Answered step by step

Verified Expert Solution

Question

1 Approved Answer

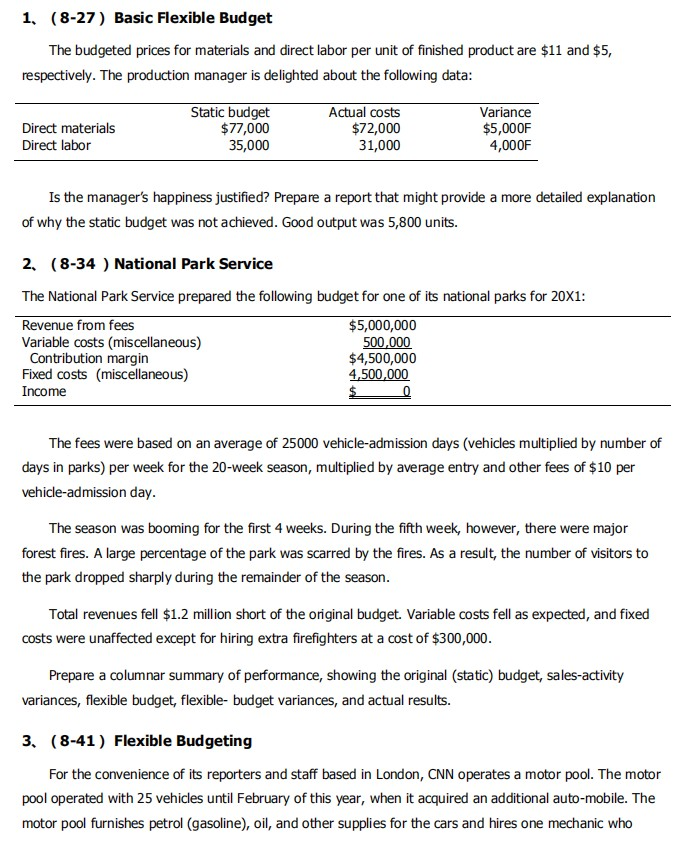

1. (8-27) Basic Flexible Budget The budgeted prices for materials and direct labor per unit of finished product are $11 and $5, respectively. The production

