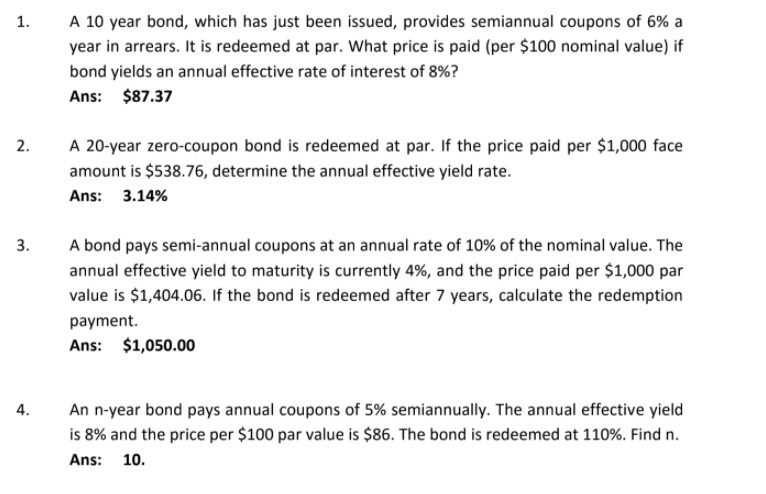

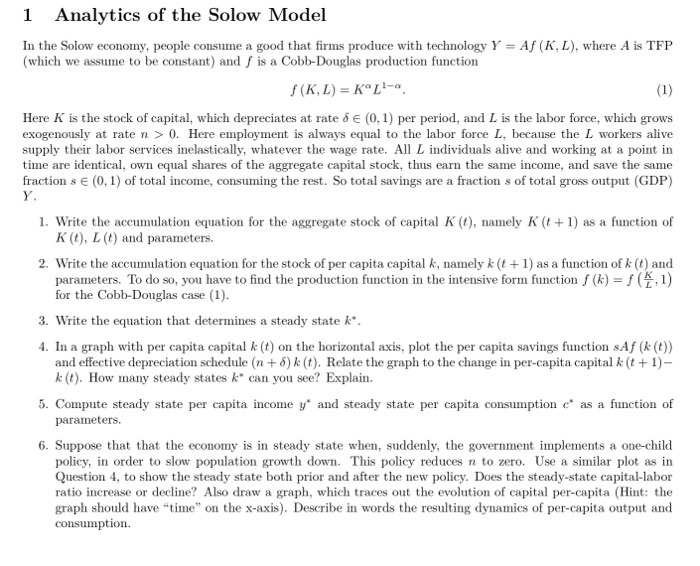

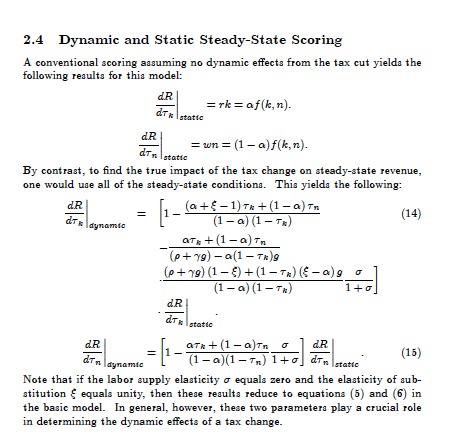

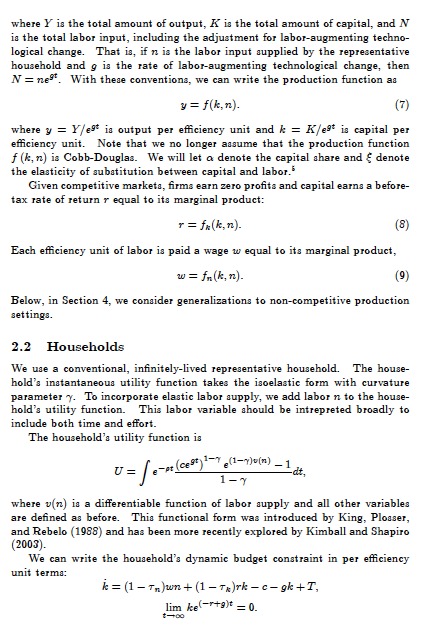

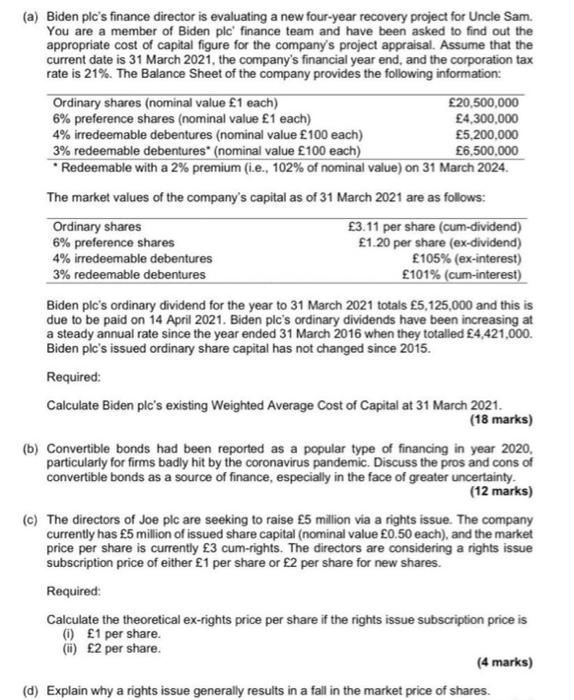

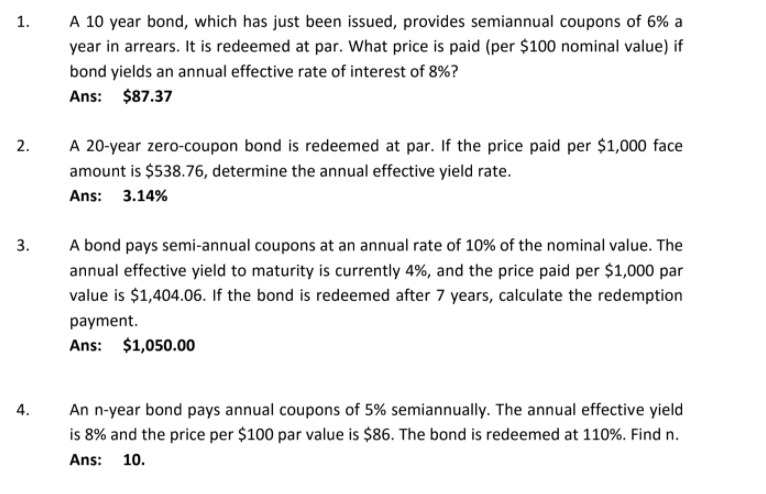

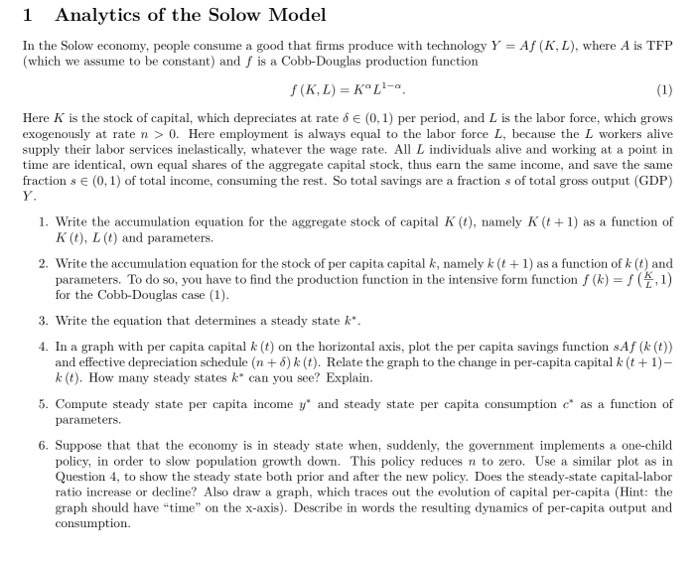

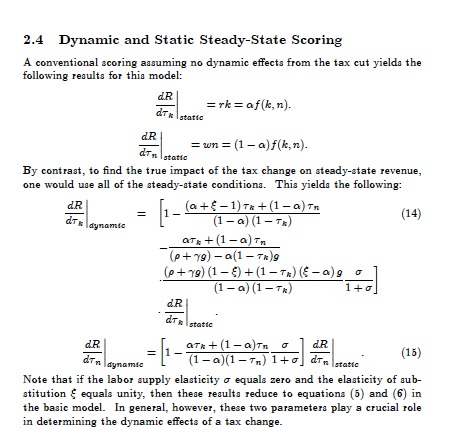

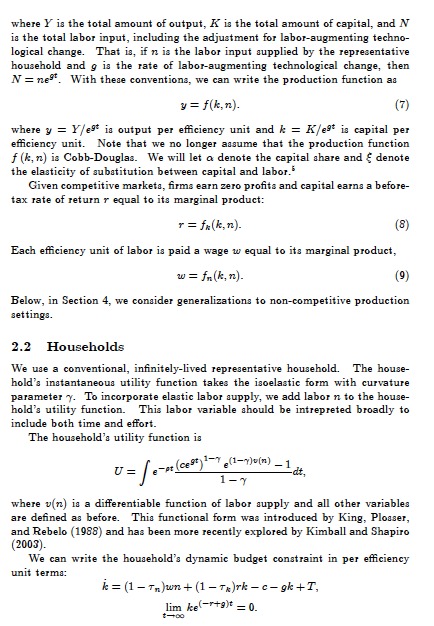

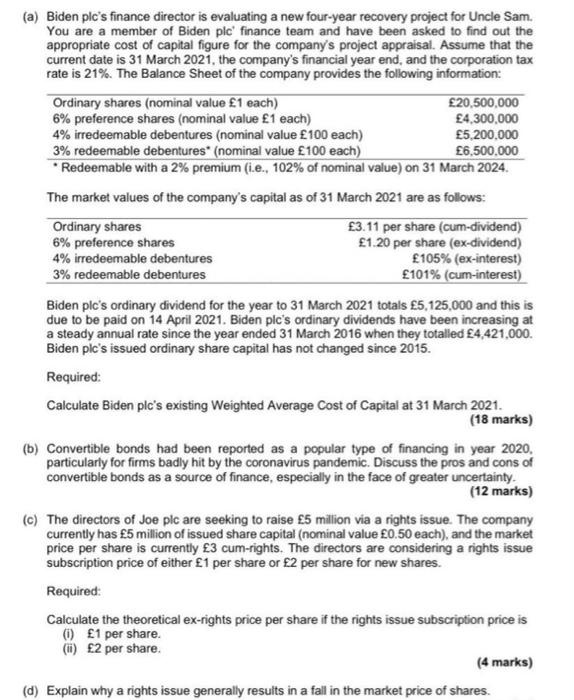

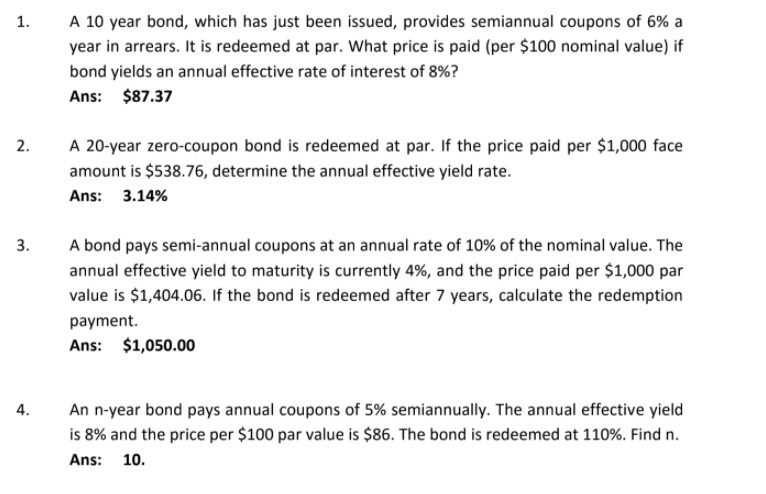

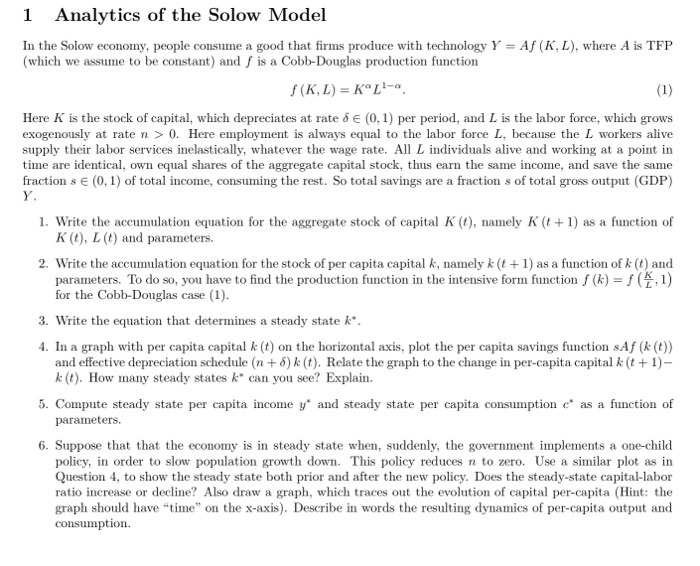

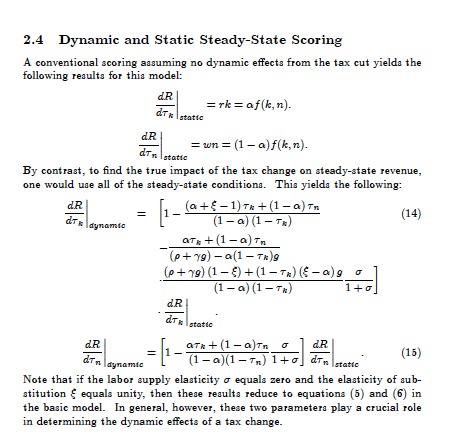

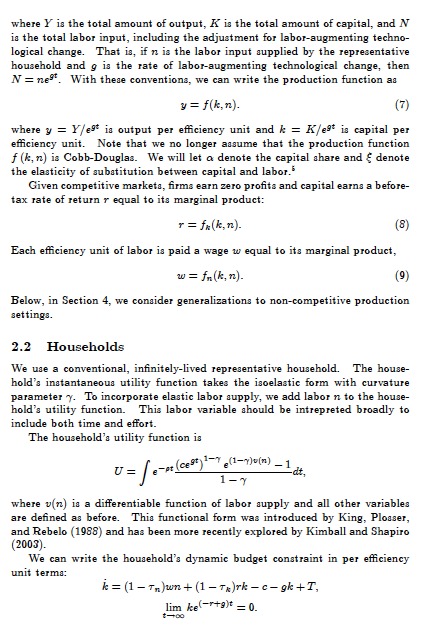

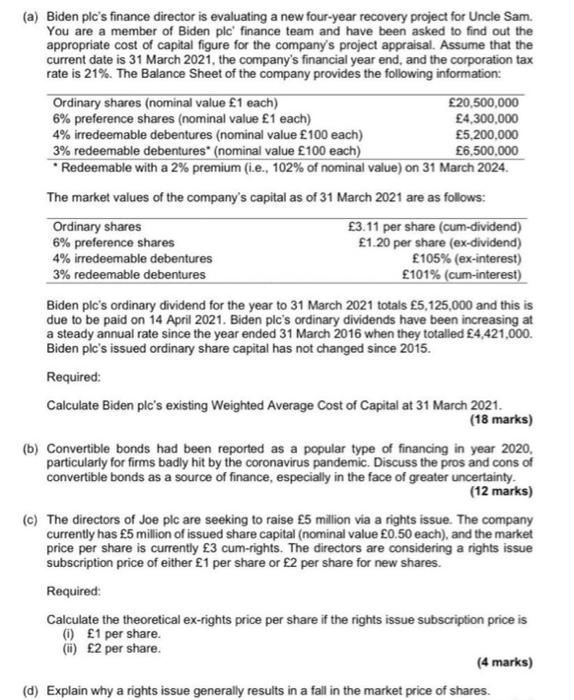

1. A 10 year bond, which has just been issued, provides semiannual coupons of 6% a year in arrears. It is redeemed at par. What price is paid (per $100 nominal value) if bond yields an annual effective rate of interest of 8%? Ans: $87.37 2. A 20-year zero-coupon bond is redeemed at par. If the price paid per $1,000 face amount is $538.76, determine the annual effective yield rate. Ans: 3.14% 3. A bond pays semi-annual coupons at an annual rate of 10% of the nominal value. The annual effective yield to maturity is currently 4%, and the price paid per $1,000 par value is $1,404.06. If the bond is redeemed after 7 years, calculate the redemption payment. Ans: $1,050.00 4. An n-year bond pays annual coupons of 5% semiannually. The annual effective yield is 8% and the price per $100 par value is $86. The bond is redeemed at 110%. Find n. Ans: 10.1 Analytics of the Solow Model In the Solow economy, people consume a good that firms produce with technology Y = Af (K, L), where A is TFP (which we assume to be constant) and f is a Cobb-Douglas production function f ( K, L) = KOL-a. (1) Here K is the stock of capital, which depreciates at rate o e (0, 1) per period, and