Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(1) A bank granted a credit to 62 firms in the construction business and to 45 firms in the waste management business. Among these

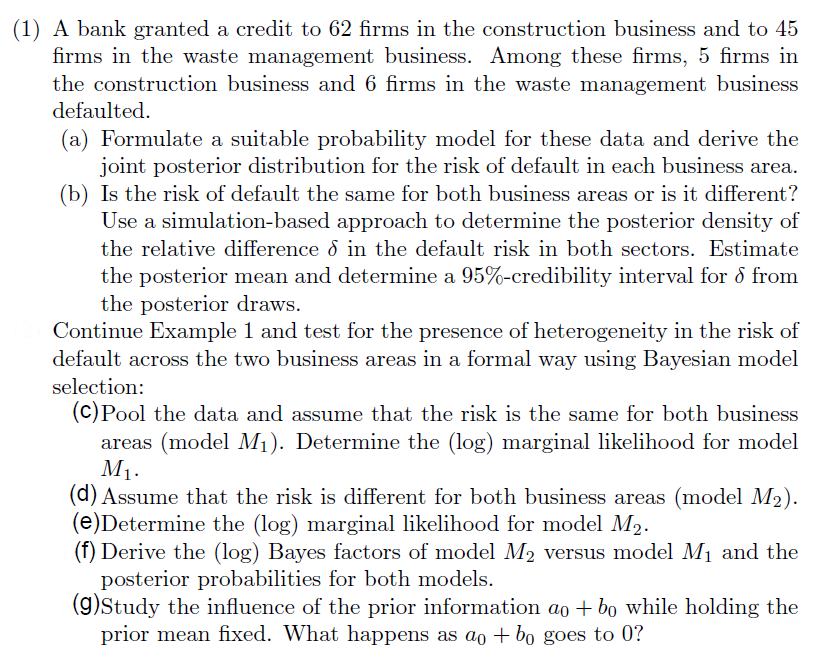

(1) A bank granted a credit to 62 firms in the construction business and to 45 firms in the waste management business. Among these firms, 5 firms in the construction business and 6 firms in the waste management business defaulted. (a) Formulate a suitable probability model for these data and derive the joint posterior distribution for the risk of default in each business area. (b) Is the risk of default the same for both business areas or is it different? Use a simulation-based approach to determine the posterior density of the relative difference d in the default risk in both sectors. Estimate the posterior mean and determine a 95%-credibility interval for d from the posterior draws. Continue Example 1 and test for the presence of heterogeneity in the risk of default across the two business areas in a formal way using Bayesian model selection: (c) Pool the data and assume that the risk is the same for both business areas (model M). Determine the (log) marginal likelihood for model M. (d) Assume that the risk is different for both business areas (model M). (e)Determine the (log) marginal likelihood for model M. (f) Derive the (log) Bayes factors of model M2 versus model M and the posterior probabilities for both models. (9)Study the influence of the prior information ao + bo while holding the prior mean fixed. What happens as ao + bo goes to 0?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This problem set is asking you to perform Bayesian statistical analysis on a dataset involving credit defaults of firms in two different business areas construction and waste management Lets go throug...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started