1. a) Do you agree with John Slager's statement that "it is now pretty obvious to all of us that using our own sales force would be out of the question from the standpoint of costs? Explain why or why not

b) Having your own sales force is very attractive because of the control aspect and knowledge that 100% of the salesperson's selling time is for your company. Is there any alternative/combination way to use your own sales force for parts of the US distribution and how might you do this?

Hint: forget about Q1a) and keep an open mind about combinations & regional coverage - as a marketer, what do you do when you are not sure about a specific/particular strategy?

2. Regardless, of your preference develop an argument for the exclusive use of Manufacturers Representatives to distribute the relay.

3. Regardless, of your preference develop an argument for the exclusive use of Industrial Distributors to distribute the relay.

4. Could a combination of Manufacturer's Representatives and Industrial Distributors be used in the Channel Design for relays in the USA? How would this generally work (don't get into the "weeds/all the detail"- provide an overview of your thinking, and what you might use as the criteria to determine the type of representation and coverage for regions.

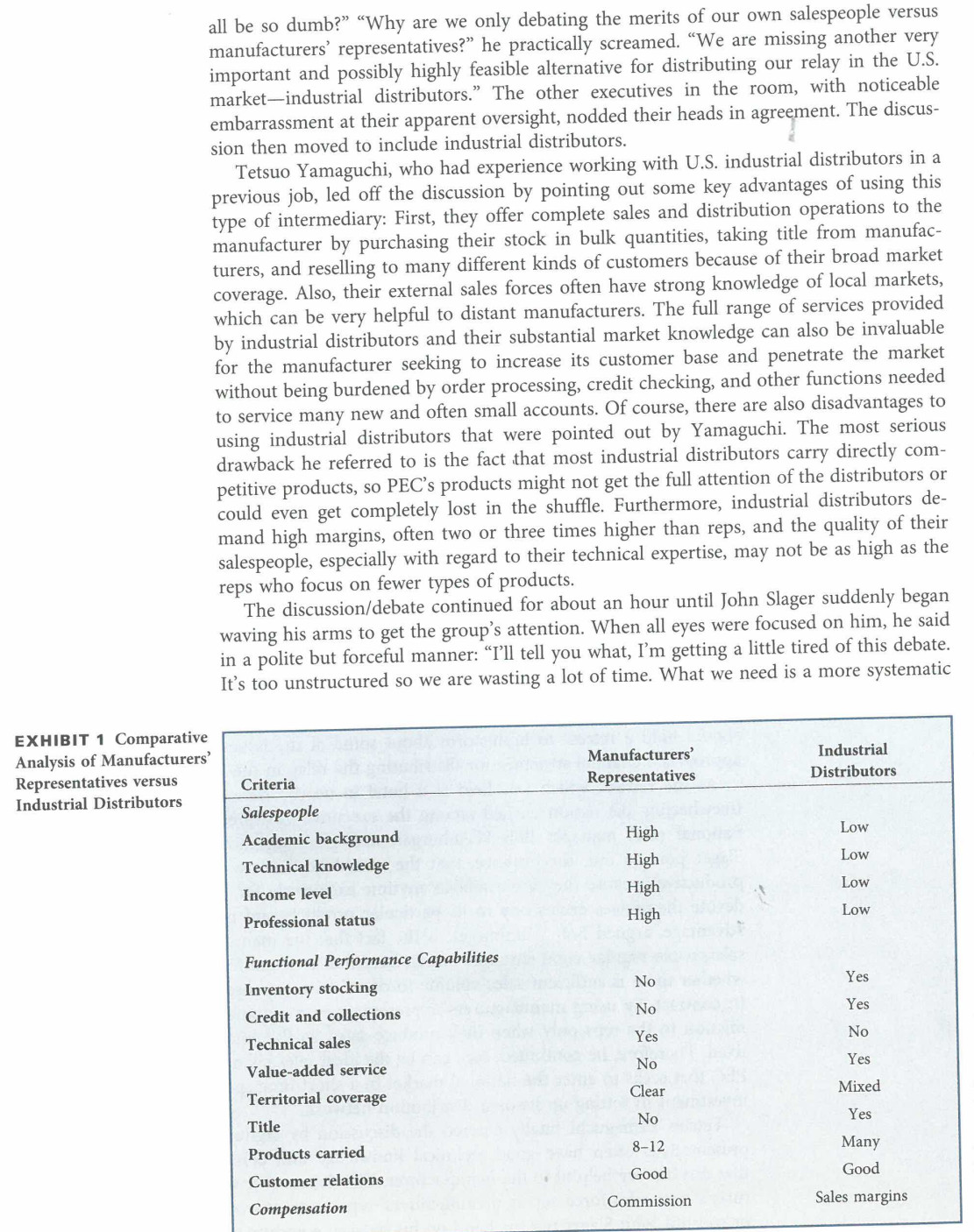

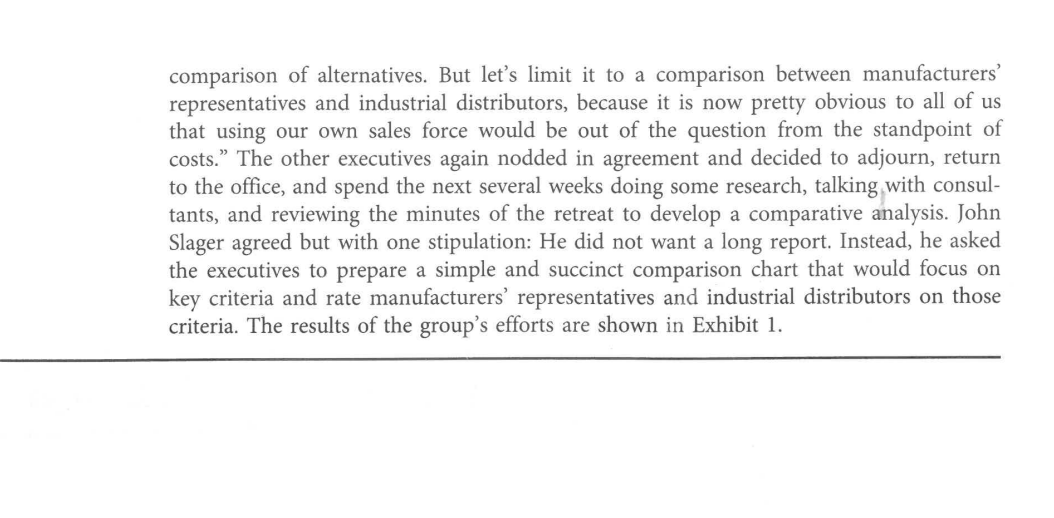

Precision Electronics Corporation t q Manufacturer's Representatives versus Industrial Distributors Background Seimitu Denki Kogyo Ltd. (SDK) Iapan developed the world's thinnest sealed polarized elec- tromechanical relay in the early 1970s. This represented a technological breakthrough for at least three features of such relay devices: First, it was miniaturized, especially with regard to height (for electronic devices, reducing the height of components that are mounted on printed circuit boards is critical). Second, it was resistant to adverse atmospheric conditions due to its plastic enclosure construction lled with dry nitrogen gas. Third, it could be used for memory functions and other logic circuits because of its polarity. SDK wanted to sell this new relay in the huge US. market, but lacked its own indus- trial marketing organization. So instead of attempting to sell the relay as an identied branded component part, SDK tried to market the relays through two US. manufactur- ing rms under their own OEM brands. However, SDK achieved little success doing so. The first rm, a manufacturer of industrial equipment, lacked experience in the compo- nent business; hence it was not able to reach the appropriate target markets. The exclu- sive sales agreement SDK had negotiated with the firm was therefore terminated within a year. The second manufacturer, a famous maker of military and aviation-related compo- nents, relegated SDK relays to a minor supplementary role in its product line rather than that of a featured product that would receive intensive sales effort. After two years of such neglect, sales were much lower than had been projected. Having attained little success marketing its new relay component through manufac- turers that paid little attention to the product, SDK decided to become much more heavily involved in marketing the relays by establishing its own industrial marketing organization in the United States. Establishment of Precision Electronics Corporation and Its Distribution Goals Precision Electronics Corporation (PEC) was established in Morristown, New Jersey, on October 1, 1974, as a wholly owned subsidiary of SDK, Iapan. PEC began its marketing activity for relays with seven employees consisting of four Americans (executive VP, national sales manager, secretary, and clerk) and three Japanese (planning manager, accounting manager, and product control supervisor). PEC's distribution goal for the relays was to penetrate the U.S. market and attain a sales volume of $50 million (a 10 