L is the labor force, which grows exogenously at rate n > 0. Here employment is always equal to the labor force L, because the L workers alive supply their labor services inelastically, whatever the wage rate. All L individuals alive and working at a point in time are identical, own equal shares of the aggregate capital stock, thus earn the same income, and save the same fraction s E (0, 1) of total income, consuming the rest. So total savings are a fraction s of total gross output (GDP) Y. 1. Write the accumulation equation for the aggregate stock of capital K (), namely K (t + 1) as a function of K (t), L (t) and parameters. 2. Write the accumulation equation for the stock of per capita capital k, namely k (t + 1) as a function of k (t) and parameters. To do so, you have to find the production function in the intensive form function / (#) = f (7,1) for the Cobb-Douglas case (1). 3. Write the equation that determines a steady state &*. 4. In a graph with per capita capital & (t) on the horizontal axis, plot the per capita savings function sAf (k ()) and effective depreciation schedule (n + 6) k (). Relate the graph to the change in per-capita capital k (t + 1)- k (t). How many steady states k* can you see? Explain. 5. Compute steady state per capita income y" and steady state per capita consumption c* as a function of parameters. 6. Suppose that that the economy is in steady state when, suddenly, the government implements a one-child policy, in order to slow population growth down. This policy reduces n to zero. Use a similar plot as in Question 4, to show the steady state both prior and after the new policy. Does the steady-state capital-labor ratio increase or decline? Also draw a graph, which traces out the evolution of capital per-capita (Hint: the graph should have "time" on the x-axis). Describe in words the resulting dynamics of per-capita output and consumption.2.4 Dynamic and Static Steady-State Scoring A conventional scoring assuming no dynamic effects from the tax cut yields the following results for this model: d.R =rk =of (k, n). dix static d.R =wn = (1 - a)f(k,n). an static By contrast, to find the true impact of the tax change on steady-state revenue, one would use all of the steady-atate conditions. This yields the following: = 1_ (a+(-1) Tat (1 -Q) Tn (14) AT & dynamic (1 -a) (1-72) are+(1-a)in (p+ 79) - a(1 - TA)9 (p+ 79) (1 - 5) + (1 - JA) (6 -0)9 0 (1 -a) (1-7*) 1to d.R Ta static AR at+ (1 - a)in d.R. (15) din dynamic (1-a)(1- 7) 1+] din static Note that if the labor supply elasticity o equals zero and the elasticity of sub- stitution { equals unity, then these results reduce to equations (5) and (6) in the basic model. In general, however, these two parameters play a crucial role in determining the dynamic effects of a tax change.where Y is the total amount of output, A is the total amount of capital, and N is the total labor input, including the adjustment for labor-augmenting techno- logical change. That is, if n is the labor input supplied by the representative household and g is the rate of labor-augmenting technological change, then N= ne". With these conventions, we can write the production function as y = f(k, n). (7) where y = 1/e" is output per efficiency unit and k = Kest is capital per efficiency unit. Note that we no longer assume that the production function f (k, n) is Cobb-Douglas. We will let a denote the capital share and { denote the elasticity of substitution between capital and labor. Given competitive markets, firms earn zero profits and capital earns a before- tax rate of return r equal to its marginal product: r = f*( k,n). (8) Each efficiency unit of labor is paid a wage w equal to its marginal product, w = fn( k, n). (9) Below, in Section 4, we consider generalizations to non-competitive production settings. 