Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A and B each contribute $100,000 to form a limited partnership. A is a general partner and B is a limited partner. The partnership

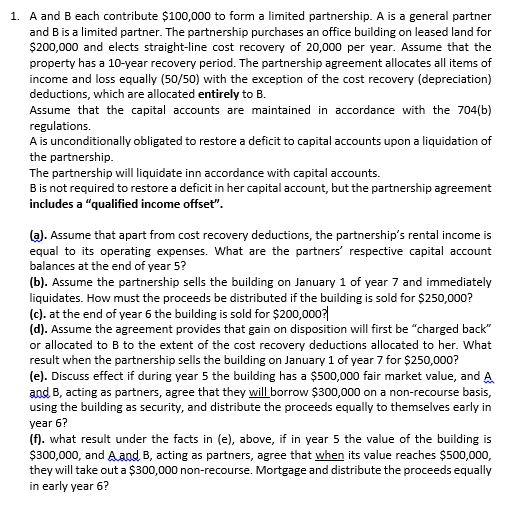

1. A and B each contribute $100,000 to form a limited partnership. A is a general partner and B is a limited partner. The partnership purchases an office building on leased land for $200,000 and elects straight-line cost recovery of 20,000 per year. Assume that the property has a 10-year recovery period. The partnership agreement allocates all items of income and loss equally (50/50) with the exception of the cost recovery (depreciation) deductions, which are allocated entirely to B. Assume that the capital accounts are maintained in accordance with the 704(b) regulations. A is unconditionally obligated to restore a deficit to capital accounts upon a liquidation of the partnership The partnership will liquidate in accordance with capital accounts. Bis not required to restore a deficit in her capital account, but the partnership agreement includes a "qualified income offset". (a). Assume that apart from cost recovery deductions, the partnership's rental income is equal to its operating expenses. What are the partners' respective capital account balances at the end of year 5? (b). Assume the partnership sells the building on January 1 of year 7 and immediately liquidates. How must the proceeds be distributed if the building is sold for $250,000? (c). at the end of year 6 the building is sold for $200,000 (d). Assume the agreement provides that gain on disposition will first be "charged back" or allocated to B to the extent of the cost recovery deductions allocated to her. What result when the partnership sells the building on January 1 of year 7 for $250,000? (e). Discuss effect if during year 5 the building has a $500,000 fair market value, and A and B, acting as partners, agree that they will borrow $300,000 on a non-recourse basis, using the building as security, and distribute the proceeds equally to themselves early in year 6? (f). what result under the facts in (e), above, if in year 5 the value of the building is $300,000, and A and B, acting as partners, agree that when its value reaches $500,000, they will take out a $300,000 non-recourse. Mortgage and distribute the proceeds equally in early year 6? 1. A and B each contribute $100,000 to form a limited partnership. A is a general partner and B is a limited partner. The partnership purchases an office building on leased land for $200,000 and elects straight-line cost recovery of 20,000 per year. Assume that the property has a 10-year recovery period. The partnership agreement allocates all items of income and loss equally (50/50) with the exception of the cost recovery (depreciation) deductions, which are allocated entirely to B. Assume that the capital accounts are maintained in accordance with the 704(b) regulations. A is unconditionally obligated to restore a deficit to capital accounts upon a liquidation of the partnership The partnership will liquidate in accordance with capital accounts. Bis not required to restore a deficit in her capital account, but the partnership agreement includes a "qualified income offset". (a). Assume that apart from cost recovery deductions, the partnership's rental income is equal to its operating expenses. What are the partners' respective capital account balances at the end of year 5? (b). Assume the partnership sells the building on January 1 of year 7 and immediately liquidates. How must the proceeds be distributed if the building is sold for $250,000? (c). at the end of year 6 the building is sold for $200,000 (d). Assume the agreement provides that gain on disposition will first be "charged back" or allocated to B to the extent of the cost recovery deductions allocated to her. What result when the partnership sells the building on January 1 of year 7 for $250,000? (e). Discuss effect if during year 5 the building has a $500,000 fair market value, and A and B, acting as partners, agree that they will borrow $300,000 on a non-recourse basis, using the building as security, and distribute the proceeds equally to themselves early in year 6? (f). what result under the facts in (e), above, if in year 5 the value of the building is $300,000, and A and B, acting as partners, agree that when its value reaches $500,000, they will take out a $300,000 non-recourse. Mortgage and distribute the proceeds equally in early year 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started