Question

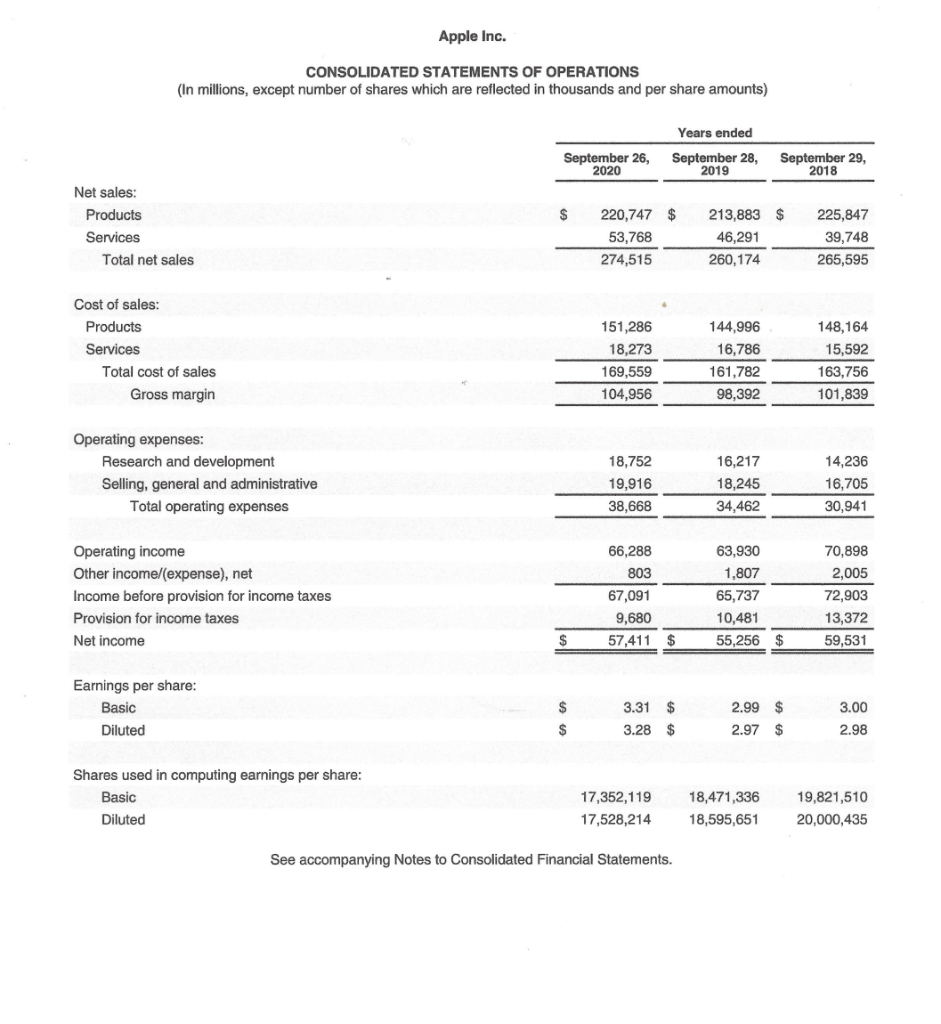

1 A Calculate the Profit Margin Ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. Does this ratio appear favorable or unfavorable? Why?

1

A Calculate the Profit Margin Ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. Does this ratio appear favorable or unfavorable? Why?

2.