2.2 Households We use a conventional, infinitely-lived representative household. The house- hold's instantaneous utility function takes the isoelastic form with curvature parameter y. To incorporate elastic labor supply, we add labor n to the house- hold's utility function. This labor variable should be intrepreted broadly to include both time and effort. The household's utility function is U= e-m (ce)1-7 (1-)(m) - 1 1-7 where v(n) is a differentiable function of labor supply and all other variables are defined as before. This functional form was introduced by King, Ploaser, and Rebelo (1988) and has been more recently explored by Kimball and Shapiro (2003). We can write the household's dynamic budget constraint in per efficiency unit terms: k= (1 - T)wn+ (1 -Tx)rk - c- gk+I, lim kertalt = 0.2 A More General Ramsey Model In this and the next three sections, we extend the basic Ramsey model along a number of dimensions. In this section we include elastic labor supply and a more general production technology. We also present a more detailed derivation of our results. To allow for elastic labor supply, we use a form of preferences over consump- tion and labor proposed by King, Plosser, and Rebelo (1988). King-Plosser- Rebelo preferences have the property that the uncompensated elasticity of labor supply is zero. This feature has the appealing implication that long-run growth caused by technological progress does not lead to a trend in hours worked. The compensated (constant-consumption) elasticity of labor supply need not be zero, however. This parameter, which we will call o, will have a significant role in some of our results. 