Answered step by step

Verified Expert Solution

Question

1 Approved Answer

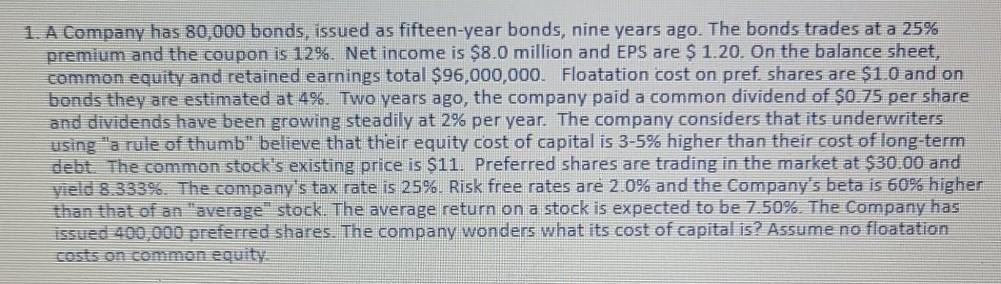

1. A Company has 80,000 bonds, issued as fifteen-year bonds, nine years ago. The bonds trades at a 25% premium and the coupon is 12%.

1. A Company has 80,000 bonds, issued as fifteen-year bonds, nine years ago. The bonds trades at a 25% premium and the coupon is 12%. Net income is $8.0 million and EPS are $ 1.20. On the balance sheet, common equity and retained earnings total $96,000,000 Floatation cost on pref shares are $1.0 and on bonds they are estimated at 4%. Two years ago, the company paid a common dividend of $0.75 per share and dividends have been growing steadily at 2% per year. The company considers that its underwriters using "a rule of thumb" believe that their equity cost of capital is 3-5% higher than their cost of long-term debt The common stock's existing price is $11. Preferred shares are trading in the market at $30.00 and Vield 8.333%. The company's tax rate is 25%. Risk free rates are 2.0% and the Company's beta is 60% higher than that of an "average stock. The average return on a stock is expected to be 7.50%. The Company has issued 400,000 preferred shares. The company wonders what its cost of capital is? Assume no floatation costs on common equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started