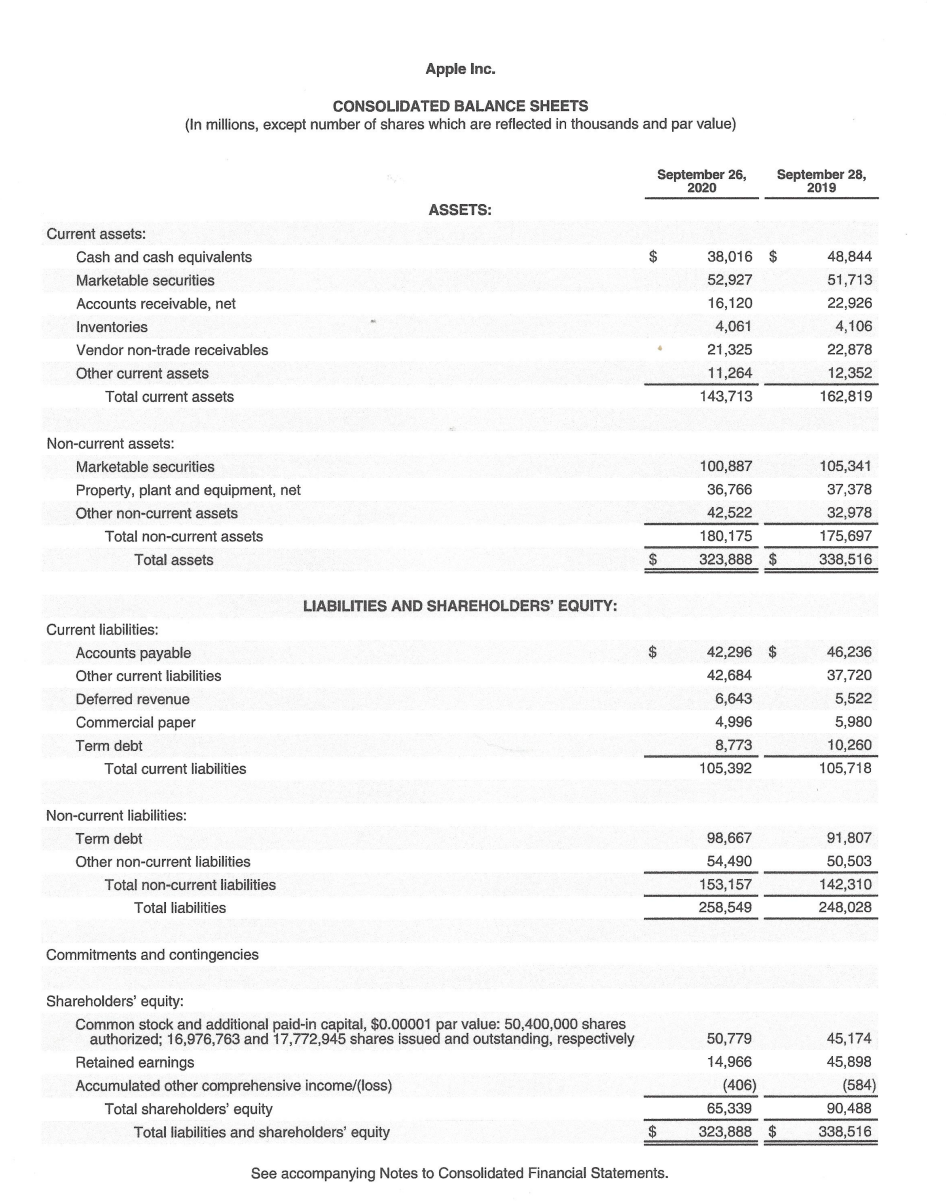

Accounts Receivable Turnover and Days Sales Uncollected

a. Calculate the Accounts Receivable Turnover Ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. Calculate the Days Sales Uncollected ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) Does this ratio appear favorable or unfavorable? Why?

3.

Inventory Turnover and Days Sales in Inventory

a. Calculate the Inventory Turnover Ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. Calculate the Days Sales in Inventory ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) Does this ratio appear favorable or unfavorable? Why?

4.

Total Asset Turnover

Calculate the Total Asset Turnover ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.)

5.

Debt Ratio:

a. Calculate the Debt Ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. What does this ratio tell you about Apple's risk?

6.

Debt-to-Equity Ratio:

a. Calculate the Debt-to-Equity ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) b. What does this ratio tell you about Apple's capital structure and risk?

7.

