5.703 | 5562 | 5.2U6 | 4,00ii | 1.5 4.2aij | 1.039 | 3.012 | 1.606 8 7.652 7325 720 6733 6.463 6210 5.4 6.335 4.98 4.63 4344 4078 3837 9 858162 778743 71086802 6247 575 3284607 4303 4031 0 94718983 8530 8111 27360 6710 6145565026 4833 44 4 82 11 0896 0.80 0722 0.850 0.585 0.527 04290.350 0.287 0237 0.1950.162 0.135 088 0.78 07010.825 0.550 0.3 0.319 0.25 020 0.180. 0.112 1110.388 9787 9.253 8780 8.30 7887 7.13 6.495 5938 5.453 5029 4858 4327 80.3 08U10.015300.4388 029 220.821b1O 12.134 11.348 10.63699889.394 8837.9047.103 6424 8425342 4910 4.63 14 13 004 120 110563989 9258244736628602550 4$11 15 13 812 49 1183 11 118 10 309712706 811 614557502465 14 15 0870 | 758 | 0661 | 0577 | 0506 | 0442 | 0340 | 263 | 0206 | O 160 0 125 | 0099 | 0078 0861 0743 0642 | 055, 0481 | 0417 | 0315 073 | 0183 0140 | 0108 0084 | 0066 20 08200673 0554 0.458 0377 0.312 0215 0.149 0.104 0073 0051 0037 0026 25 0.T80 0.810 047B 0.375 0.25 0.233 0.118 0.02 0.050.030.0210.010010 30 042 00412 030 230 000033 0020 0012004 40 0672 0463 03070208 0142 007 00460022 00110005 000001 0001 18.048 16351 14.877 13.500 12.482 11.470 9.818 8.514 74896.823 5929 5.353 487O 22.023 19.523 17.113 15822 1101 1283 10b9.036.830918 30 258022 19.600 17 292 15.372 13.765 11.258 9.427 8056 7006.517 4979 40 32 835 27355 23 115 973 17 15 54 25 979 82447105 6233 5544997 025 11122 23456 78 479 12519 3 7 3 ! 7 1-1 1 1 1 2 23345 67801 264 17 6%-160 M6 ssi 011 100 400 eas TB 800 011 17 SOB 996 998 200 4 419 111-12 22334 55679 4 1-140 300 400 1 195 2 2 3 3 821 827 44567 13 746 57 924 0%-100 210 201 004 011 ces 48 250 m M9 and des 198 ASL 2 4 6075 114 d'A-8% 000 195 200 360 400 ser 74 asi 999 150 $15 /20 997 112 001 2 Vi 19 04 94 89 91 98 12 33 61 97 07 92 43 567 80123 227 66 07 01122 4456 77 02507 56930 915 1 1631 271 3 2 445 1% 010 000 000 oat osi 002 012 003 004 105 16 27 198 49 61 220 202 400 no 1 12345 20 25 30 40 12345 6789 1 Reference Future Value of Annuity of $1 Periods 8 948710089 10.730 11.414 12.1422916 9897 10.63711.436 12.300 13 233 14.240 15.327 16.499 9.75510.15910.583 11.0271.4912.488 1357914.77616.085 7.519 19086 20.799 046210.950 11.464 12.006 2578 13181 14.487 5.93717.549 9.33721321 23.521 25.959 11.5672.16912.808 13.486 14.20714.972 16.645 18.531 20.655 23.04525.733 28.755 32.150 12.68313,412 14.192 15026 15.91716.870 18.97721.384 24.133 27.27130.850 34.931 39.581 13.80914.680 15,618 16.62717.713 18.882 21.495 24.523 28.029 32.08936.786 42219 48.497 4.94715.974 17.086 18.292 19.599 21.015 24.215 27.975 32.393 37.5843.672 50.818 59.196 16.09717 293 18.599 20024 21.579 23.276 27.15231.772 37.280 43.84251.660 60.965 72.035 22.01924.297 26.870 29.77833.066 36.786 45.76257275 72.052 91.025 115.380 146.628 186.688 28.24332.030 36.459 41.646 47.727 54.865 73.106 98.347133.334 181.871249.214 342.603 471.981 2 34.78540.56847.575 56.085 66439 79.058113 283 164.494241.333 356.787 530.312 790.9481,181.882 48.886 6040275401 95.026 120.800 154.762 