2.1 Firms We begin with production. Assume there are many identical firms in competi- tive input and output markets, producing output with constant returns to scale technology according to the production function Y = F(K, N), The feedback depends critically on the tax rate. If the capital tax rate were 0.40 instead of 0.15, and all other parameter values are the some, the feedback from a capital tax cut would be 75 percent rether than 50 percent. The literature on taxation in the United States suggests that our choice of 7% = 7 = 0.25 is within the range of plausible estimates, although perhaps a bit conservative. Mendoza, Romin, and Tesar (1994) estimate a 40.7 percent capital tax rate (applied to corporate and non-corporate capital) for the United States in 1986, the last year of their series. This is above the estimate given by Gravelle (2004), who reports a rate of 37 percent for all capital in that year. Gravelle extends her estimates through 2003, by which point the capital tax rate had fallen to 17 percent. Mendoza et al. estimate a labor tax rate of 28.5 percent in 1980, together with a consumption tax of about 5 percent; these tax rates would combine to be equivalent to a tax on labor of about 31 percent.(a) Biden pic's finance director is evaluating a new four-year recovery project for Uncle Sam. You are a member of Biden pic' finance team and have been asked to find out the appropriate cost of capital figure for the company's project appraisal. Assume that the current date is 31 March 2021. the company's financial year end, and the corporation tax rate is 21%. The Balance Sheet of the company provides the following information: Ordinary shares (nominal value $1 each) E20,500,000 6% preference shares (nominal