percent market share) through its own distribution network within ten years. The Channel Decision Management at both SDK and PEC discussed whether the distribution structure of the new corporation should be composed entirely of its own salespeople or should use out- side sales forces such as manufacturer's representatives. To arrive at a decision, management made some basic calculations: First, PEC wanted to determine how many of its own salespeople it could afford. To do this, PEC decided to use typical commission rates that would have to be paid to manufacturers' representa- tives to achieve the sales goal as a benchmark and then work backward from there. Thus, if a 5 percent commission were paid on the projected $50 million in sales, this would amount to $2.5 million. Assuming each company salesperson would be paid $75,000, PEC could employ 33 salespeople to match what it would be paying in commissions to manufacturers' representatives ($2,500,000!$75,000). Given the huge US. market, PEC had serious doubts about whether 33 salespeople would be sufcient to cover the market. And, of course, this calculation was made based on achieving $50 million in sales, which was not expected to occur until the tenth year. Obviously, the number of salespeople that PEC could afford in the earlier years w0uld be much lower and hence even less sufficient to cover the giant US. market. PEC decided to do some further calculations to determine the coverage that might be provided by manufacturers' representatives at the same level of the projected tenyear sales target of $50 million. After checking with industry sources, PEC estimated that each manufacturer's representative could, on average, provide market coverage equal to ve company salespeOple. If this estimate were accurate, PEC could get sales coverage equivalent to 33 company salespeople by using only six or seven manufacturers' repre sentatives (335 = 6.6). Further, by using 18 to 20 manufacturers' representatives, PEC could get the equivalent of between 90 and 100 company salespeople (18 X 5 = 90; 20 X 5 = [00]. Yet management did not want to make such an important channel design decision based only on some rough calmlations of ten-year sales projections. They believed that other qualitative factors also needed to be considered. It was decided that management should hold a retreat to brainstorm about some of the issues involved in choosing an appropriate channel structure for distributing the relay in the US. market. At the retreat, which was held at a hotel in nearby New Brunswick, New Jersey, a freewheeling discussion ensued among the executive vice president (EVP) Iohn Slager, national sales manager Bob Weinburger, and planning manager Tetsuo Yamaguchi. Slager pointed out, for instance, that the manufacturer's own salespeople can be very productive because they are available anytime exclusively for the manufacturer and can devote themselves exclusively to its particular products and policies. But offsetting this advantage, argued Bob Weinburger, is the fact that the manufacturer must pay its own salespeople regular compensation, which becomes a virtual fixed expense, regardless of whether there is sufcient sales volume to cover the compensation and provide a profit. In contrast, by using manufacturers' representatives, a manufacturer needs to pay com- mission to the reps only when they produce sales, so the costs are variable rather than fixed. Therefore, he continued, reps can be the ideal sales channel for a company such as PEC that seeks to enter the national market in a short time span without making a huge investment in setting up its own distribution network. Tetsuo Yamaguchi nally entered the discussion by arguing that manufacturers' re- presentatives often have good technical knowledge and complementary product lines that can be very helpful to the manufacturer. The debate over the merits of the manufac- turer's own sales force versus manufacturers' representatives continued for another hour or so until Iohn Slager put his hand on his head in a gesture suggestive of \"How can we EXHIBIT 1 Comparative Analysis of Manufacturers' Representatives versus Industrial Distributors all be so dumb?