Answered step by step

Verified Expert Solution

Question

1 Approved Answer

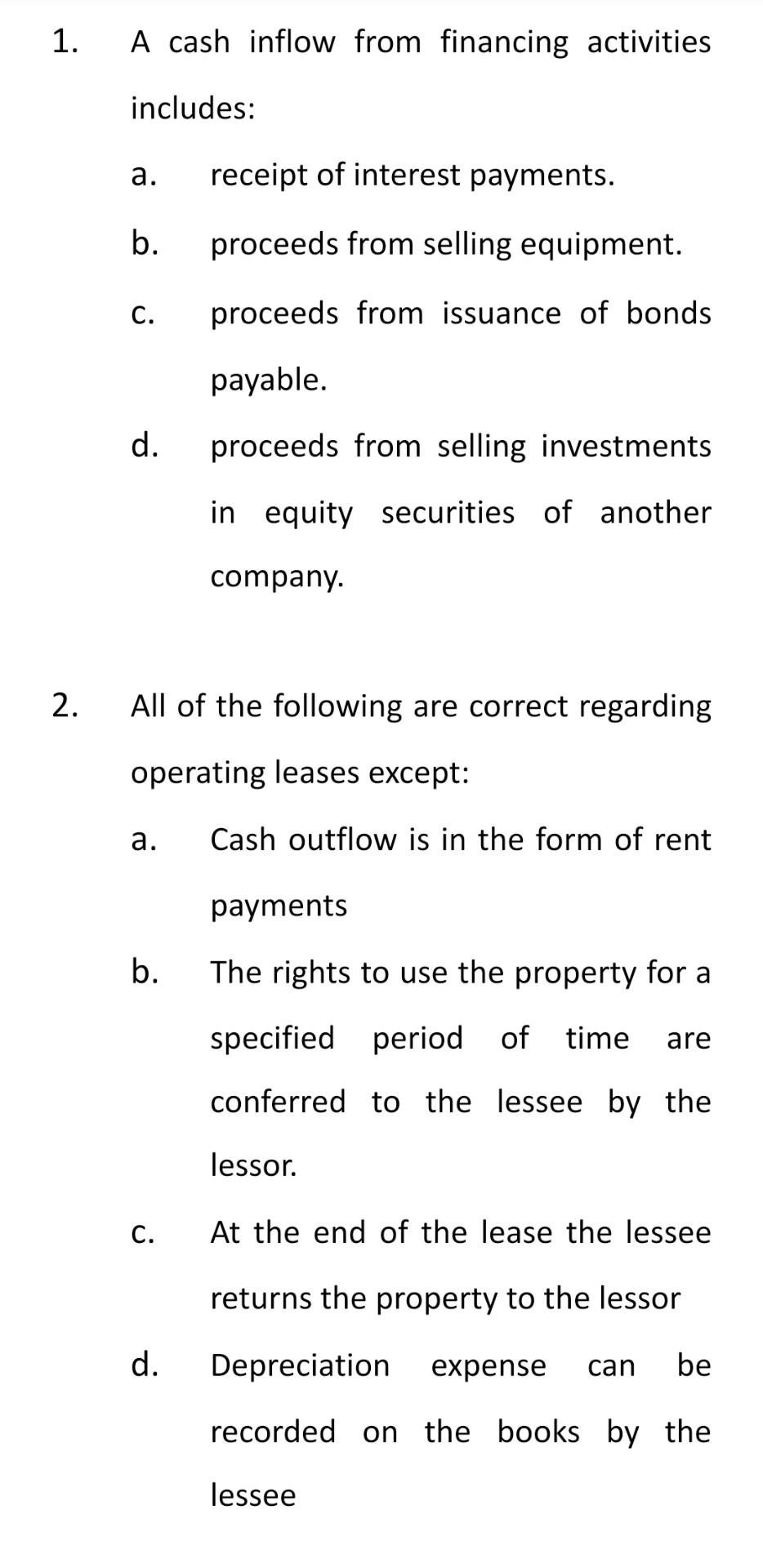

1. A cash inflow from financing activities includes: a. receipt of interest payments. b. proceeds from selling equipment. C. proceeds from issuance of bonds payable.

