Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A customer buys a 50-strike put on an index when the market price of the index is also 50. The premium for the put

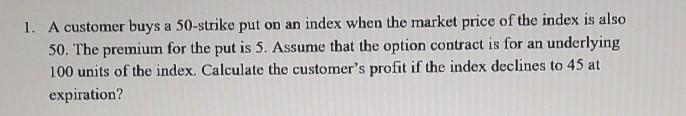

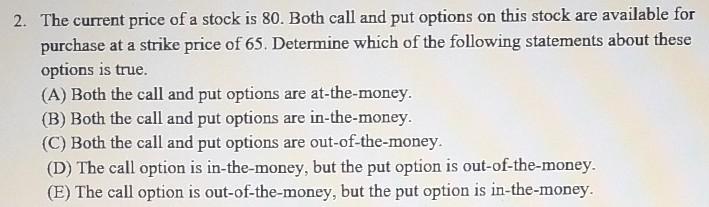

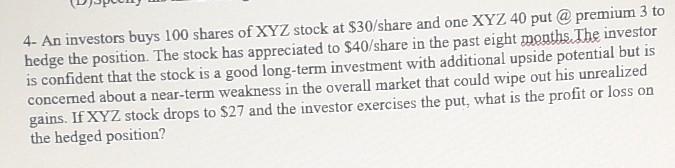

1. A customer buys a 50-strike put on an index when the market price of the index is also 50. The premium for the put is 5. Assume that the option contract is for an underlying 100 units of the index. Calculate the customer's profit if the index declines to 45 at expiration? 2. The current price of a stock is 80. Both call and put options on this stock are available for purchase at a strike price of 65. Determine which of the following statements about these options is true. (A) Both the call and put options are at-the-money. (B) Both the call and put options are in-the-money. (C) Both the call and put options are out-of-the-money. (D) The call option is in-the-money, but the put option is out-of-the-money. (E) The call option is out-of-the-money, but the put option is in-the-money. 3- Suppose Z Inc put with exercise price of $40 is selling for $0.20 What is the payoff and the profit to the put option holder if the stock price at expiration (strike price) is: $30 35 40 45 50 (A) What is the breakeven point for the investor? (B)What is his maximum gain/loss from each transaction? (C) What is the payoff for the put writer? (D)Specify his maximum gain/loss from each transaction 4- An investors buys 100 shares of XYZ stock at $30/share and one XYZ 40 put @premium 3 to hedge the position. The stock has appreciated to S40/share in the past eight months. The investor is confident that the stock is a good long-term investment with additional upside potential but is concerned about a near-term weakness in the overall market that could wipe out his unrealized gains. If XYZ stock drops to $27 and the investor exercises the put, what is the profit or loss on the hedged position

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started