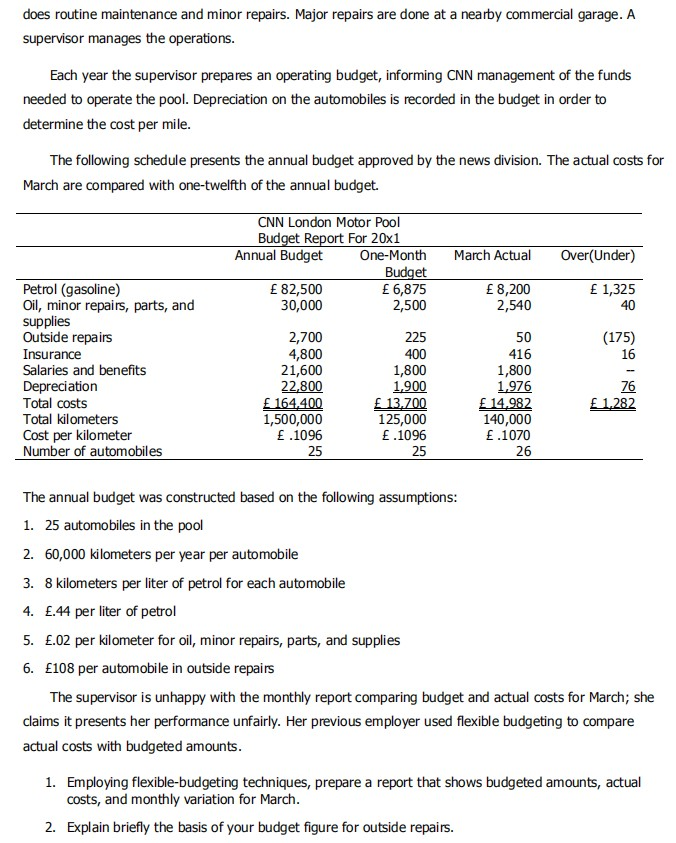

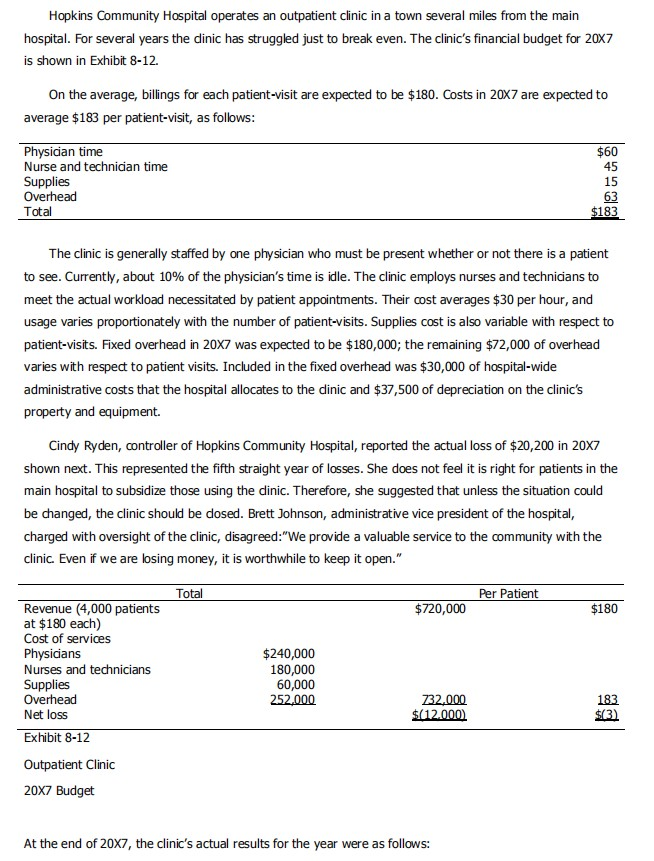

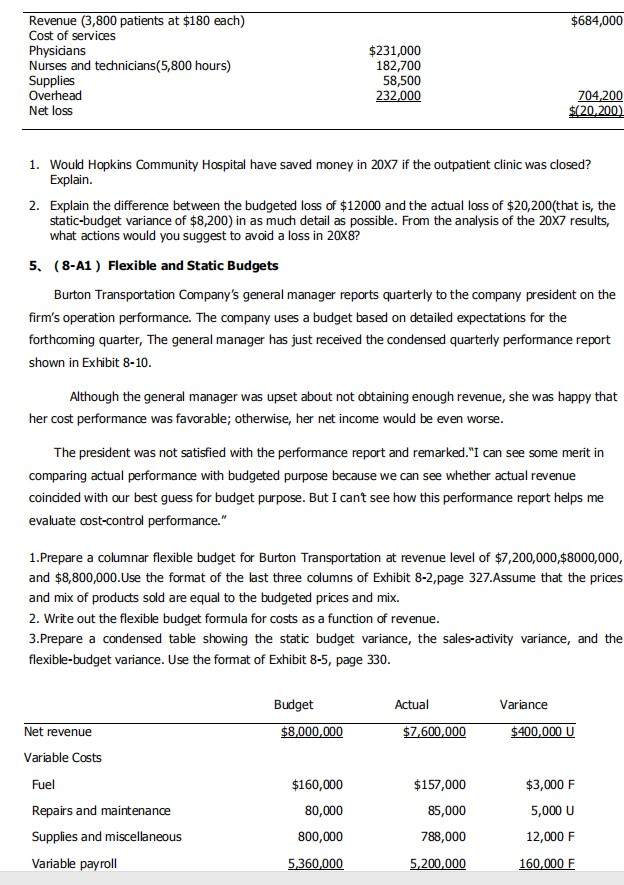

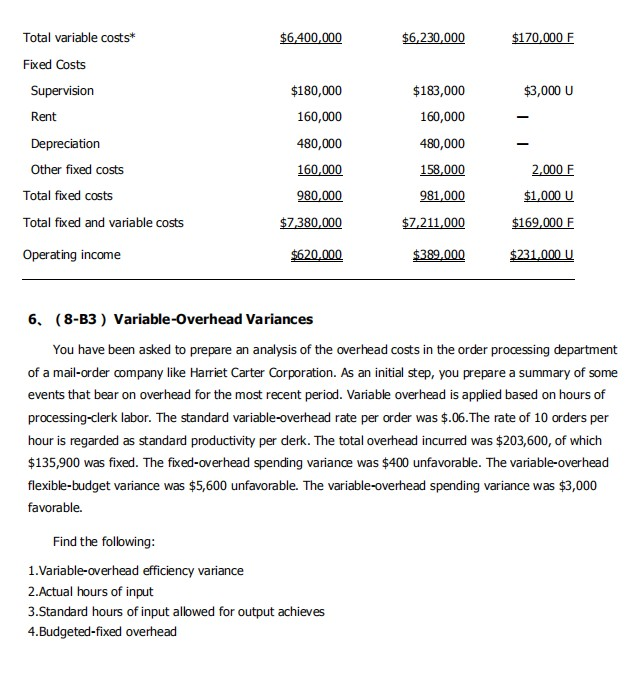

1. (8-27) Basic Flexible Budget The budgeted prices for materials and direct labor per unit of finished product are $11 and $5, respectively. The production manager is delighted about the following data: Direct materials Direct labor Static budget $77,000 35,000 Actual costs $72,000 31,000 Variance $5,000F 4,00 OF Is the manager's happiness justified? Prepare a report that might provide a more detailed explanation of why the static budget was not achieved. Good output was 5,800 units. 2, (8-34 ) National Park Service The National Park Service prepared the following budget for one of its national parks for 20X1: Revenue from fees Variable costs (miscellaneous) Contribution margin Fixed costs (miscellaneous) Income $5,000,000 500,000 $4,500,000 4,500,000 0 The fees were based on an average of 25000 vehicle-admission days (vehicles multiplied by number of days in parks) per week for the 20-week season, multiplied by average entry and other fees of $10 per vehicle-admission day. The season was booming for the first 4 weeks. During the fifth week, however, there were major forest fires. A large percentage of the park was scarred by the fires. As a result, the number of visitors to the park dropped sharply during the remainder of the season. Total revenues fell $1.2 million short of the original budget. Variable costs fell as expected, and fixed costs were unaffected except for hiring extra firefighters at a cost of $300,000. Prepare a columnar summary of performance, showing the original (static) budget, sales-activity variances, flexible budget, flexible-budget variances, and actual results. 3. (8-41 ) Flexible Budgeting For the convenience of its reporters and staff based in London, CNN operates a motor pool. The motor pool operated with 25 vehicles until February of this year, when it acquired an additional auto-mobile. The motor pool furnishes petrol (gasoline), oil, and other supplies for the cars and hires one mechanic who does routine maintenance and minor repairs. Major repairs are done at a nearby commercial garage. A supervisor manages the operations. Each year the supervisor prepares an operating budget, informing CNN management of the funds needed to operate the pool. Depreciation on the automobiles is recorded in the budget in order to determine the cost per mile. The following schedule presents the annual budget approved by the news division. The actual costs for March are compared with one-twelfth of the annual budget. March Actual Over(Under) CNN London Motor Pool Budget Report For 20x1 Annual Budget One-Month Budget 82,500 6,875 30,000 2,500 8,200 2,540 1,325 (175) Petrol (gasoline) Oil, minor repairs, parts, and supplies Outside repairs Insurance Salaries and benefits Depreciation Total costs Total kilometers Cost per kilometer Number of automobiles 2,700 4,800 21,600 22,800 164.400 1,500,000 .1096 225 400 1,800 1.900 13.700 125,000 .1096 25 50 416 1,800 1,976 14.982 140,000 .1070 26 1.282 25 The annual budget was constructed based on the following assumptions: 1. 