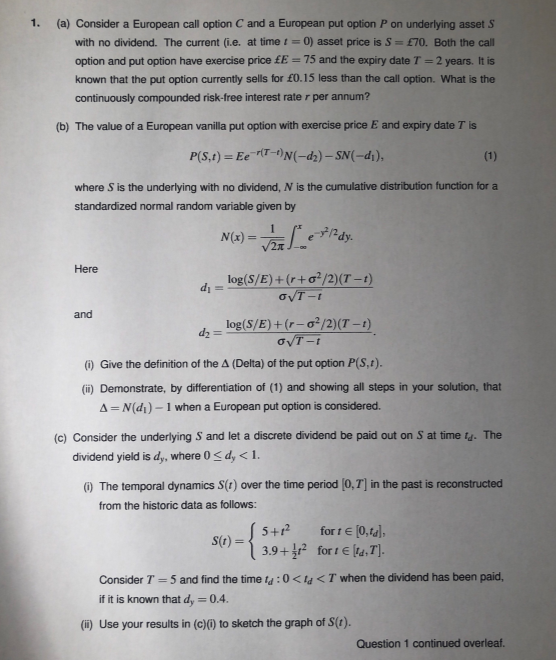

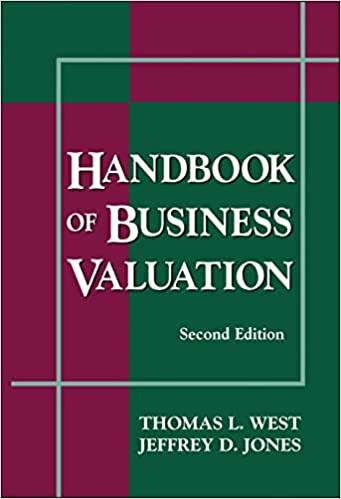

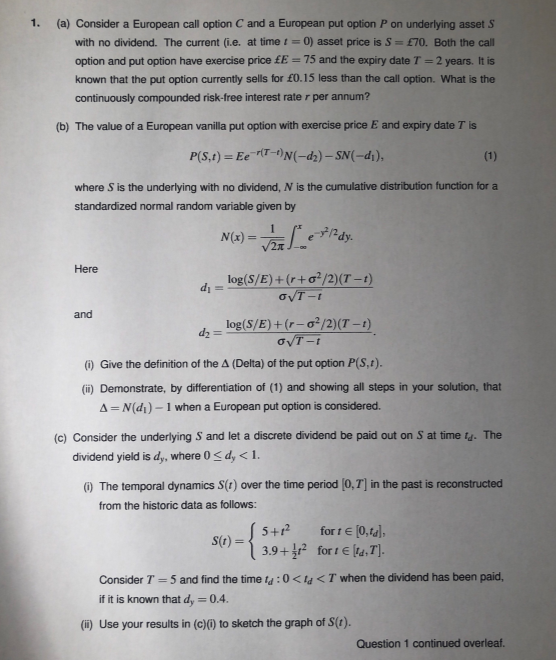

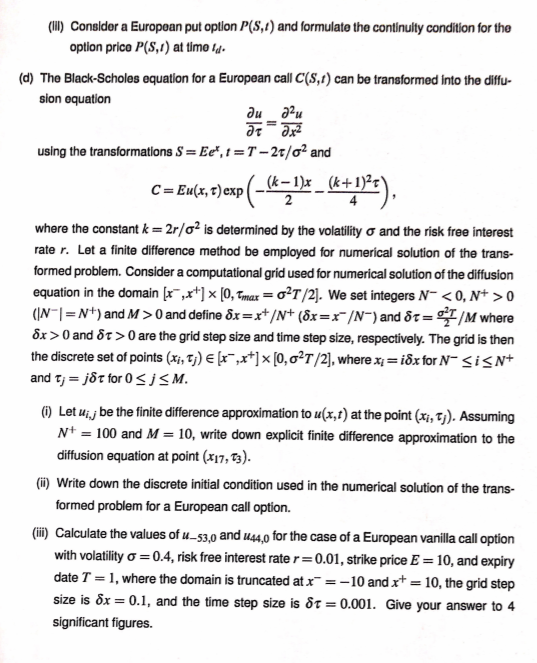

1. (a) Consider a European call option C and a European put option P on underlying assets with no dividend. The current (i.e. at time t = 0) asset price is S = 70. Both the call option and put option have exercise price E = 75 and the expiry date T = 2 years. It is known that the put option currently sells for 0.15 less than the call option. What is the continuously compounded risk-free interest rater per annum? (b) The value of a European vanilla put option with exercise price E and expiry date T is P(S.:) = Ee-MT-)(-da) - SN(-d), (1) where S is the underlying with no dividend, N is the cumulative distribution function for a standardized normal random variable given by N(x) = vale lady . Here di log(S/E) + (r+oP/2)(T-1) OVT-T and d2 = log(S/E) + (r-o/2)(T-1) OT-1 0 Give the definition of the A(Delta) of the put option P(S,t). (i) Demonstrate, by differentiation of (1) and showing all steps in your solution, that A=N(01) - 1 when a European put option is considered. (c) Consider the underlying S and let a discrete dividend be paid out on S at time is. The dividend yield is dy, where 0

0 (IN"]=N+) and M >0 and define 8x=x+/N+ (8x=x+/N-) and 8t=1/M where 8x >0 and 87>0 are the grid step size and time step size, respectively. The grid is then the discrete set of points (xi, tj) (x+,x+]> [0,62T/2], where x1 = idx for N- SisN+ and t;=j&t for OsjSM. () Let uij be the finite difference approximation to u(x,t) at the point (xi, tj). Assuming N+ = 100 and M = 10, write down explicit finite difference approximation to the diffusion equation at point (X17,13). (i) Write down the discrete initial condition used in the numerical solution of the trans- formed problem for a European call option. (ii) Calculate the values of u_53,0 and 144,0 for the case of a European vanilla call option with volatility o = 0.4, risk free interest rate r=0.01, strike price E = 10, and expiry date T = 1, where the domain is truncated at x = -10 and x+ = 10, the grid step size is 8x = 0.1, and the time step size is 8t = 0.001. Give your answer to 4 significant figures. 