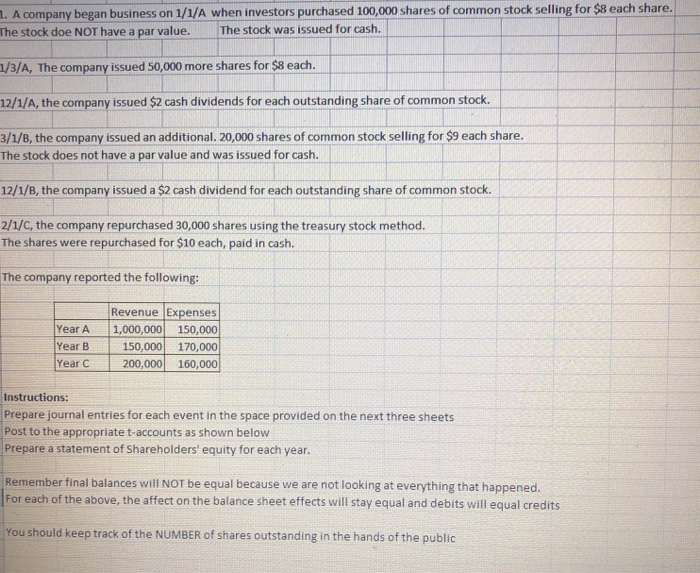

1. A company began business on 1/1/A when investors purchased 100,000 shares of common stock selling for $8 each share. The stock doe NOT have a par value. The stock was issued for cash. 1/3/A, The company issued 50,000 more shares for $8 each. 12/1/A, the company issued $2 cash dividends for each outstanding share of common stock. - 3/1/B, the company issued an additional. 20,000 shares of common stock selling for $9 each share. The stock does not have a par value and was issued for cash. 12/1/B, the company issued a $2 cash dividend for each outstanding share of common stock. - 2/1/c, the company repurchased 30,000 shares using the treasury stock method. - The shares were repurchased for $10 each, paid in cash. The company reported the following: Year A Year B Year C Revenue Expenses 1,000,000 150,000 150,000 170,000 200,000 160,000 - Instructions: Prepare journal entries for each event in the space provided on the next three sheets - Post to the appropriate t-accounts as shown below Prepare a statement of Shareholders' equity for each year. Remember final balances will NOT be equal because we are not looking at everything that happened. For each of the above, the affect on the balance sheet effects will stay equal and debits will equal credits You should keep track of the NUMBER of shares outstanding in the hands of the public 1. A company began business on 1/1/A when investors purchased 100,000 shares of common stock selling for $8 each share. The stock doe NOT have a par value. The stock was issued for cash. 1/3/A, The company issued 50,000 more shares for $8 each. 12/1/A, the company issued $2 cash dividends for each outstanding share of common stock. 3/1/B, the company issued an additional. 20,000 shares of common stock selling for $9 each share. The stock does not have a par value and was issued for cash. 12/1/B, the company issued a $2 cash dividend for each outstanding share of common stock. 2/1/C, the company repurchased 30,000 shares using the treasury stock method. The shares were repurchased for $10 each, paid in cash. The company reported the following: Year A Year B Year C Revenue Expenses 1,000,000 150,000 150,000 170,000 200,000 160,000 Instructions: Prepare journal entries for each event in the space provided on the next three sheets Post to the appropriate t-accounts as shown below Prepare a statement of Shareholders' equity for each year. Remember final balances will NOT be equal because we are not looking at everything that happened. For each of the above, the affect on the balance sheet effects will stay equal and debits will equal credits You should keep track of the NUMBER of shares outstanding in the hands of the public