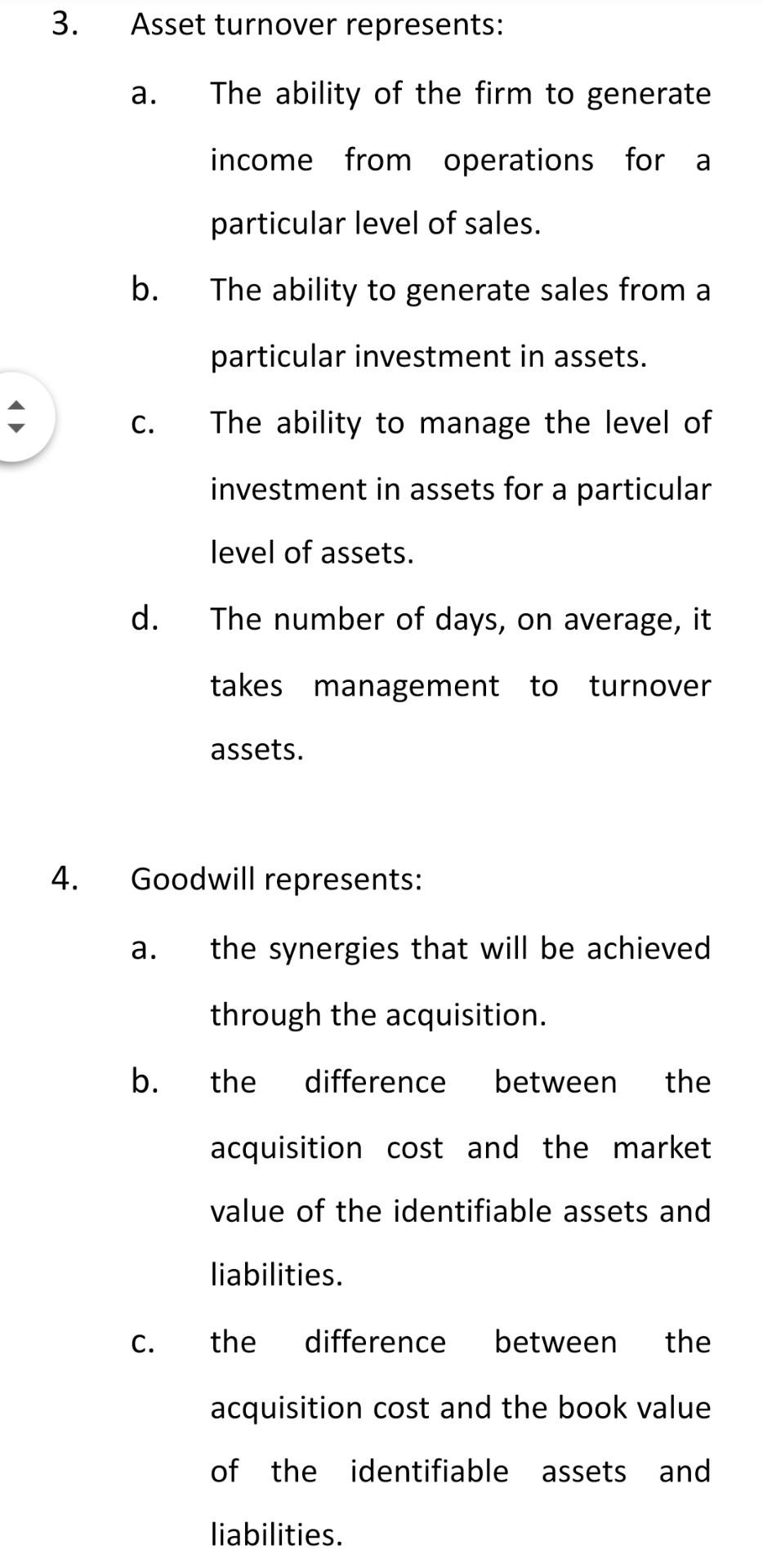

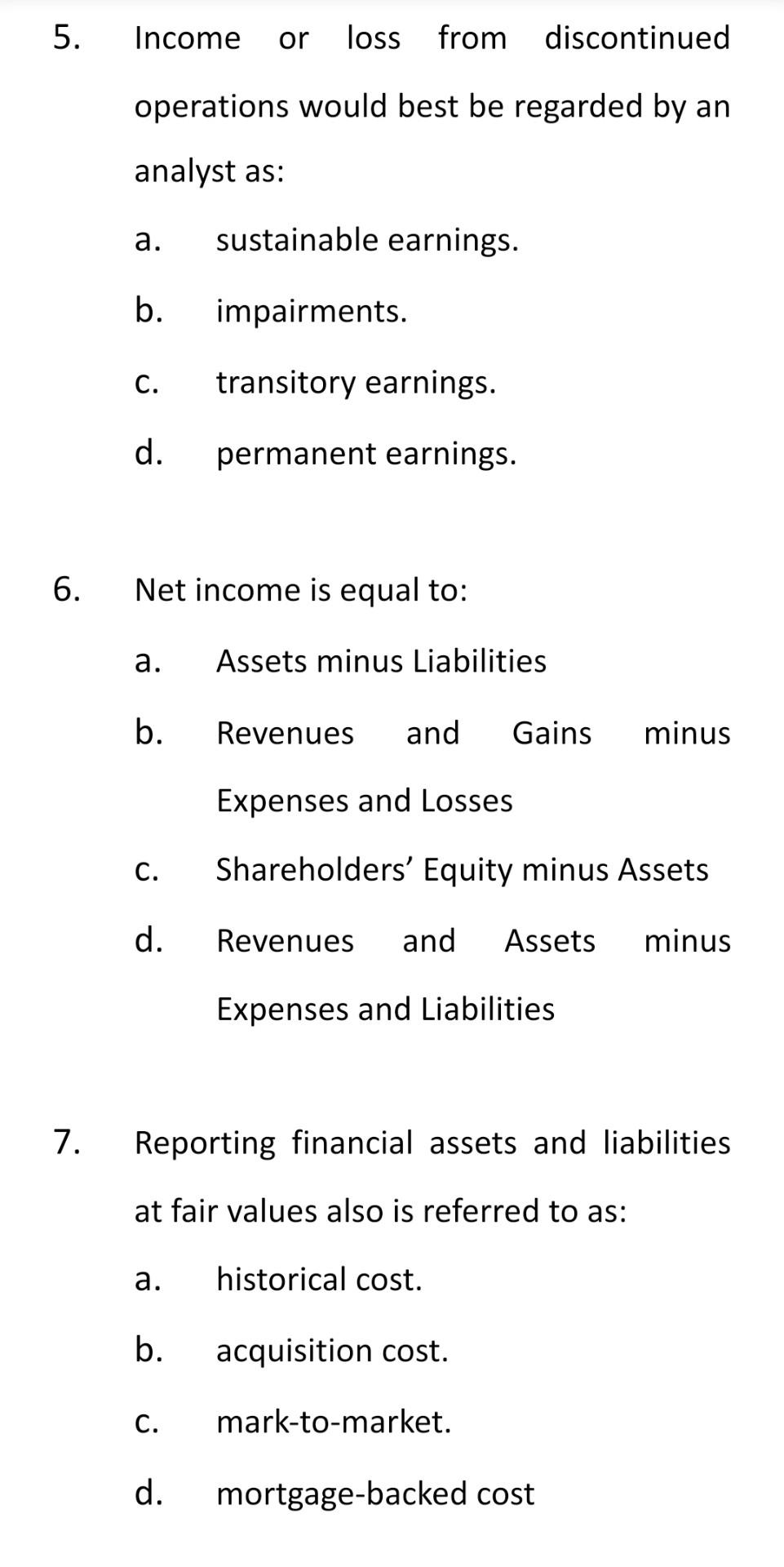

1. A cash inflow from financing activities includes: a. receipt of interest payments. b. proceeds from selling equipment. C. proceeds from issuance of bonds payable. d. proceeds from selling investments in equity securities of another company. 2. All of the following are correct regarding operating leases except: a. Cash outflow is in the form of rent payments b. The rights to use the property for a specified period of time are conferred to the lessee by the lessor. C. At the end of the lease the lessee returns the property to the lessor d. Depreciation expense can be recorded on the books by the lessee 3 . Asset turnover represents: a. The ability of the firm to generate income from operations for a particular level of sales. b. The ability to generate sales from a particular investment in assets. C. The ability to manage the level of investment in assets for a particular level of assets. d. The number of days, on average, it takes management to turnover assets. 4. Goodwill represents: a. the synergies that will be achieved through the acquisition. b. the difference between the acquisition cost and the market value of the identifiable assets and liabilities. C. the difference between the acquisition cost and the book value of the identifiable assets and liabilities. 5. Income or loss from discontinued operations would best be regarded by an analyst as: a. sustainable earnings. b. impairments. c. transitory earnings. d. permanent earnings. 6. Net income is equal to: a. Assets minus Liabilities b. Revenues and Gains minus Expenses and Losses c. Shareholders' Equity minus Assets d. Revenues and Assets minus Expenses and Liabilities 7. Reporting financial assets and liabilities at fair values also is referred to as: a. historical cost. b. acquisition cost. c . mark-to-market. d. mortgage-backed cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started