1)

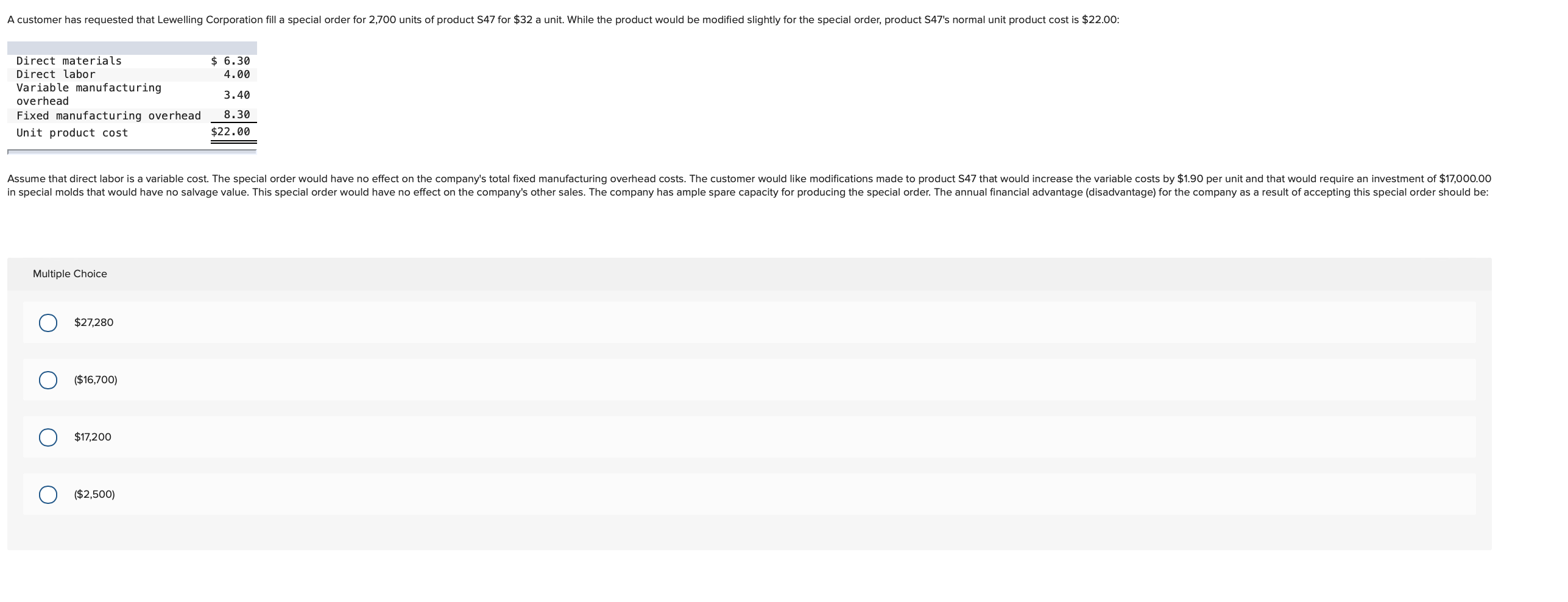

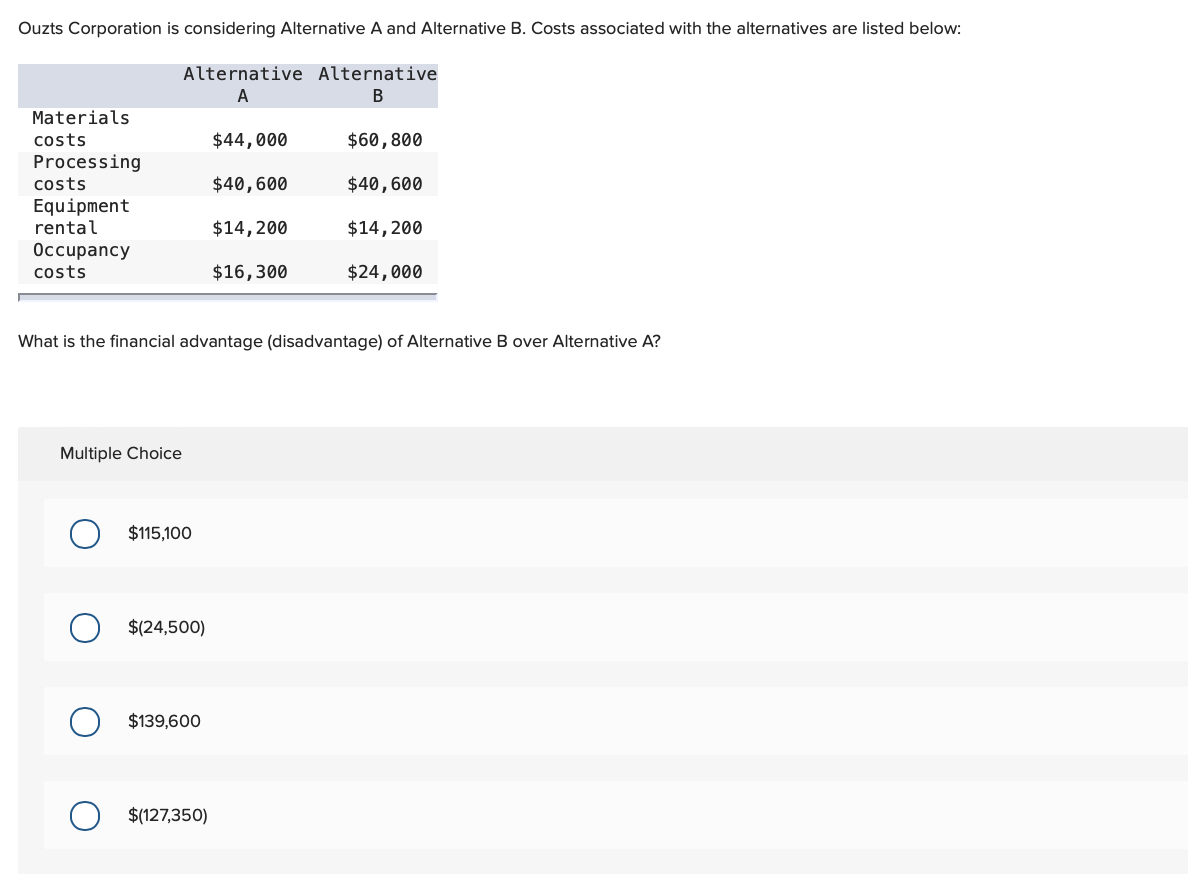

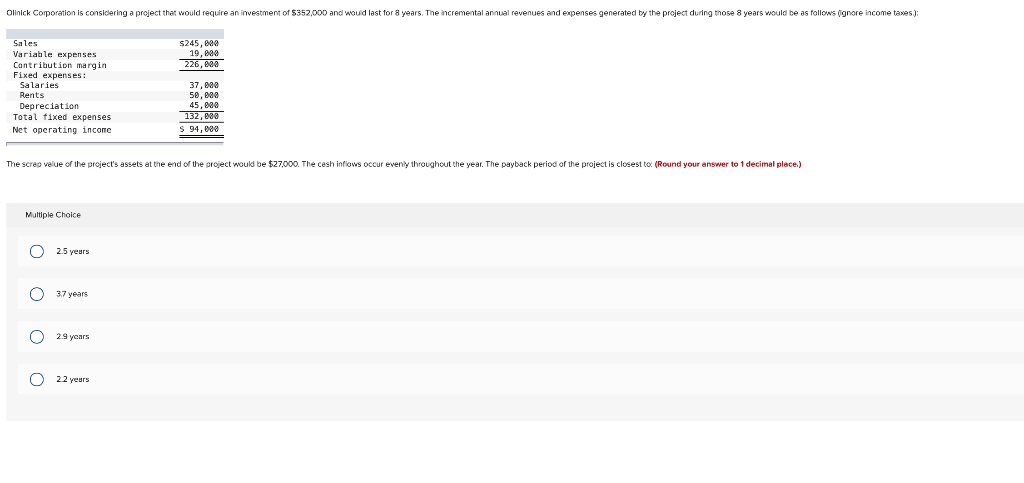

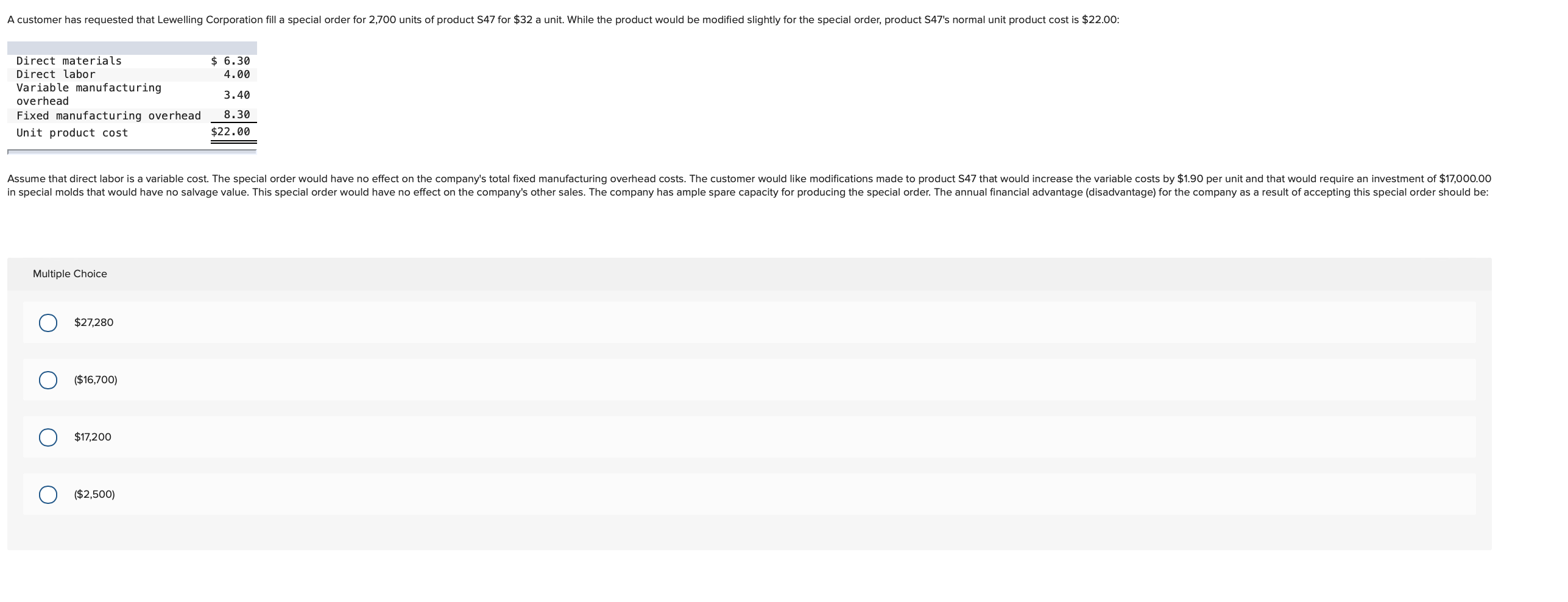

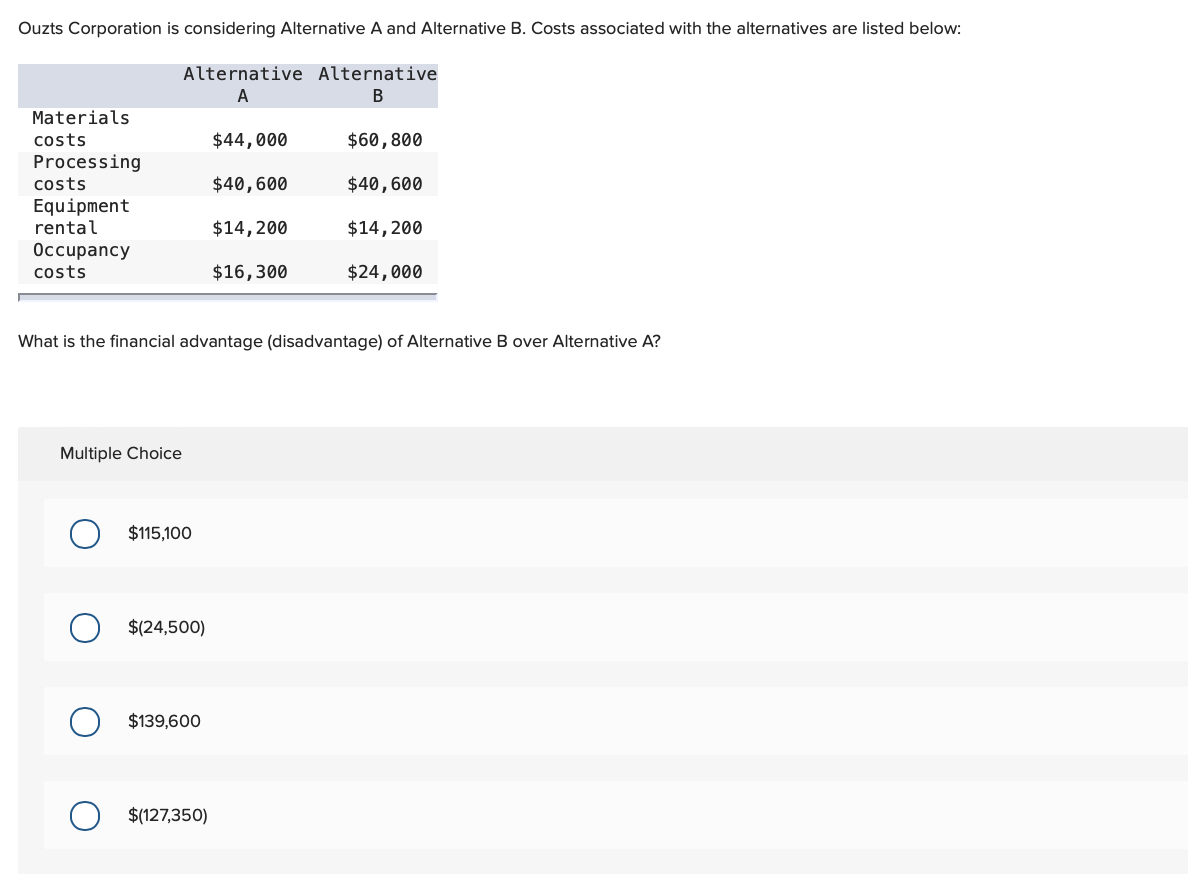

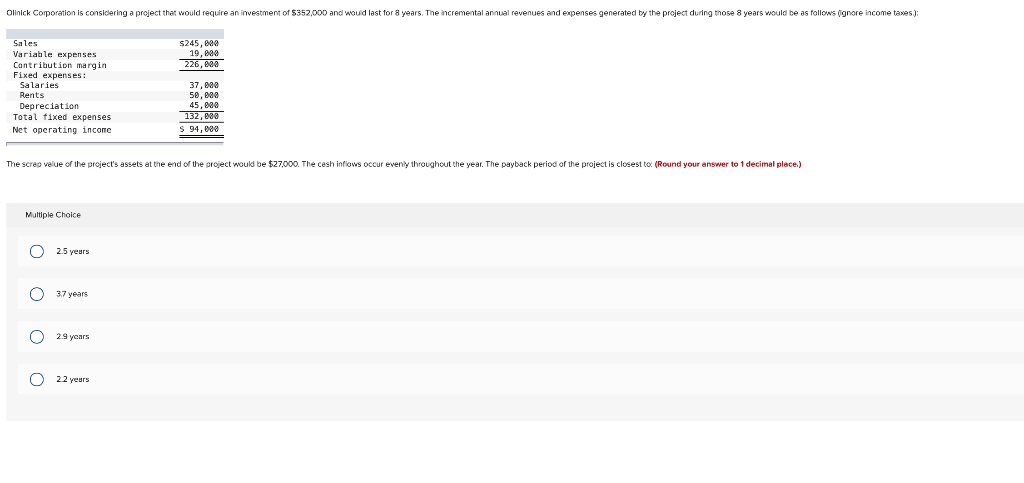

A customer has requested that Lewelling Corporation fill a special order for 2,700 units of product S47 for $32 a unit. While the product would be modified slightly for the special order, product S47's normal unit product cost is $22.00: $ 6.30 4.00 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost 3.40 8.30 $22.00 Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product S47 that would increase the variable costs by $1.90 per unit and that would require an investment of $17,000.00 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be: Multiple Choice $27,280 ($16,700) $17,200 ($2,500) Ouzts Corporation is considering Alternative A and Alternative B. Costs associated with the alternatives are listed below: Alternative Alternative A B $44,000 $60,800 Materials costs Processing costs Equipment rental Occupancy costs $40,600 $40,600 $14,200 $14,200 $16,300 $24,000 What is the financial advantage (disadvantage) of Alternative B over Alternative A? Multiple Choice $115,100 $(24,500) $139,600 $(127,350) Olinick Corporation is considering a project that would require an investment of $352,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows ignore income taxes): $245,90 19,690 226,600 Sales Variable expenses Contribution margin Fixed expenses: Salaries Rents Depreciation Total fixed expenses Net operating income 37,990 50,990 45,800 132,990 $ 94,990 The screp value of the project's assets at the end of the project would be $27,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to (Round your answer to 1 decimal place.) Multiple Choice 2.5 years c 3.7 years 29 years c 22 years