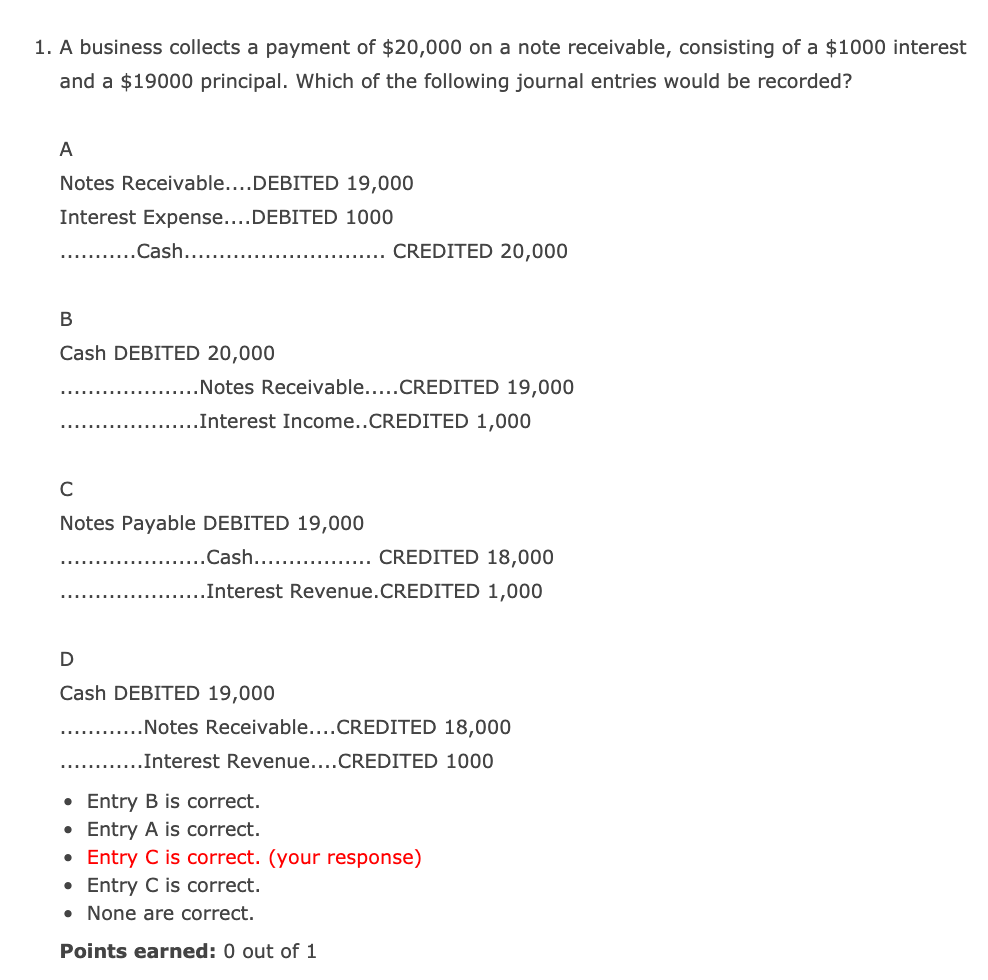

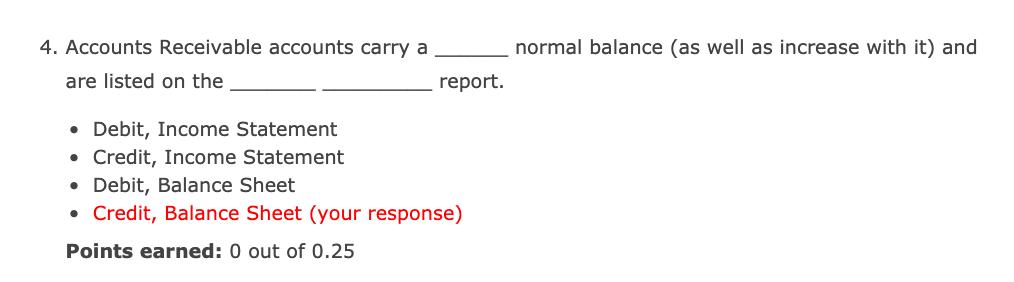

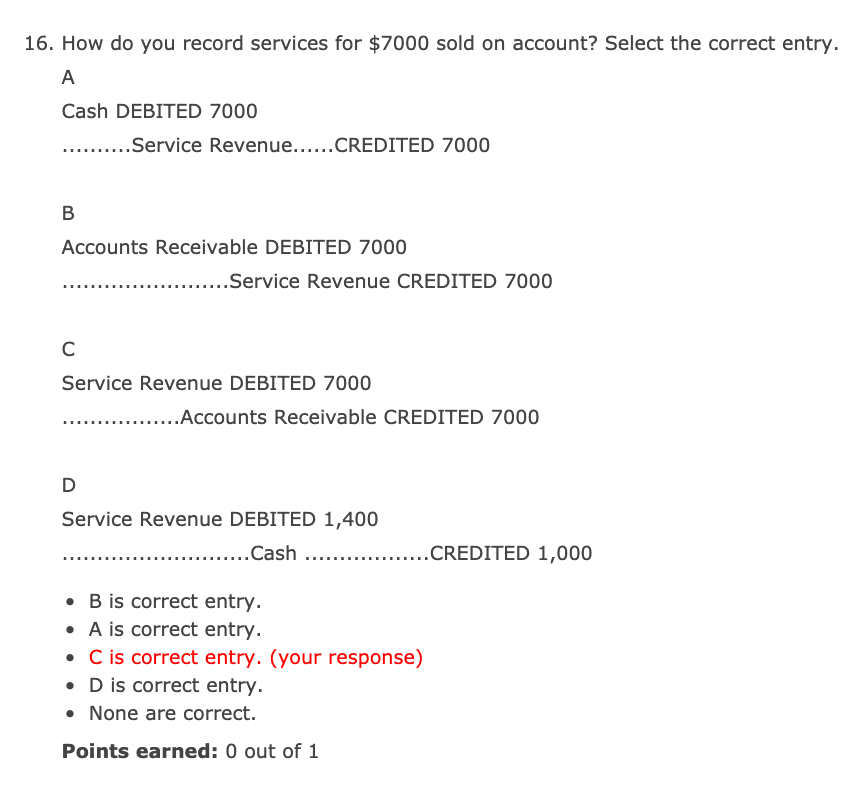

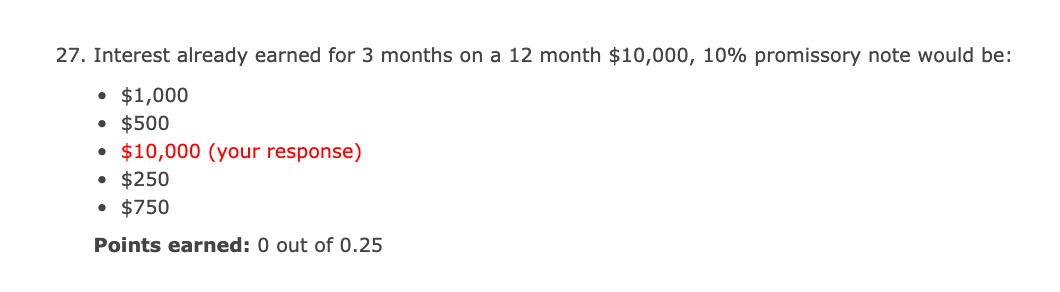

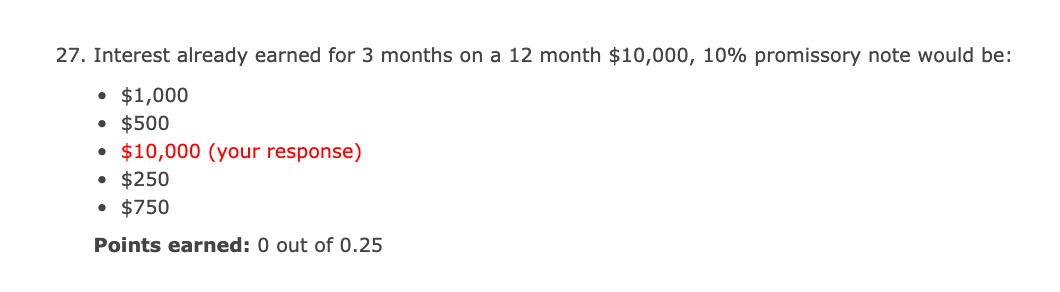

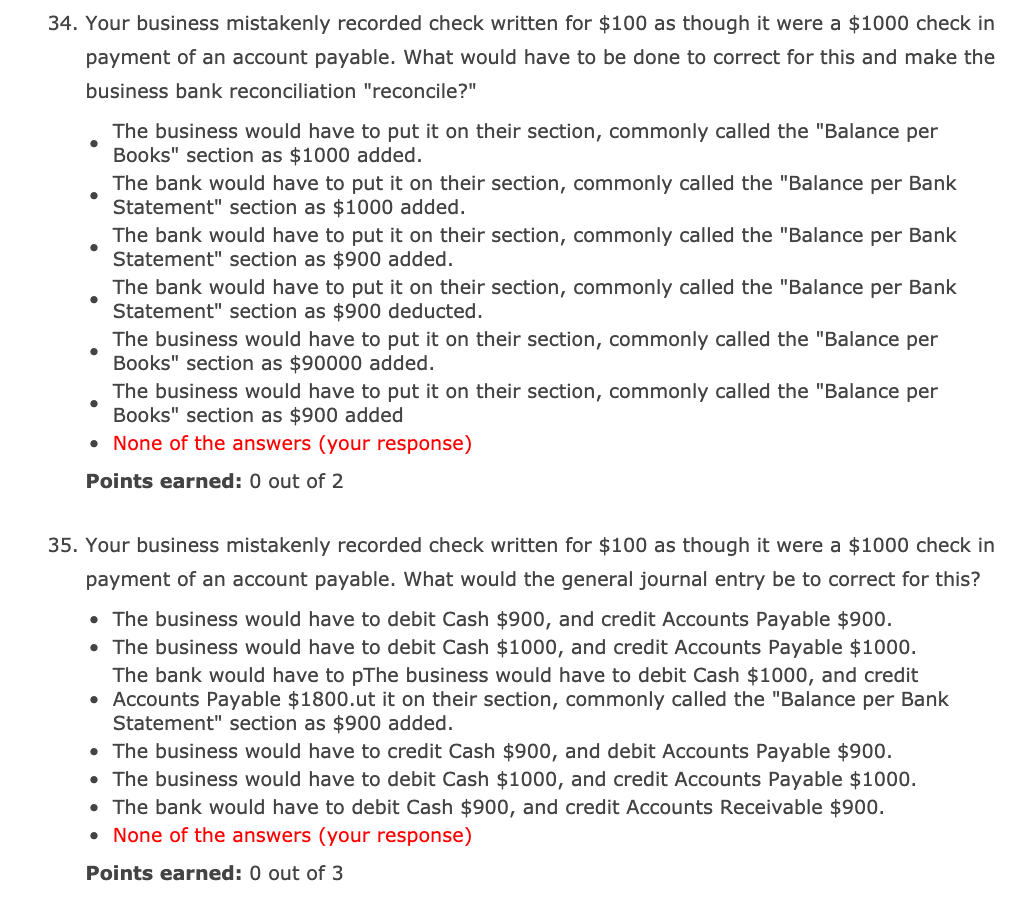

1. A business collects a payment of $20,000 on a note receivable, consisting of a $1000 interest and a $19000 principal. Which of the following journal entries would be recorded? Notes Receivable....DEBITED 19,000 Interest Expense....DEBITED 1000 ...........Cash.. ..... CREDITED 20,000 Cash DEBITED 20,000 ...........Notes Receivable.....CREDITED 19,000 .......... Interest Income..CREDITED 1,000 Notes Payable DEBITED 19,000 .............Cash................. CREDITED 18,000 ........ Interest Revenue.CREDITED 1,000 Cash DEBITED 19,000 ........Notes Receivable....CREDITED 18,000 .......... Interest Revenue....CREDITED 1000 Entry B is correct. Entry A is correct. Entry C is correct. (your response) Entry C is correct. None are correct. Points earned: 0 out of 1 4. Accounts Receivable accounts carry a normal balance (as well as increase with it) and are listed on the _ report. Debit, Income Statement Credit, Income Statement Debit, Balance Sheet Credit, Balance Sheet (your response) Points earned: 0 