Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A company reports the following aging of accounts receivable as of September 30, 2017: Accounts receivable % 0 to 60 days 200,000 3%

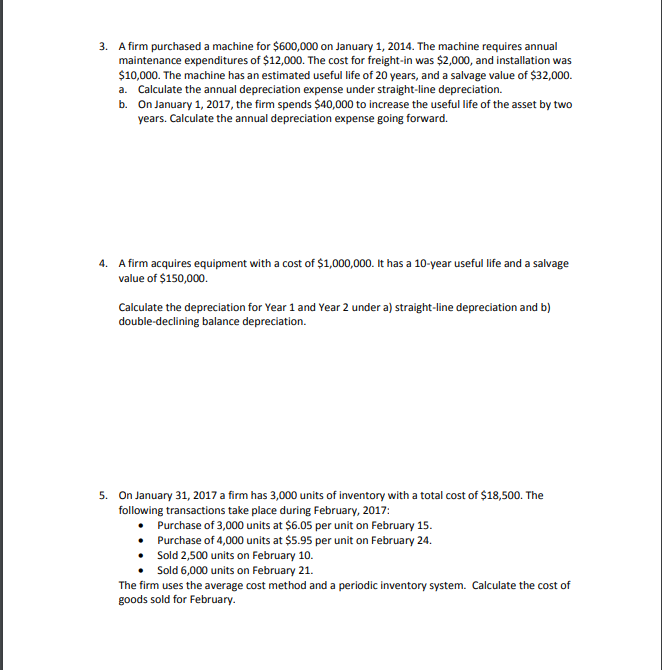

1. A company reports the following aging of accounts receivable as of September 30, 2017: Accounts receivable % 0 to 60 days 200,000 3% 61+ days 30,000 15% The balance in the allowance for doubtful accounts as of July 1, 2017, was $11,700. Additionally, during the quarter ended September 30, 2017, the company wrote off accounts totaling $7,100. Using this information, calculate the bad debt expense for the company for the quarter ended September 30, 2017. 2. A company reports the following values of inventory as of December 31, 2016. FIFO Lot K Units 100 LIFO Lot B K Units 80 20 Cost/Unit 62.00 Cost/Unit 50.00 62.00 The following transactions occur during January 2017: January 3: purchased 30 units @ $63.00 per unit January 8: purchased 40 units @ $63.50 per unit January 17: sold 110 units January 19: purchased 50 units @ $66.00 per unit January 24: sold 80 units The firm uses LIFO for inventory costing in a periodic inventory system. Calculate the LIFO reserve as of a) December 31, 2016 and b) January 31, 2017. 3. A firm purchased a machine for $600,000 on January 1, 2014. The machine requires annual maintenance expenditures of $12,000. The cost for freight-in was $2,000, and installation was $10,000. The machine has an estimated useful life of 20 years, and a salvage value of $32,000. a. Calculate the annual depreciation expense under straight-line depreciation. b. On January 1, 2017, the firm spends $40,000 to increase the useful life of the asset by two years. Calculate the annual depreciation expense going forward. 4. A firm acquires equipment with a cost of $1,000,000. It has a 10-year useful life and a salvage value of $150,000. Calculate the depreciation for Year 1 and Year 2 under a) straight-line depreciation and b) double-declining balance depreciation. 5. On January 31, 2017 a firm has 3,000 units of inventory with a total cost of $18,500. The following transactions take place during February, 2017: Purchase of 3,000 units at $6.05 per unit on February 15. Purchase of 4,000 units at $5.95 per unit on February 24. Sold 2,500 units on February 10. Sold 6,000 units on February 21. The firm uses the average cost method and a periodic inventory system. Calculate the cost of goods sold for February.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started