259.057442.593 767.091 1,342.025 2,360.757 4,163.213 7,343.858 8 Toy World Products is considering producing toy action figures and sandbox toys. The products require different specialized machines, each costing $1 million. Each machine has a five-year life and zero residual value. The two products have different patterns of predicted net cash inflows. EEB(Click the icon to view the data.) Calculate the sandbox toy project's ARR. If the sandbox toy project had a residual value of $200,000, would the ARR change? Explain and recalculate if necessary. Does this investment pass Toy World's ARR screening rule? First, enter the formula, then compute the ARR of the sandbox toy project. (Enter amounts in dollars, not millions. Enter your answer as a percent rounded to two decimal places.) Accounting - rate of return Average annual operating income from asset 1305000 Initial investment 50000g -| 20.20 |96 1 8% | 10% 12%| 14% 16%| 18% 20% 1 0.990 0.880 0971 0.962 0952 0.843 0926 0.809 0893 0877 0882 0.847 0833 2 0.90 0.561 0.9130.25 0.90T 0.800 0857 0.828 0TS 07800.7430.718 0851 Periods 1% | 2% 3% | 4% 5% | 6% 8% | 10% | 12% | 14% | 16% | 18% | 20% 0.50 0900 0.9 092 0.952 0943 0.928 0.509 0853 0.877 0862 0.847 0833 2 1.91912 1.13138 1333 1U3 1.3180 106 1.503 1520 2.941 2884 2829 2776 2.23 23 2677 2482402 2322 2246 2.14 2106 3902 | 3808 | 3717 | 3630 | 3548 | 3466 | 3312 | 3170 | 3037 | 2014 | 2706 | 2690 | 2589 4853 4713454452432 4212 3933791 3603433 3274 312791 4 0981024 0888 0865 0823 0792073 0683 0636 0520652 0516 0482 0951 | 00 08A3 | 0822 | 0784 0747 | 0681 | 0 1 | ()567 519 | 0476 | 0437 | 0407 6 0942 0.888 0837 0.790 0746 0.705 0.630 0564 0.5070453 0.4100.370 0335 0.933 0.B71 0813078 071 0.885 0.5830.5130452 0.400 0350.314 02T9 0.923 0.63 UrU0300.62 U54 40.361 3 0288 233 90914 0837 07660703 06450592 0600 0424 0381 0308 02630225 014 0906 | 080 0744 | 067a | 0614 | 0.558 | 04A3 | 038A | 0322 | 0270 | 0227 | 0191 | 016? 5.795 5801 5.417 52425.07 4917 4.623 4.355 4.1113.88 3885 3.499 3326 6.720 72 | 6.230 | 6002 | 5.703 | 5562 | 5.2U6 | 4,00ii | 1.5 4.2aij | 1.039 | 3.012 | 1.606 8 7.652 7325 720 6733 6.463 6210 5.4 6.335 4.98 4.63 4344 4078 3837 9 858162 778743 71086802 6247 575 3284607 4303 4031 0 94718983 8530 8111 27360 6710 6145565026 4833 44 4 82 11 0896 0.80 0722 0.850 0.585 0.527 04290.350 0.287 0237 0.1950.162 0.135 088 0.78 07010.825 0.550 0.3 0.319 0.25 020 0.180. 0.112 1110.388 9787 9.253 8780 8.30 7887 7.13 6.495 5938 5.453 5029 4858 4327 80.3 08U10.015300.4388 029 220.821b1O 12.134 11.348 10.63699889.394 8837.9047.103 6424 8425342 4910 4.63 14 13 004 120 110563989 9258244736628602550 4$11 15 13 812 49 1183 11 118 10 309712706 811 614557502465 14 15 0870 | 758 | 0661 | 0577 | 0506 | 0442 | 0340 | 263 | 0206 | O 160 0 125 | 0099 | 0078 0861 0743 0642 | 055, 0481 | 0417 | 0315 073 | 0183 0140 | 0108 0084 | 0066 20 08200673 0554 0.458 0377 0.312 0215 0.149 0.104 0073 0051 0037 0026 25 0.T80 