Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 ) A . An explanation of why I chose ( or did not choose ) to early adopt the goodwill impairment testing provisions of

A An explanation of why I chose or did not choose to early adopt the goodwill impairment testing provisions of ASU ;

B an evaluation of the efficacy of the reported goodwill amount from Requirement in contributing to the quality of the information reported to AM shareholders and the public.

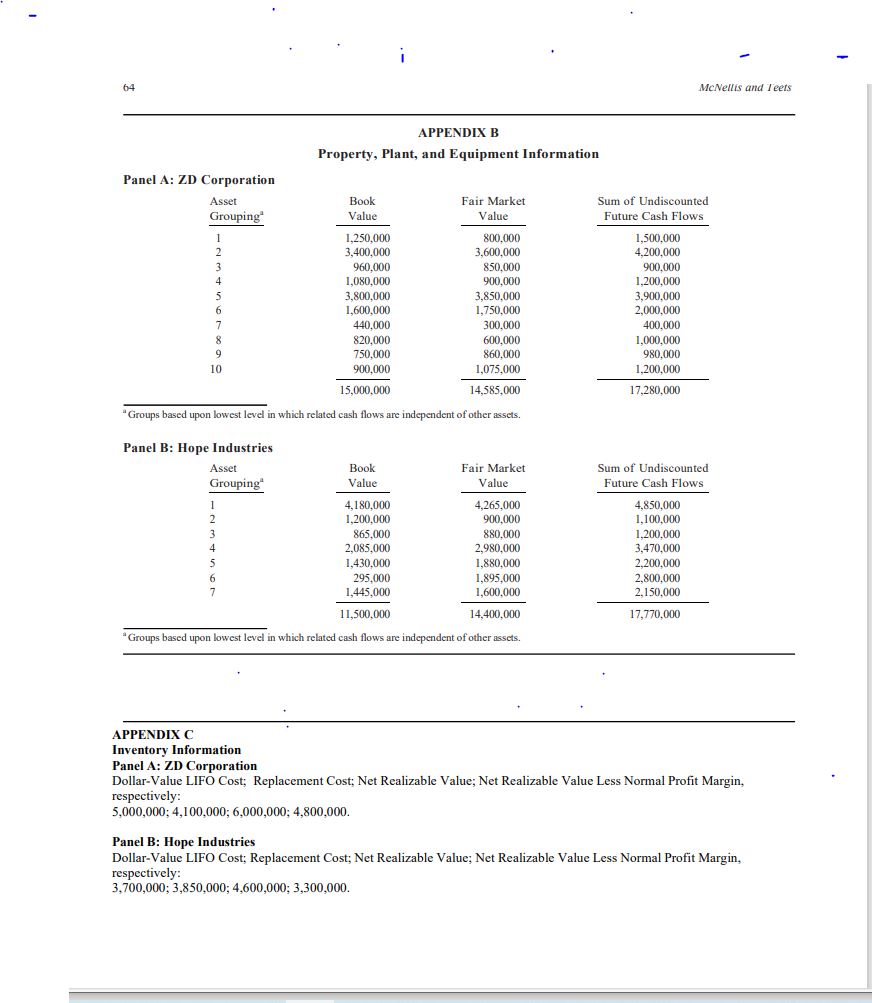

64 Panel A: ZD Corporation APPENDIX B Property, Plant, and Equipment Information McNellis and Teets Asset Grouping" Book Fair Market Value Value 1 1,250,000 800,000 2 3,400,000 3,600,000 Sum of Undiscounted Future Cash Flows 1,500,000 4,200,000 3 960,000 850,000 900,000 4 1,080,000 900,000 1,200,000 5 3,800,000 3,850,000 3,900,000 6 1,600,000 1,750,000 2,000,000 7 440,000 300,000 400,000 8 820,000 600,000 1,000,000 9 750,000 860,000 980,000 10 900,000 1,075,000 1,200,000 15,000,000 14,585,000 17,280,000 *Groups based upon lowest level in which related cash flows are independent of other assets. Panel B: Hope Industries Asset Book Grouping Value Fair Market Value 1 4,180,000 4,265,000 Sum of Undiscounted Future Cash Flows 4,850,000 2 1,200,000 900,000 1,100,000 3 865,000 880,000 1,200,000 4 2,085,000 2,980,000 3,470,000 5 1,430,000 1,880,000 2,200,000 6 295,000 1,895,000 2,800,000 1,445,000 1,600,000 2,150,000 11,500,000 14,400,000 17,770,000 Groups based upon lowest level in which related cash flows are independent of other assets. APPENDIX C Inventory Information Panel A: ZD Corporation Dollar-Value LIFO Cost; Replacement Cost; Net Realizable Value; Net Realizable Value Less Normal Profit Margin, respectively: 5,000,000; 4,100,000; 6,000,000; 4,800,000. Panel B: Hope Industries Dollar-Value LIFO Cost; Replacement Cost; Net Realizable Value; Net Realizable Value Less Normal Profit Margin, respectively: 3,700,000; 3,850,000; 4,600,000; 3,300,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started