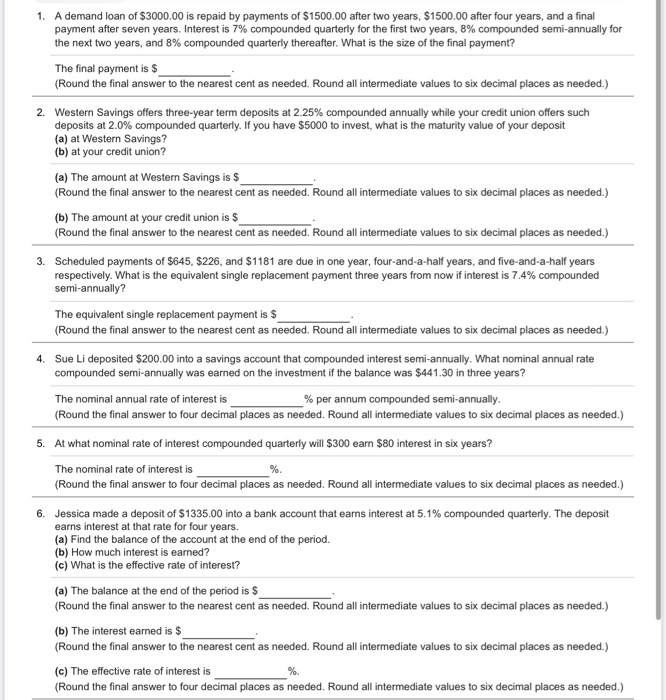

1. A demand loan of $3000.00 is repaid by payments of $1500.00 after two years, $1500.00 after four years, and a final payment after seven years. Interest is 7% compounded quarterly for the first two years, 8% compounded semi-annually for the next two years, and 8% compounded quarterly thereafter. What is the size of the final payment? The final payment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) 2. Western Savings offers three-year term deposits at 2.25% compounded annually while your credit union offers such deposits at 2.0% compounded quarterly. If you have $5000 to invest, what is the maturity value of your deposit (a) at Western Savings? (b) at your credit union? (a) The amount at Western Savings is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (b) The amount at your credit union is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) 3. Scheduled payments of $645, $226, and $1181 are due in one year, four-and-a-half years, and five-and-a-half years respectively. What is the equivalent single replacement payment three years from now if interest is 7.4% compounded semi-annually? The equivalent single replacement payment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) 4. Sue Li deposited $200.00 into a savings account that compounded interest semi-annually. What nominal annual rate compounded semi-annually was earned on the investment if the balance was $441.30 in three years? The nominal annual rate of interest is % per annum compounded semi-annually. (Round the final answer to four decimal places as needed. Round all intermediate values to six decimal places as needed.) 5. At what nominal rate of interest compounded quarterly will $300 earn $80 interest in six years? The nominal rate of interest is (Round the final answer to four decimal places as needed. Round all intermediate values to six decimal places as needed.) %. 6. Jessica made a deposit of $1335.00 into a bank account that earns interest at 5.1% compounded quarterly. The deposit earns interest at that rate for four years. (a) Find the balance of the account at the end of the period. (b) How much interest is earned? (c) What is the effective rate of interest? (a) The balance at the end of the period is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (b) The interest earned is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (c) The effective rate of interest is %. (Round the final answer to four decimal places as needed. Round all intermediate values to six decimal places as needed.)