value $1 each) E4,300.000 4% irredeemable debentures (nominal value (100 each) $5,200,000 3% redeemable debentures" (nominal value [100 each) E6.500.000 *Redeemable with a 2% premium (i.e., 102% of nominal value) on 31 March 2024. The market values of the company's capital as of 31 March 2021 are as follows: Ordinary shares E3.11 per share (cum-dividend) 6% preference shares E1.20 per share (ex-dividend) 4% irredeemable debentures (105% (ex-interest) 3% redeemable debentures $101% (cum-interest) Biden pic's ordinary dividend for the year to 31 March 2021 totals $5,125,000 and this is due to be paid on 14 April 2021. Biden pic's ordinary dividends have been increasing at a steady annual rate since the year ended 31 March 2016 when they totalled $4,421,000. Biden pic's issued ordinary share capital has not changed since 2015. Required: Calculate Biden pic's existing Weighted Average Cost of Capital at 31 March 2021. (18 marks) (b) Convertible bonds had been reported as a popular type of financing in year 2020. particularly for firms badly hit by the coronavirus pandemic. Discuss the pros and cons of convertible bonds as a source of finance, especially in the face of greater uncertainty. (12 marks) (c) The directors of Joe pic are seeking to raise $5 million via a rights issue. The company currently has $5 million of issued share capital (nominal value $0.50 each), and the market price per share is currently $3 cum-rights. The directors are considering a rights issue subscription price of either $1 per share or $2 per share for new shares. Required: Calculate the theoretical ex-rights price per share if the rights issue subscription price is (i) 61 per share. (ii) E2 per share. (4 marks) (d) Explain why a rights issue generally results in a fall in the market price of shares