Question

1. A country has a government debt-to-DGP ratio of d=80%. The effective interest rate on the debt, r=4% and the long-run growth rate of

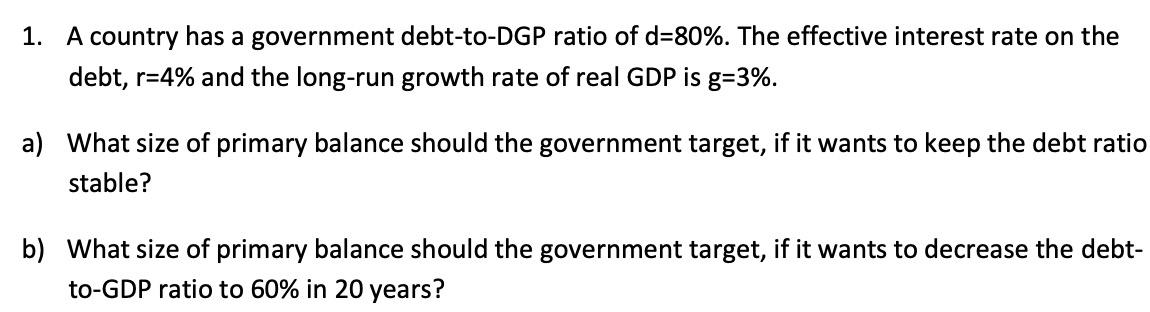

1. A country has a government debt-to-DGP ratio of d=80%. The effective interest rate on the debt, r=4% and the long-run growth rate of real GDP is g=3%. a) What size of primary balance should the government target, if it wants to keep the debt ratio stable? b) What size of primary balance should the government target, if it wants to decrease the debt- to-GDP ratio to 60% in 20 years?

Step by Step Solution

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To keep the debt ratio stable the primary balance should be equal to the interest expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical Financial Management

Authors: William R. Lasher

7th edition

128560721X, 9781133593669, 1133593682, 9781285607214, 978-1133593683

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App