Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the current year, Sigmund purchased two pieces of equipment for active use in his business. Equipment A, which is new property with an

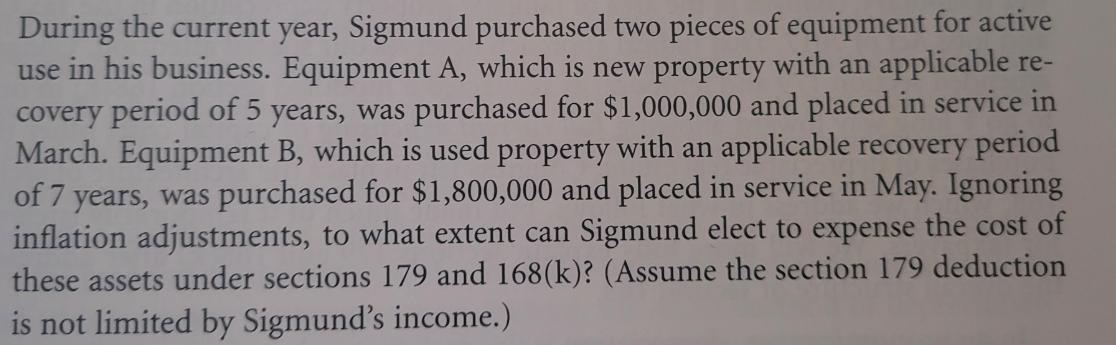

During the current year, Sigmund purchased two pieces of equipment for active use in his business. Equipment A, which is new property with an applicable re- covery period of 5 years, was purchased for $1,000,000 and placed in service in March. Equipment B, which is used property with an applicable recovery period of 7 years, was purchased for $1,800,000 and placed in service in May. Ignoring inflation adjustments, to what extent can Sigmund elect to expense the cost of these assets under sections 179 and 168(k)? (Assume the section 179 deduction is not limited by Sigmund's income.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Under Section 179 of the IRS tax code businesses can elect to expense a certain amount of the cost o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started