\" \"Why are we only debating the merits of our own salespeople versus manufacturers' representatives?\" he practically screamed. \"We are missing another very important and possibly highly feasible alternative for distributing our relay in the U.S. marketindustrial distributors.\" The other executives in the room, with noticeable embarrassment at their apparent oversight, nodded their heads in agreement. The discus- sion then moved to include industrial distributors. r: Tetsuo Yamaguchi, who had experience working with U.S. industrial distributors in a previous job, led off the discussion by pointing out some key advantages of using this type of intermediary: First, they offer complete sales and distribution operations to the manufacturer by purchasing their stock in bulk quantities, taking title from manufac- turers, and reselling to many different kinds of customers because of their broad market coverage. Also, their external sales forces often have strong knowledge of local markets, which can be very helpful to distant manufacturers. The full range of services provided by industrial distributors and their substantial market knowledge can also be invaluable for the manufacturer seeking to increase its customer base and penetrate the market without being burdened by order processing, credit checking, and other functions needed to service many new and often small accounts. Of course, there are also disadvantages to using industrial distributors that were pointed out by Yamaguchi. The most serious drawback he referred to is the fact that most industrial distributors carry directly com- petitive products, so PEC's products might not get the full attention of the distributors or could even get completely lost in the shufe. Furthermore, industrial distributors de- mand high margins, often two or three times higher than reps, and the quality of their salespeople, especially with regard to their technical expertise, may not be as high as the reps who focus on fewer types of products. The discussionidebate continued for about an hour until John Slager suddenly began waving his arms to get the group's attention. When all eyes were focused on him, he said in a polite but forceful manner: \"I'll tell you what, I'm getting a little tired of this debate. It's too unstructured so we are wasting a lot of time. What we need is a more systematic Criteria Representatives Salespeople Academic background High Low Technical knowledge High Low Income level High 4 Low Professional status " Functional Performance Capabilities Inventory stocking No Credit and collections No Yes Technical sales Yes No Value-added service No Yes Territorial coverage Clear Mixed Title No Yes Products carried 81 2 Many Customer relations . Good Compensation comparison of alternatives. But let's limit it to a comparison between manufacturers' representatives and industrial distributors, because it is now pretty obvious to all of us that using our own sales force would be out of the question from the standpoint of costs.\" The other executives again nodded in agreement and decided to adjourn, return to the office, and spend the next several weeks doing some research, talking,with consul- tants, and reviewing the minutes of the retreat to develop a comparative analysis. Iohn Slager agreed but with one stipulation: He did not want a long report. Instead, he asked the executives to prepare a simple and succinct comparison chart that would focus on key criteria and rate manufacturers' representatives and industrial distributors on those criteria. The results of the group's efforts are shown in Exhibit 1