25 automobiles in the pool 2. 60,000 kilometers per year per automobile 3. 8 kilometers per liter of petrol for each automobile 4. .44 per liter of petrol 5. .02 per kilometer for oil, minor repairs, parts, and supplies 6. 108 per automobile in outside repairs The supervisor is unhappy with the monthly report comparing budget and actual costs for March; she claims it presents her performance unfairly. Her previous employer used flexible budgeting to compare actual costs with budgeted amounts. 1. Employing flexible-budgeting techniques, prepare a report that shows budgeted amounts, actual costs, and monthly variation for March. 2. Explain briefly the basis of your budget figure for outside repairs. Hopkins Community Hospital operates an outpatient clinic in a town several miles from the main hospital. For several years the dinic has struggled just to break even. The clinic's financial budget for 20x7 is shown in Exhibit 8-12. On the average, billings for each patient-visit are expected to be $180. Costs in 20X7 are expected to average $183 per patient-visit, as follows: $60 Physician time Nurse and technician time Supplies Overhead 15 Total $183 The clinic is generally staffed by one physician who must be present whether or not there is a patient to see. Currently, about 10% of the physician's time is idle. The clinic employs nurses and technicians to meet the actual workload necessitated by patient appointments. Their cost averages $30 per hour, and usage varies proportionately with the number of patient-visits. Supplies cost is also variable with respect to patient-visits. Fixed overhead in 20X7 was expected to be $180,000; the remaining $72,000 of overhead varies with respect to patient visits. Included in the fixed overhead was $30,000 of hospital-wide administrative costs that the hospital allocates to the dinic and $37,500 of depreciation on the clinic's property and equipment. Cindy Ryden, controller of Hopkins Community Hospital, reported the actual loss of $20,200 in 20X7 shown next. This represented the fifth straight year of losses. She does not feel it is right for patients in the main hospital to subsidize those using the dinic. Therefore, she suggested that unless the situation could be changed, the clinic should be dosed. Brett Johnson, administrative vice president of the hospital, charged with oversight of the clinic, disagreed:"We provide a valuable service to the community with the clinic. Even if we are losing money, it is worthwhile to keep it open." Total Per Patient $720,000 $180 Revenue (4,000 patients at $180 each) Cost of services Physicians Nurses and technicians Supplies Overhead Net loss Exhibit 8-12 $240,000 180,000 60,000 252,000 732.000 $(12.000) 183 $(3) Outpatient Clinic 20X7 Budget At the end of 20X7, the clinic's actual results for the year were as follows: $684,000 Revenue (3,800 patients at $180 each) Cost of services Physicians Nurses and technicians(5,800 hours) Supplies Overhead Net loss $231,000 182,700 58,500 232,000 704,200 $(20,200) 1. Would Hopkins Community Hospital have saved money in 20X7 if the outpatient clinic was closed? Explain. 