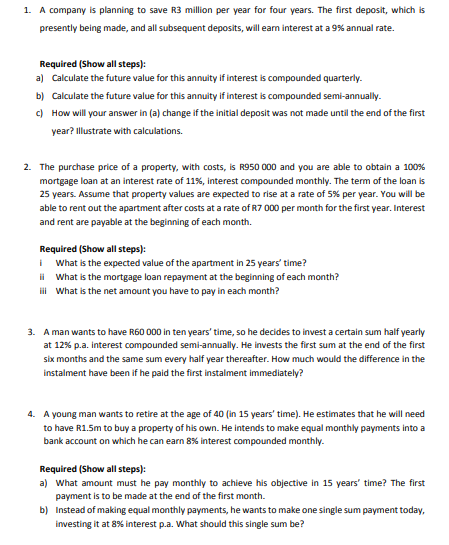

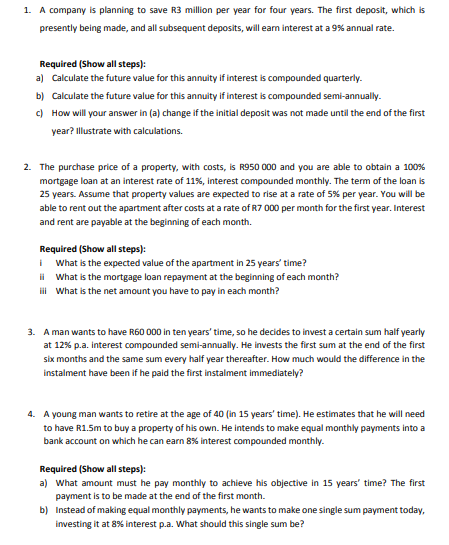

1. A company is planning to save R3 million per year for four years. The first deposit, which is presently being made, and all subsequent deposits, will earn interest at a 9% annual rate. Required (Show all steps): a) Calculate the future value for this annuity if interest is compounded quarterly. b) Calculate the future value for this annuity if interest is compounded semi-annually. c) How will your answer in (a) change if the initial deposit was not made until the end of the first year? illustrate with calculations. 2. The purchase price of a property, with costs, is R950 000 and you are able to obtain a 100% mortgage loan at an interest rate of 11%, interest compounded monthly. The term of the loan is 25 years. Assume that property values are expected to rise at a rate of 5% per year. You will be able to rent out the apartment after costs at a rate of R7 000 per month for the first year. Interest and rent are payable at the beginning of each month. Required (Show all steps): | What is the expected value of the apartment in 25 years' time? ii What is the mortgage loan repayment at the beginning of each month? il What is the net amount you have to pay in each month? 3. A man wants to have R60 000 in ten years' time, so he decides to invest a certain sum half yearly at 12% p.a. interest compounded semi-annually. He invests the first sum at the end of the first six months and the same sum every half year thereafter. How much would the difference in the instalment have been if he paid the first instalment immediately? 4. A young man wants to retire at the age of 40 (in 15 years' time). He estimates that he will need to have R1.5m to buy a property of his own. He intends to make equal monthly payments into a bank account on which he can earn 8% interest compounded monthly Required (Show all steps): a) What amount must he pay monthly to achieve his objective in 15 years' time? The first payment is to be made at the end of the first month. b) Instead of making equal monthly payments, he wants to make one single sum payment today, investing it at 8% interest p.a. What should this single sum be