1. (a) Consider a European call option C and a European put option P on underlying assets with no dividend. The current (i.e. at time t = 0) asset price is S = 70. Both the call option and put option have exercise price E = 75 and the expiry date T = 2 years. It is known that the put option currently sells for 0.15 less than the call option. What is the continuously compounded risk-free interest rater per annum? (b) The value of a European vanilla put option with exercise price E and expiry date T is P(S.:) = Ee-MT-)(-da) - SN(-d), (1) where S is the underlying with no dividend, N is the cumulative distribution function for a standardized normal random variable given by N(x) = vale lady . Here di log(S/E) + (r+oP/2)(T-1) OVT-T and d2 = log(S/E) + (r-o/2)(T-1) OT-1 0 Give the definition of the A(Delta) of the put option P(S,t). (i) Demonstrate, by differentiation of (1) and showing all steps in your solution, that A=N(01) - 1 when a European put option is considered. (c) Consider the underlying S and let a discrete dividend be paid out on S at time is. The dividend yield is dy, where 0 0 (IN"]=N+) and M >0 and define 8x=x+/N+ (8x=x+/N-) and 8t=1/M where 8x >0 and 87>0 are the grid step size and time step size, respectively. The grid is then the discrete set of points (xi, tj) (x+,x+]> [0,62T/2], where x1 = idx for N- SisN+ and t;=j&t for OsjSM. () Let uij be the finite difference approximation to u(x,t) at the point (xi, tj). Assuming N+ = 100 and M = 10, write down explicit finite difference approximation to the diffusion equation at point (X17,13). (i) Write down the discrete initial condition used in the numerical solution of the trans- formed problem for a European call option. (ii) Calculate the values of u_53,0 and 144,0 for the case of a European vanilla call option with volatility o = 0.4, risk free interest rate r=0.01, strike price E = 10, and expiry date T = 1, where the domain is truncated at x = -10 and x+ = 10, the grid step size is 8x = 0.1, and the time step size is 8t = 0.001. Give your answer to 4 significant figures