2. Explain the difference between the budgeted loss of $12000 and the actual loss of $20,200(that is, the static-budget variance of $8,200) in as much detail as possible. From the analysis of the 20X7 results, what actions would you suggest to avoid a loss in 20X8? 5. (8-A1 ) Flexible and Static Budgets Burton Transportation Company's general manager reports quarterly to the company president on the firm's operation performance. The company uses a budget based on detailed expectations for the forthcoming quarter, The general manager has just received the condensed quarterly performance report shown in Exhibit 8-10. Although the general manager was upset about not obtaining enough revenue, she was happy that her cost performance was favorable; otherwise, her net income would be even worse. The president was not satisfied with the performance report and remarked. "I can see some merit in comparing actual performance with budgeted purpose because we can see whether actual revenue coincided with our best guess for budget purpose. But I cant see how this performance report helps me evaluate cost-control performance." 1. Prepare a columnar flexible budget for Burton Transportation at revenue level of $7,200,000,$8000,000, and $8,800,000. Use the format of the last three columns of Exhibit 8-2, page 327.Assume that the prices and mix of products sold are equal to the budgeted prices and mix. 2. Write out the flexible budget formula for costs as a function of revenue. 3.Prepare a condensed table showing the static budget variance, the sales-activity variance, and the flexible-budget variance. Use the format of Exhibit 8-5, page 330. Actual Variance Budget $8,000,000 Net revenue $7,600,000 $400,000 U Variable Costs Fuel $3,000 F $160,000 80,000 $157,000 85,000 5,000 U Repairs and maintenance Supplies and miscellaneous 800,000 788,000 12,000 F Variable payroll 5,360,000 5,200,000 160,000 F Total variable costs* $6,400,000 $6,230,000 $170,000 F Fixed Costs Supervision $180,000 $3,000 U $183,000 160,000 Rent 160,000 480,000 Depreciation 480,000 Other fixed costs 160,000 Total fixed costs 980,000 158,000 981,000 $7,211,000 2,000 F $1,000 U $169,000 F Total fixed and variable costs $7,380,000 Operating income $620,000 $389,000 $231.000 U 6. (8-B3) Variable-Overhead Variances You have been asked to prepare an analysis of the overhead costs in the order processing department of a mail-order company like Harriet Carter Corporation. As an initial step, you prepare a summary of some events that bear on overhead for the most recent period. Variable overhead is applied based on hours of processing-clerk labor. The standard variable-overhead rate per order was $.06.The rate of 10 orders per hour is regarded as standard productivity per derk. The total overhead incurred was $203,600, of which $135,900 was fixed. The fixed-overhead spending variance was $400 unfavorable. The variable-overhead flexible-budget variance was $5,600 unfavorable. The variable-overhead spending variance was $3,000 favorable. Find the following: 1. Variable-overhead efficiency variance 2.Actual hours of input 3.Standard hours of input allowed for output achieves 4.Budgeted-fixed overhead

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started