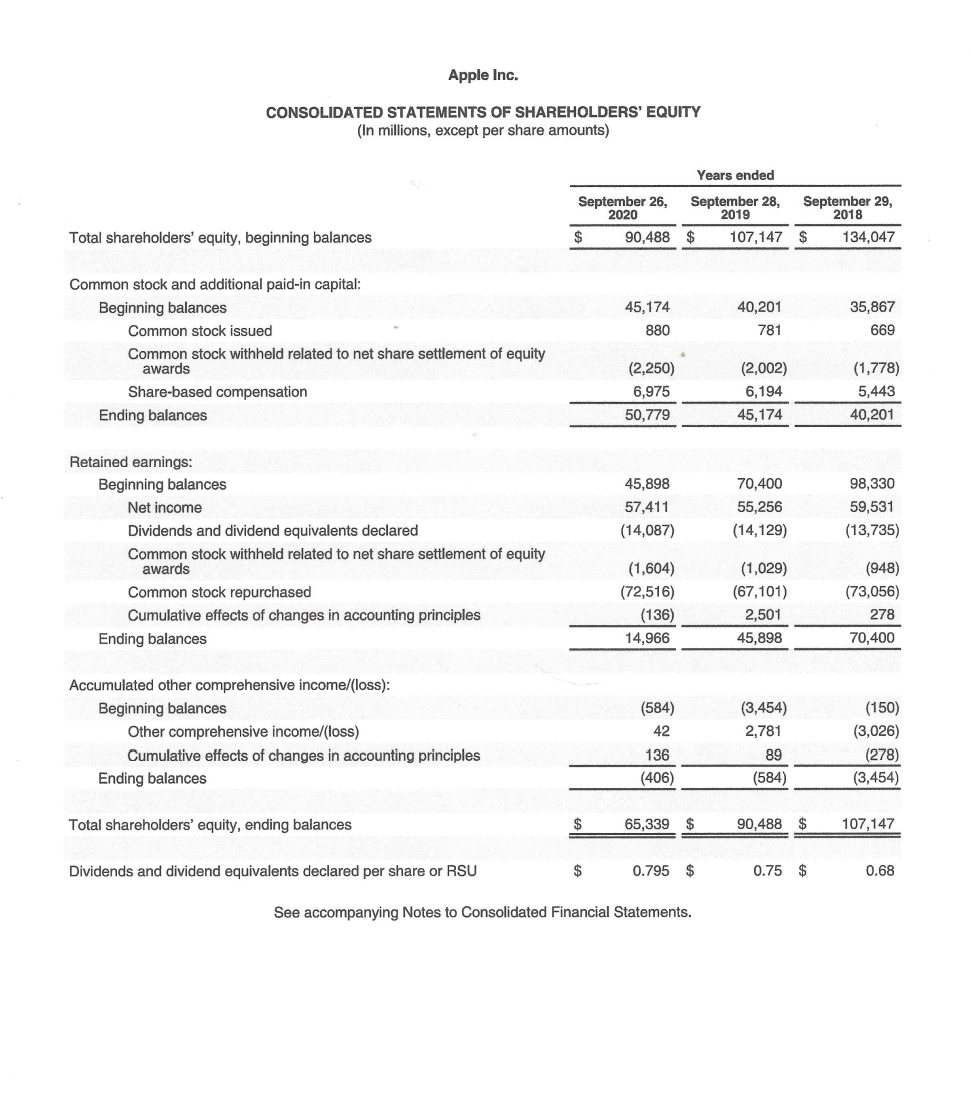

Market Price, Dividend Yield & Price-Earnings Ratios

a. What is the current market price of the stock? (Give the date that you found this price). (This is not in the financial statements provided.) It is noted on Apples website or go to www.yahoofinance.com to get the quote. The ticker symbol for Apple is AAPL.

b. Calculate the Dividend Yield. (SHOW YOUR WORK. Calculate ratio to three decimal places.)

c. Calculate the Price-Earnings Ratio. (SHOW YOUR WORK. Calculate ratio to three decimal places.) d, If analysts give a range of higher than 20-25 for a stock to be considered overpriced and less than 5-8 for a stock to be considered underpriced, how is Apple doing?

Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 26, 2020 September 28, 2019 September 29, 2018 $ Net sales: Products Services Total net sales 220,747 $ 53,768 274,515 213,883 $ 46,291 260,174 225,847 39,748 265,595 Cost of sales: Products Services Total cost of sales Gross margin 151,286 18,273 169,559 104,956 144,996 16,786 161,782 98,392 148,164 15,592 163,756 101,839 Operating expenses: Research and development Selling, general and administrative Total operating expenses 18,752 19,916 38,668 16,217 18,245 34,462 14,236 16,705 30,941 Operating income Other income/expense), net Income before provision for income taxes Provision for income taxes Net income 66,288 803 67,091 9,680 57,411 $ 63,930 1,807 65,737 10,481 55,256 70,898 2,005 72,903 13,372 59,531 $ $ Earnings per share: Basic Diluted $ 3.31 $ 3.28 $ 2.99 $ 2.97 $ 3.00 2.98 $ Shares used in computing earnings per share: Basic Diluted 17,352,119 17,528,214 18,471,336 18,595,651 19,821,510 20,000,435 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 26, 2020 September 28, 2019 ASSETS: Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 38,016 52,927 16,120 4,061 21,325 11,264 143,713 48,844 51,713 22,926 4,106 22,878 12,352 162,819 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 100,887 36,766 42,522 180,175 323,888 $ 105,341 37,378 32,978 175,697 338,516 $ LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 42,296 $ 42,684 6,643 4,996 8,773 105,392 46,236 37,720 5,522 5,980 10,260 105,718 Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities 98,667 54,490 153,157 258,549 91,807 50,503 142,310 248,028 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 50,400,000 shares authorized; 16,976,763 and 17,772,945 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 50,779 14,966 (406) 65,339 323,888 $ 45,174 45,898 (584) 90,488 338,516 $ See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except per share amounts) Years ended September 26, September 28, September 29, 2020 2019 2018 $ 90,488 $ 107,147 $ 134,047 Total shareholders' equity, beginning balances 45,174 880 40,201 781 35,867 669 Common stock and additional paid-in capital: Beginning balances Common stock issued Common stock withheld related to net share settlement of equity awards Share-based compensation Ending balances . (2,250) 6,975 50,779 (2,002) 6,194 45,174 (1,778) 5,443 40,201 98,330 45,898 57,411 (14,087) 70,400 55,256 (14,129) 59,531 (13,735) Retained earnings: Beginning balances Net income Dividends and dividend equivalents declared Common stock withheld related to net share settlement of equity awards Common stock repurchased Cumulative effects of changes in accounting principles Ending balances (1,604) (72,516) (136) 14,966 (1,029) (67,101) 2,501 45,898 (948) (73,056) 278 70,400 Accumulated other comprehensive income/(loss): Beginning balances Other comprehensive income/(loss) Cumulative effects of changes in accounting principles Ending balances (584) 42 136 (406) (3,454) 2,781 89 (584) (150) (3,026) (278) (3,454) Total shareholders' equity, ending balances $ 65,339 $ 90,488 $ 107,147 Dividends and dividend equivalents declared per share or RSU $ 0.795 $ 0.75 $ 0.68 See accompanying Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started