out of 0.25 16. How do you record services for $7000 sold on account? Select the correct entry. Cash DEBITED 7000 ......... Service Revenue......CREDITED 7000 Accounts Receivable DEBITED 7000 ....... Service Revenue CREDITED 7000 Service Revenue DEBITED 7000 ......Accounts Receivable CREDITED 7000 Service Revenue DEBITED 1,400 ..........Cash ..................CREDITED 1,000 B is correct entry. A is correct entry. C is correct entry. (your response) D is correct entry. None are correct. Points earned: 0 out of 1 27. Interest already earned for 3 months on a 12 month $10,000, 10% promissory note would be: $1,000 $500 $10,000 (your response) $250 $750 Points earned: 0 out of 0.25 34. Your business mistakenly recorded check written for $100 as though it were a $1000 check in payment of an account payable. What would have to be done to correct for this and make the business bank reconciliation "reconcile?" The business would have to put it on their section, commonly called the "Balance per Books" section as $1000 added. The bank would have to put it on their section, commonly called the "Balance per Bank Statement" section as $1000 added. The bank would have to put it on their section, commonly called the "Balance per Bank Statement" section as $900 added. The bank would have to put it on their section, commonly called the "Balance per Bank Statement" section as $900 deducted. The business would have to put it on their section, commonly called the "Balance per Books" section as $90000 added. The business would have to put it on their section, commonly called the "Balance per Books" section as $900 added None of the answers (your response) Points earned: 0 out of 2 35. Your business mistakenly recorded check written for $100 as though it were a $1000 check in payment of an account payable. What would the general journal entry be to correct for this? The business would have to debit Cash $900, and credit Accounts Payable $900. The business would have to debit Cash $1000, and credit Accounts Payable $1000. The bank would have to pThe business would have to debit Cash $1000, and credit Accounts Payable $1800.ut it on their section, commonly called the "Balance per Bank Statement" section as $900 added. The business would have to credit Cash $900, and debit Accounts Payable $900. The business would have to debit Cash $1000, and credit Accounts Payable $1000. The bank would have to debit Cash $900, and credit Accounts Receivable $900. None of the answers (your response) Points earned: 0 out of 3