Answered step by step

Verified Expert Solution

Question

1 Approved Answer

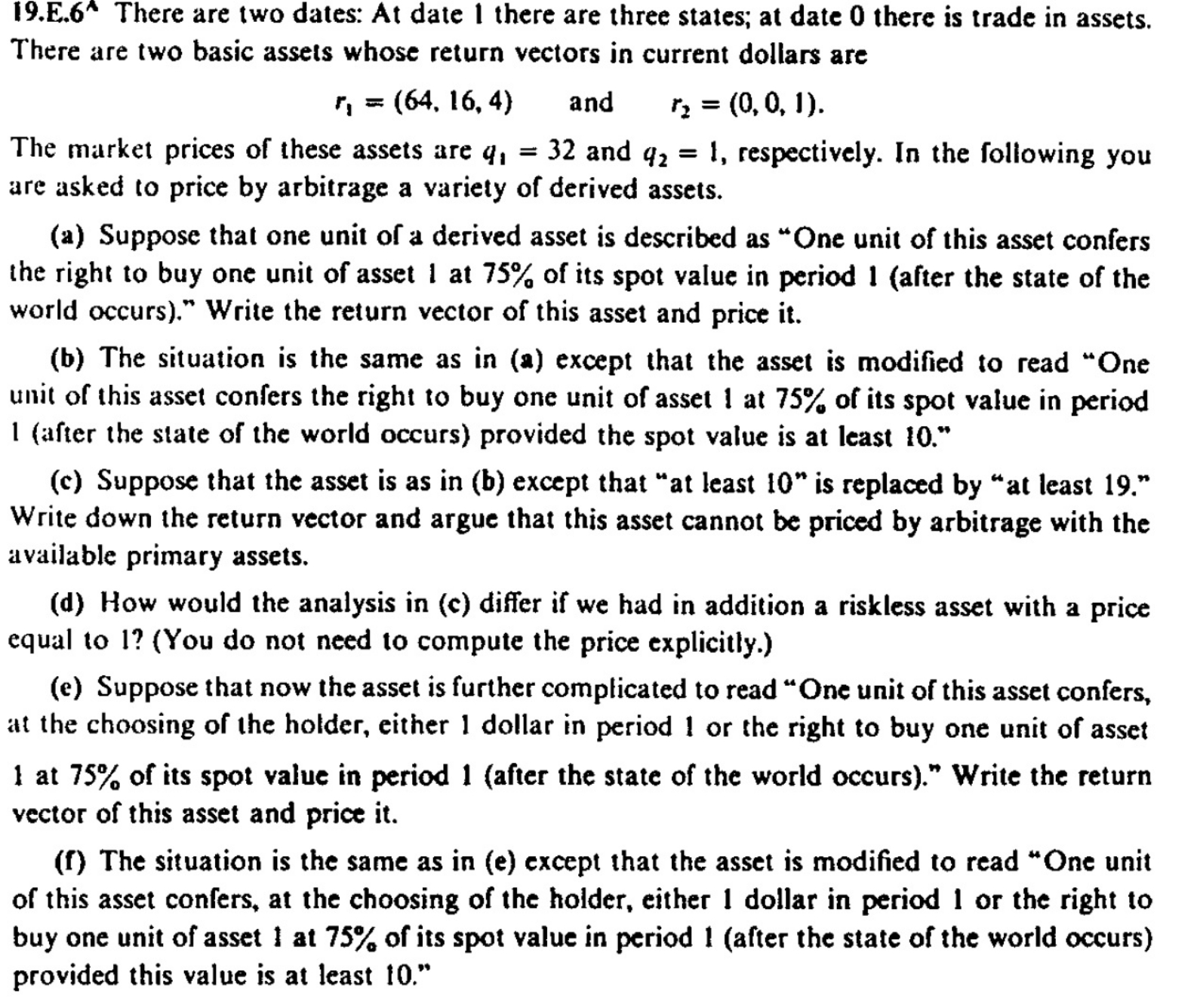

1 9 . E . 6 ? There are two dates: At date 1 there are three states; at date 0 there is trade in

E There are two dates: At date there are three states; at date there is trade in assets.

There are two basic assets whose return vectors in current dollars are

and

The market prices of these assets are and respectively. In the following you

are asked to price by arbitrage a variety of derived assets.

a Suppose that one unit of a derived asset is described as "One unit of this asset confers

the right to buy one unit of asset at of its spot value in period after the state of the

world occurs Write the return vector of this asset and price it

b The situation is the same as in a except that the asset is modified to read "One

unit of this asset confers the right to buy one unit of asset at of its spot value in period

after the state of the world occurs provided the spot value is at least

c Suppose that the asset is as in b except that at least is replaced by at least

Write down the return vector and argue that this asset cannot be priced by arbitrage with the

available primary assets.

d How would the analysis in c differ if we had in addition a riskless asset with a price

equal to You do not need to compute the price explicitly.

e Suppose that now the asset is further complicated to read "One unit of this asset confers,

at the choosing of the holder, either dollar in period or the right to buy one unit of asset

at of its spot value in period after the state of the world occurs Write the return

vector of this asset and price it

f The situation is the same as in e except that the asset is modified to read "One unit

of this asset confers, at the choosing of the holder, either dollar in period or the right to

buy one unit of asset at of its spot value in period after the state of the world occurs

provided this value is at least

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started