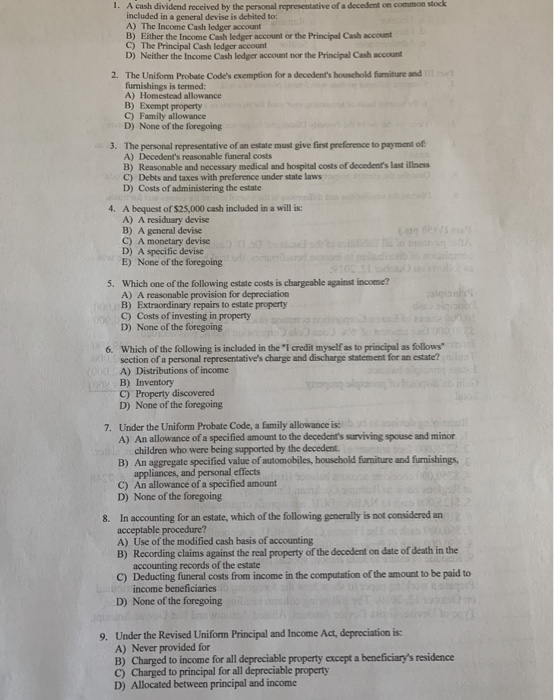

1. A cash dividend received by the personal representative of a decedent on common stock included in a general devise is debited to: A) The Income Cash ledger account B) Either the income Cash ledger account or the Principal Cash account C) The Principal Cash ledger account D) Neither the Income Cash ledger account nor the Principal Cash account 2. The Uniform Probate Code's exemption for a decedent's household furniture and furnishings is termed: A) Homestead allowance B) Exempt property C) Family allowance D) None of the foregoing 3. The personal representative of an estate must give first preference to payment of A) Decedent's reasonable funeral costs B) Reasonable and necessary medical and hospital costs of decedent's last illness C) Debts and taxes with preference under state laws D) Costs of administering the estate 4. A bequest of $25,000 cash included in a will is: A) A residuary devise B) A general devise C) A monetary devise D) A specific devise E) None of the forening 5. Which one of the following estate costs is chargeable against income? A) A reasonable provision for depreciation sloths B) Extraordinary repairs to estate property C) Costs of investing in property D) None of the foregoing 6. Which of the following is included in the "I credit myself as to principal as follows section of a personal representative's charge and discharge statement for an estate? 000A) Distributions of income B) Inventory C) Property discovered D) None of the foregoing 7. Under the Uniform Probate Code, a family allowance is A) An allowance of a specified amount to the decedent's surviving spouse and minor children who were being supported by the decedent. B) An aggregate specified value of automobiles, household furniture and furnishings. appliances, and personal effects C) An allowance of a specified amount D) None of the foregoing 8. In accounting for an estate, which of the following generally is not considered an acceptable procedure? A) Use of the modified cash basis of accounting B) Recording claims against the real property of the decedent on date of death in the accounting records of the estate C) Deducting funeral costs from income in the computation of the amount to be paid to income beneficiaries D) None of the foregoing 9. Under the Revised Uniform Principal and Income Act, depreciation is: A) Never provided for B) Charged to income for all depreciable property except a beneficiary's residence C) Charged to principal for all depreciable property D) Allocated between principal and income