Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 8 Issued credit memo to Targhee Co . for merchandise with an invoice amount of $ 4 , 8 0 0 returned from sale

Issued credit memo to Targhee Co for merchandise with an invoice amount of $ returned from

sale on March The cost of the merchandise returned was $

Record on page of the journal

Mar. Sold merchandise on account to Vista Co $ terms FOB shipping point, neom Added $ to the

invoice for prepaid freight. The cost of the goods sold was $ Record the freight as a separate

transaction.

Received check for amount due from Vista Co for sale of March

Received check for amount due from Empire Co for sale of March

Paid Fleetwood Delivery Service $ for merchandise delivered during March to customers under

shipping terms of FOB destination.

Paid local newspaper $ for advertising that included pointofsale coupons for $ off April

purchases of $ or more. It is estimated that of the coupons will be redeemed. Do not create any

liability for the estimated coupon redemption at this time.

Apr. Received check for amount due from Equinox Co for sale on March

Paid City Bank $ for service fees for handling MasterCard and American Express sales during

March. Paid City Bank $ for service fees for handling MasterCard and American Express sales during

March.

Paid $ to state sales tax division for taxes owed on sales.

Received check for amount due from Targhee Co for sale on March less credit memo of March

Sold merchandise with a list price of $ to customers using MasterCard. Customers redeemed

of the pointofsale, $off coupons distributed on March The cost of the merchandise sold

was $

Required:

Journalize the entries to record the transactions of Amsterdam Supply Co CHART OF ACCOUNTS

Amsterdam Supply Co

General Ledger

ASSETS

Cash

Accounts ReceivableEmpire Co

Accounts ReceivableEquinox Co

Accounts ReceivableTarghee Co

Accounts ReceivableVista Co

Notes Receivable

Inventory

Estimated Returns Inventory

Office Supplies

Store Supplies

REVENUE

Sales

Interest Revenue

EXPENSES

Cost of Goods Sold

Delivery Expense

Advertising Expense

Depreciation ExpenseStore Equipment

Depreciation ExpenseOffice Equipment

Salaries ExpenseChart of Accounts

Store Supplies

Prepaid Insurance

Land

Store Equipment

Accumulated DepreciationStore Equipment

Office Equipment

Accumulated DepreciationOffice Equipment

LIABILITIES

Accounts Payable

Salaries Payable

Sales Tax Payable

Estimated Coupons Payable

Customer Refunds Payable

Notes Payable

Salaries Expense

Rent Expense

Insurance Expense

Store Supplies Expense

Office Supplies Expense

Credit Card Expense

Miscellaneous Expense

Interest Expense General Journal

Journalize the entries to record the transactions of Amsterdam Supply Co

General Journal InstructionsGeneral Journal

PAGE

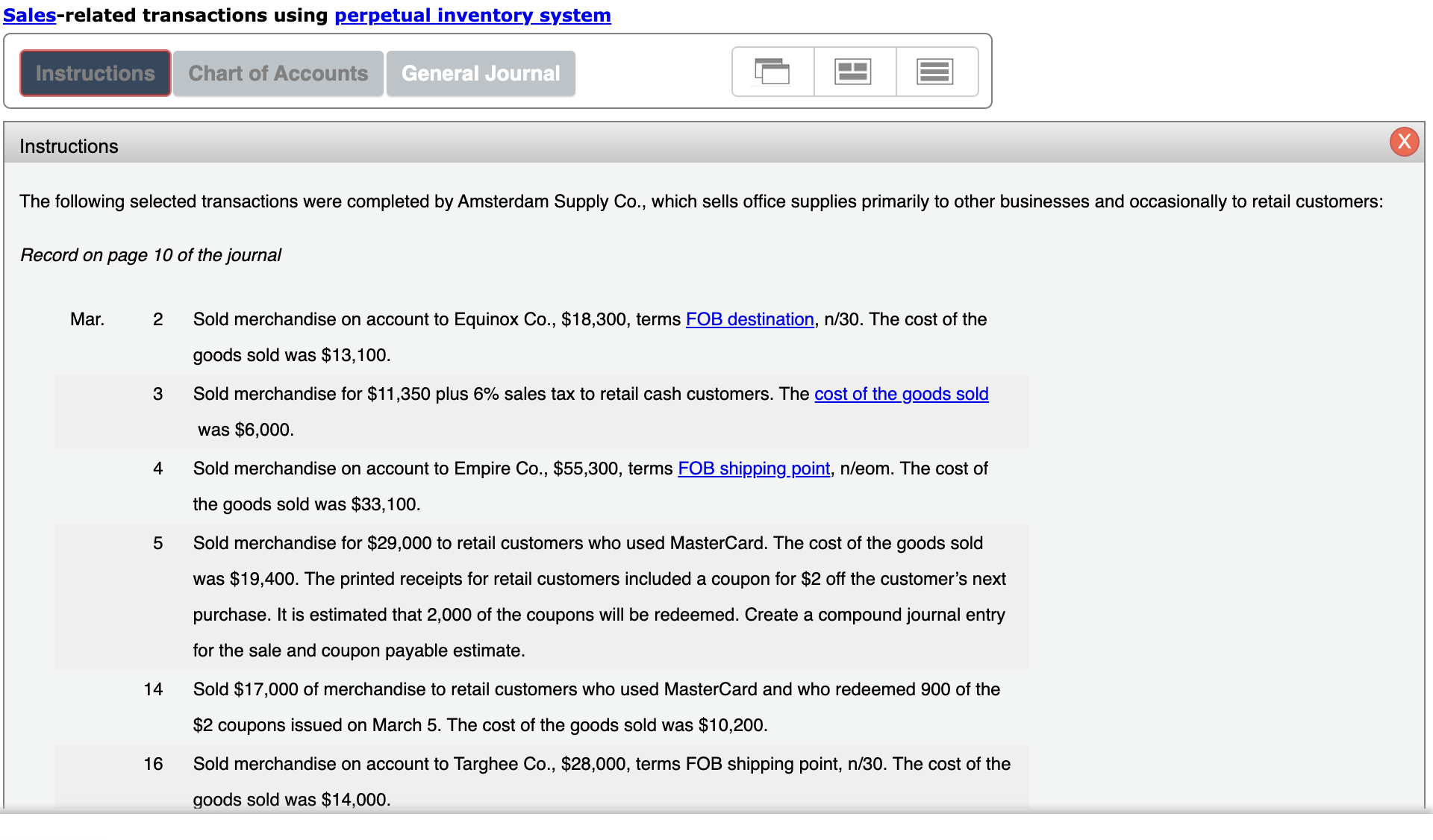

tableJOURNAL,ACCOUNTINThe following selected transactions were completed by Amsterdam Supply Co which sells office supplies primarily to other businesses and occasionally to retail customers:

Record on page of the journal

Mar. Sold merchandise on account to Equinox Co $ terms FOB destination, The cost of the

goods sold was $

Sold merchandise for $ plus sales tax to retail cash customers. The cost of the goods sold

was $

Sold merchandise on account to Empire Co $ terms FOB shippingpoint, neom The cost of

the goods sold was $

Sold merchandise for $ to retail customers who used MasterCard. The cost of the goods sold

was $ The printed receipts for retail customers included a coupon for $ off the customer's next

purchase. It is estimated that of the coupons will be redeemed. Create a compound journal entry

for the sale and coupon payable estimate.

Sold $ of merchandise to retail customers who used MasterCard and who redeemed of the

$ coupons issued on March The cost of the goods sold was $

Sold merchandise on account to Targhee Co $ terms FOB shipping point, The cost of the

goods sold was $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started