Question

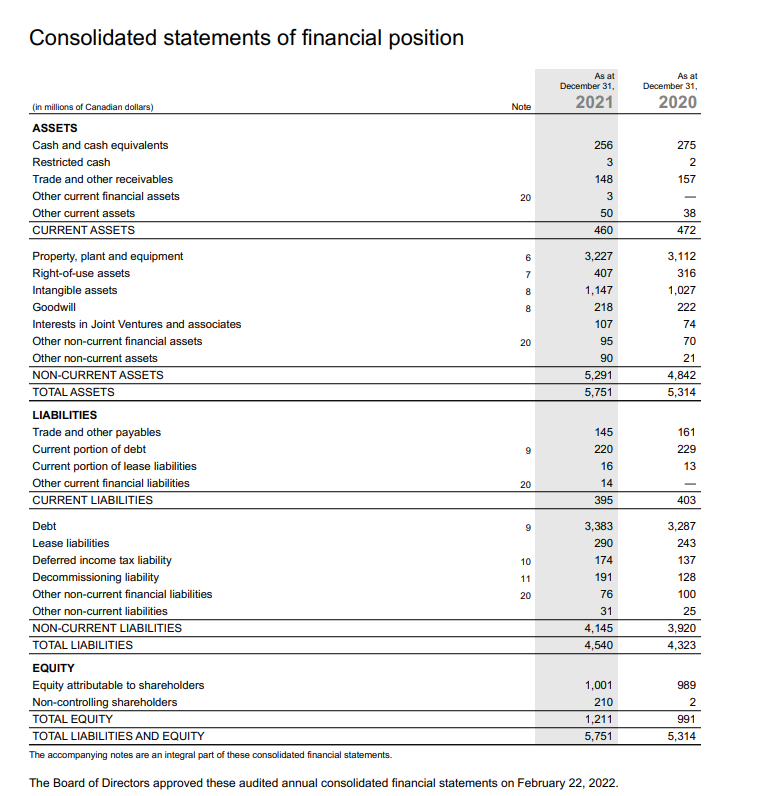

1) a. Current ratio = Current assets / Current liabilities = 460/395 = 1.16 Working capital = current assets - current liabilities = 460 -

1) a.

Current ratio = Current assets / Current liabilities

= 460/395 = 1.16

Working capital = current assets - current liabilities = 460 - 395 = 65

Net profit margin = Net income / Revenue

= Net profit / sales * 100

Debt to assets ratio = Total debt / Total assets = 220/ 5,751 = 0.03

b. For each of the ratios calculated in Part a, calculate the percentage change from prior year. Have they improved or declined?

c. Calculate the following ratios for your company using the financial statements for the current year only: - Fixed Asset Turnover - Return on Equity SHOW ALL WORK and include an analysis for each calculation (explained in Part a).

d. Are net cash flows from operating activities considered healthy or unhealthy in the current year? Why?

e. Briefly skim the annual report provided to you (do not read the entire report simply skim through the material) and state ONE interesting fact that you learned about the company from the annual report.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started