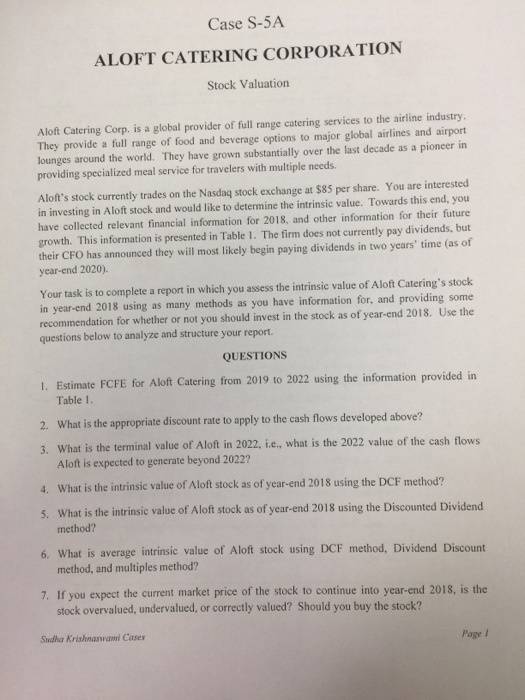

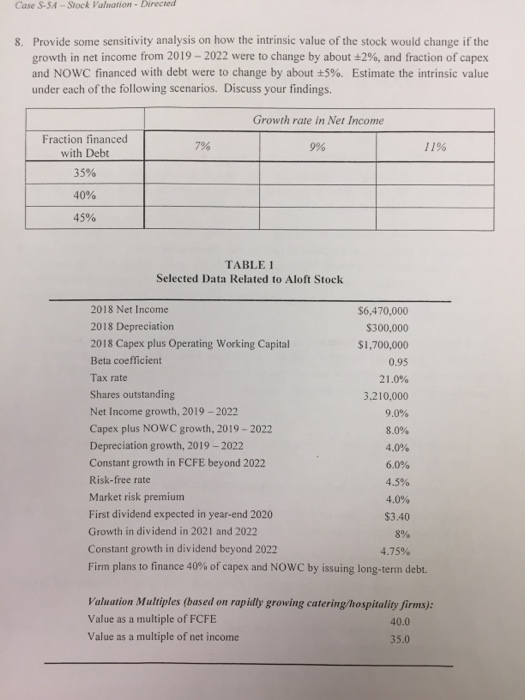

Case S-5A ALOFT CATERING CORPORATION Stock Valuation Aloft Catering Corp. is a global provider of full range catering services to the airline industry. They provide a full range of food and beverage options to major global airlines and airport lounges around the world. They have grown substantially over the last decade as a pioneer in providing specialized meal service for travelers with multiple needs. Aloft's stock currently trades on the Nasdag stock exchange at $85 per share. You are interested in investing in Aloft stock and would like to determine the intrinsic value. Towards this end, you have collected relevant financial information for 2018, and other information for their future growth. This information is presented in Table 1. The firm does not currently pay dividends, but their CFO has announced they will most likely begin paying dividends in two years' time (as of year-end 2020). Your task is to complete a report in which you assess the intrinsic value of Aloft Catering's stock in year-end 2018 using as many methods as you have information for, and providing some recommendation for whether or not you should invest in the stock as of year-end 2018. Use the questions below to analyze and structure your report QUESTIONS 1. Estimate FCFE for Aloft Catering from 2019 to 2022 using the information provided in Table 1 What is the appropriate discount rate to apply to the cash flows developed above? what is the terminal value of Aloft in 2022, ie., what is the 2022 value of the cash flows Aloft is expected to generate beyond 2022? What is the intrinsic value of Aloft stock as of year-end 2018 using the DCF method? 2. 3. 4. 5. What is the intrinsic value of Aloft stock as of year-end 2018 using the Discounted Dividend 6. What is average intrinsic value of Aloft stock using DCF method, Dividend Discount 7. If you expect the current market price of the stock to continue into year-end 2018, is the method? method, and multiples method? stock overvalued, undervalued, or correctly valued? Should you buy the stock? Sudha Krishnaswami Case Page I Case S-SA -Stock Vanation-Directed Provide some sensitivity analysis on how the intrinsic value of the stock would change if the growth in net income from 2019-2022 were to change by about 2%, and fraction of capex and NOC financed with debt were to change by about 5%. Estimate the intrinsic value under each of the following scenarios. Discuss your findings. 8. Growth rate in Net Income Fraction financed with Debt 35% 40% 45% 796 9% 1 1% TABLE1 Selected Data Related to Aloft Stock 2018 Net Income 2018 Depreciation 2018 Capex plus Operating Working Capital Beta coefficient Tax rate Shares outstanding Net Income growth, 2019-2022 Capex plus NOWC growth, 2019-2022 Depreciation growth, 2019-2022 Constant growth in FCFE beyond 2022 Risk-free rate Market risk premium First dividend expected in year-end 2020 Growth in dividend in 2021 and 2022 Constant growth in dividend beyond 2022 Firm plans to finance 40% of capex and NOWC by issuing long-term debt. $6,470,000 S300,000 $1,700,000 0.95 21.0% 3.210,000 90% 8.0% 4.0% 6.0% 4.5% 4.0% $3.40 8% 4.75% Valuation Multiples (based on rapidly growing catering hospitality firms) Value as a multiple of FCFE Value as a multiple of net income 40.0 35.0