Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) A $32,000 loan is taken out on a boat with the terms 3% APR for 36 months. How much are the monthly payments on

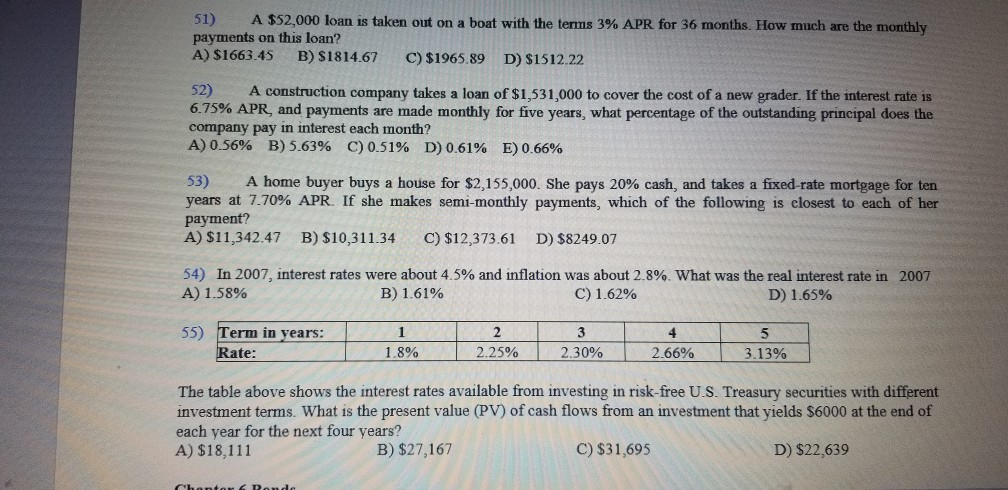

1) A $32,000 loan is taken out on a boat with the terms 3% APR for 36 months. How much are the monthly payments on this loan? A) $1663.45 B) $1814.67 C) $1965.89 D) $1512.22 52) A construction company takes a loan of $1,531,000 to cover the cost of a new grader. If the interest rate is! 6.75% APR, and payments are made monthly for five years, what percentage of the outstanding principal does the company pay in interest each month? A) 0.56% B) 5.63% C) 0.51% D) 0.61% E) 0.66% 53) A home buyer buys a house for $2,155,000. She pays 20% cash, and takes a fixed-rate mortgage for ten years at 7.70% APR. If she makes semi-monthly payments, which of the following is closest to each of her payment? A) $11,342.47 B) $10,311.34 C) $12,373.61 D) $8249.07 54) In 2007, interest rates were about 4.5% and inflation was about 2.8%. What was the real interest rate in 2007 A) 1.58% B) 1.61% C) 1.62% D) 1.65% 55) Term in years: Rate: 1 1.8% 2 2.25% 3 2.30% 4 2.66% 5 3.13% The table above shows the interest rates available from investing in risk-free U.S. Treasury securities with different investment terms. What is the present value (PV) of cash flows from an investment that yields $6000 at the end of each year for the next four years? A) $18,111 B) $27,167 C) $31,695 D) $22,639

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started