Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A, B and C decide to form a partnership for the purpose of developing real property. A and B are wealthy individuals, with no

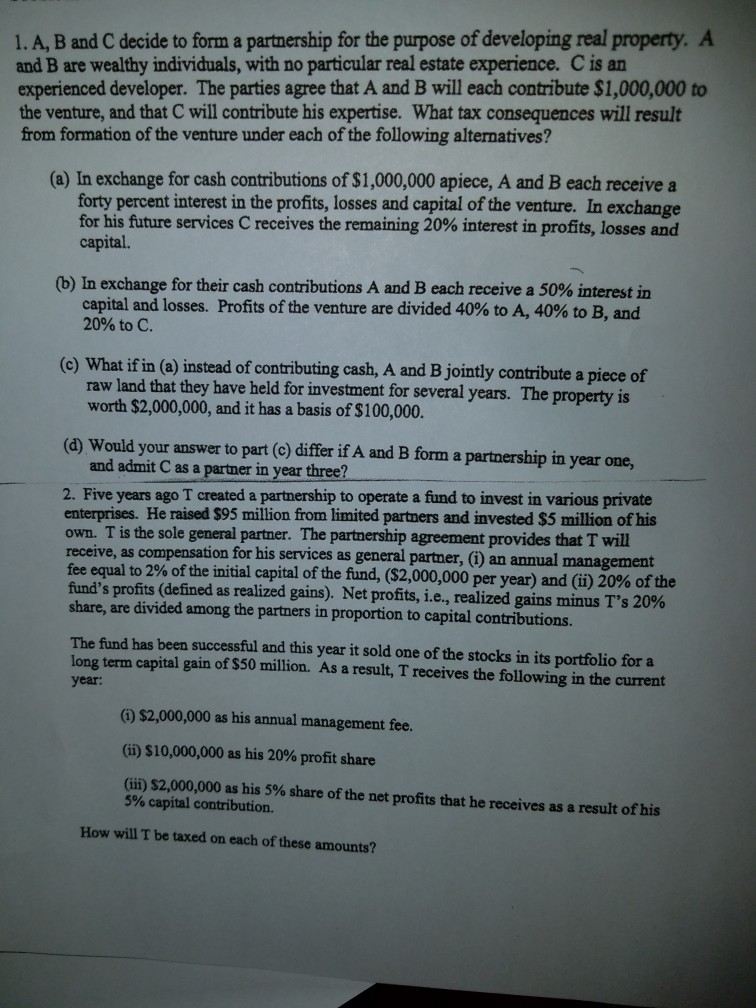

1. A, B and C decide to form a partnership for the purpose of developing real property. A and B are wealthy individuals, with no particular real estate experience. C is an experienced developer. The parties agree that A and B will each contribute $1,000,000 to the venture, and that C will contribute his expertise. What tax consequences will result from formation of the venture under each of the following alternatives? (a) In exchange for cash contributions of $1,000,000 apiece, A and B each receive a forty percent interest in the profits, losses and capital of the venture. In exchange for his future services C receives the remaining 20% interest in profits, losses and capital. (b) In exchange for their cash contributions A and B each receive a 50% interest in capital and losses. Profits of the venture are divided 40% to A, 40% to B, and 20% to C. (c) What if in (a) instead of contributing cash, A and B jointly contribute a piece of raw land that they have held for investment for several years. The property is worth $2,000,000, and it has a basis of $100,000. (d) Would your answer to part (c) differ if A and B form a partnership in year one, and admit C as a partner in year three? 2. Five years ago T created a partnership to operate a fund to invest in various private enterprises. He raised $95 million from limited partners and invested $5 million of his own. T is the sole general partner. The partnership agreement provides that T will receive, as compensation for his services as general partner, (i) an annual management fee equal to 2% of the initial capital of the fund, ($2,000,000 per year) and (ii) 20% of the fund's profits (defined as realized gains). Net profits, ie realized gains minus T's 20% share, are divided among the partners in proportion to capital contributions. The fund has been successful and this year it sold one of the stocks in its portfolio for a long term capital gain of $50 million. As a result, T receives the following in the current year (i) $2,000,000 as his annual management fee. (ii) $10,000,000 as his 20% profit share (iii) $2,000,000 as his 5% share of the net profits that he receives as a result of his 5% capital contribution. How will T be taxed on each of these amounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started