0.810 047B 0.375 0.25 0.233 0.118 0.02 0.050.030.0210.010010 30 042 00412 030 230 000033 0020 0012004 40 0672 0463 03070208 0142 007 00460022 00110005 000001 0001 18.048 16351 14.877 13.500 12.482 11.470 9.818 8.514 74896.823 5929 5.353 487O 22.023 19.523 17.113 15822 1101 1283 10b9.036.830918 30 258022 19.600 17 292 15.372 13.765 11.258 9.427 8056 7006.517 4979 40 32 835 27355 23 115 973 17 15 54 25 979 82447105 6233 5544997 025 11122 23456 78 479 12519 3 7 3 ! 7 1-1 1 1 1 2 23345 67801 264 17 6%-160 M6 ssi 011 100 400 eas TB 800 011 17 SOB 996 998 200 4 419 111-12 22334 55679 4 1-140 300 400 1 195 2 2 3 3 821 827 44567 13 746 57 924 0%-100 210 201 004 011 ces 48 250 m M9 and des 198 ASL 2 4 6075 114 d'A-8% 000 195 200 360 400 ser 74 asi 999 150 $15 /20 997 112 001 2 Vi 19 04 94 89 91 98 12 33 61 97 07 92 43 567 80123 227 66 07 01122 4456 77 02507 56930 915 1 1631 271 3 2 445 1% 010 000 000 oat osi 002 012 003 004 105 16 27 198 49 61 220 202 400 no 1 12345 20 25 30 40 12345 6789 1 Reference Future Value of Annuity of $1 Periods 8 948710089 10.730 11.414 12.1422916 9897 10.63711.436 12.300 13 233 14.240 15.327 16.499 9.75510.15910.583 11.0271.4912.488 1357914.77616.085 7.519 19086 20.799 046210.950 11.464 12.006 2578 13181 14.487 5.93717.549 9.33721321 23.521 25.959 11.5672.16912.808 13.486 14.20714.972 16.645 18.531 20.655 23.04525.733 28.755 32.150 12.68313,412 14.192 15026 15.91716.870 18.97721.384 24.133 27.27130.850 34.931 39.581 13.80914.680 15,618 16.62717.713 18.882 21.495 24.523 28.029 32.08936.786 42219 48.497 4.94715.974 17.086 18.292 19.599 21.015 24.215 27.975 32.393 37.5843.672 50.818 59.196 16.09717 293 18.599 20024 21.579 23.276 27.15231.772 37.280 43.84251.660 60.965 72.035 22.01924.297 26.870 29.77833.066 36.786 45.76257275 72.052 91.025 115.380 146.628 186.688 28.24332.030 36.459 41.646 47.727 54.865 73.106 98.347133.334 181.871249.214 342.603 471.981 2 34.78540.56847.575 56.085 66439 79.058113 283 164.494241.333 356.787 530.312 790.9481,181.882 48.886 6040275401 95.026 120.800 154.762 259.057442.593 767.091 1,342.025 2,360.757 4,163.213 7,343.858 8 Toy World Products is considering producing toy action figures and sandbox toys. The products require different specialized machines, each costing $1 million. Each machine has a five-year life and zero residual value. The two products have different patterns of predicted net cash inflows. EEB(Click the icon to view the data.) Calculate the sandbox toy project's ARR. If the sandbox toy project had a residual value of $200,000, would the ARR change? Explain and recalculate if necessary. Does this investment pass Toy World's ARR screening rule? First, enter the formula, then compute the ARR of the sandbox toy project. (Enter amounts in dollars, not millions. Enter your answer as a percent rounded to two decimal places.) Accounting - rate of return Average annual operating income from asset 1305000 Initial investment 50000g -| 20.20 |96