1

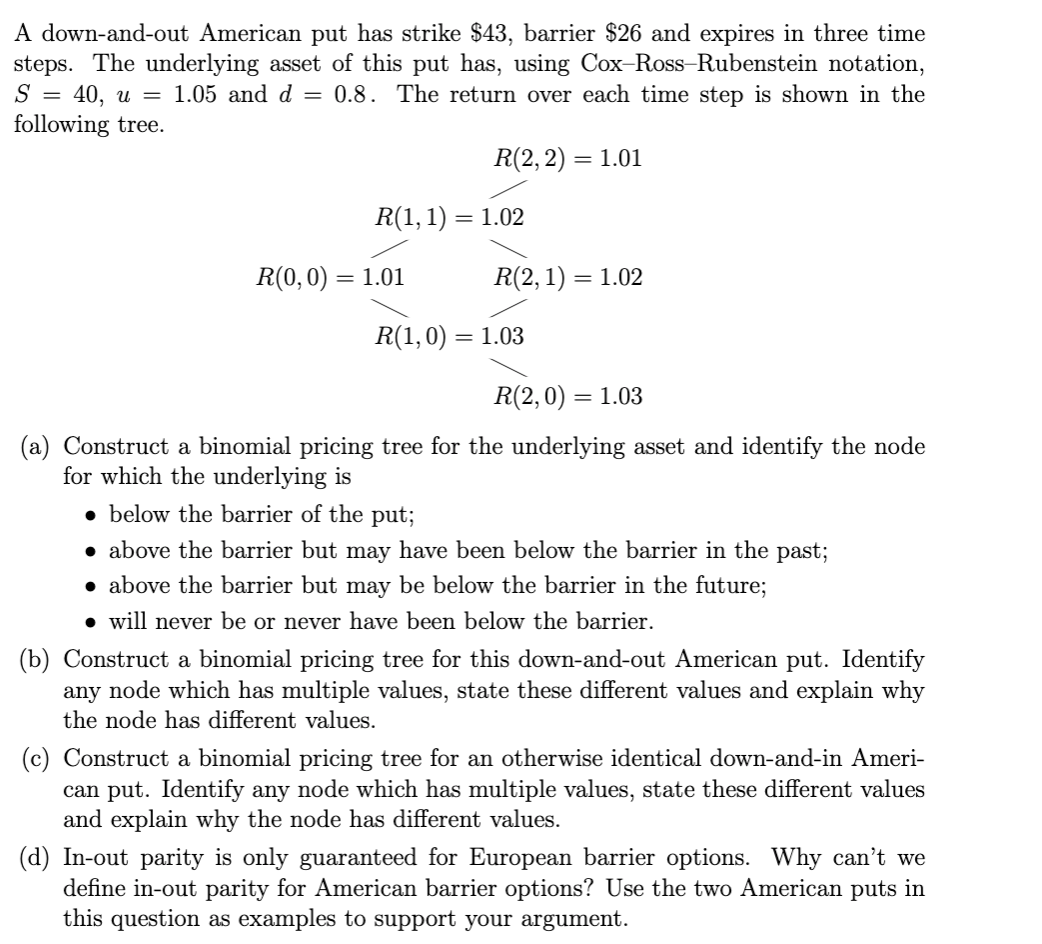

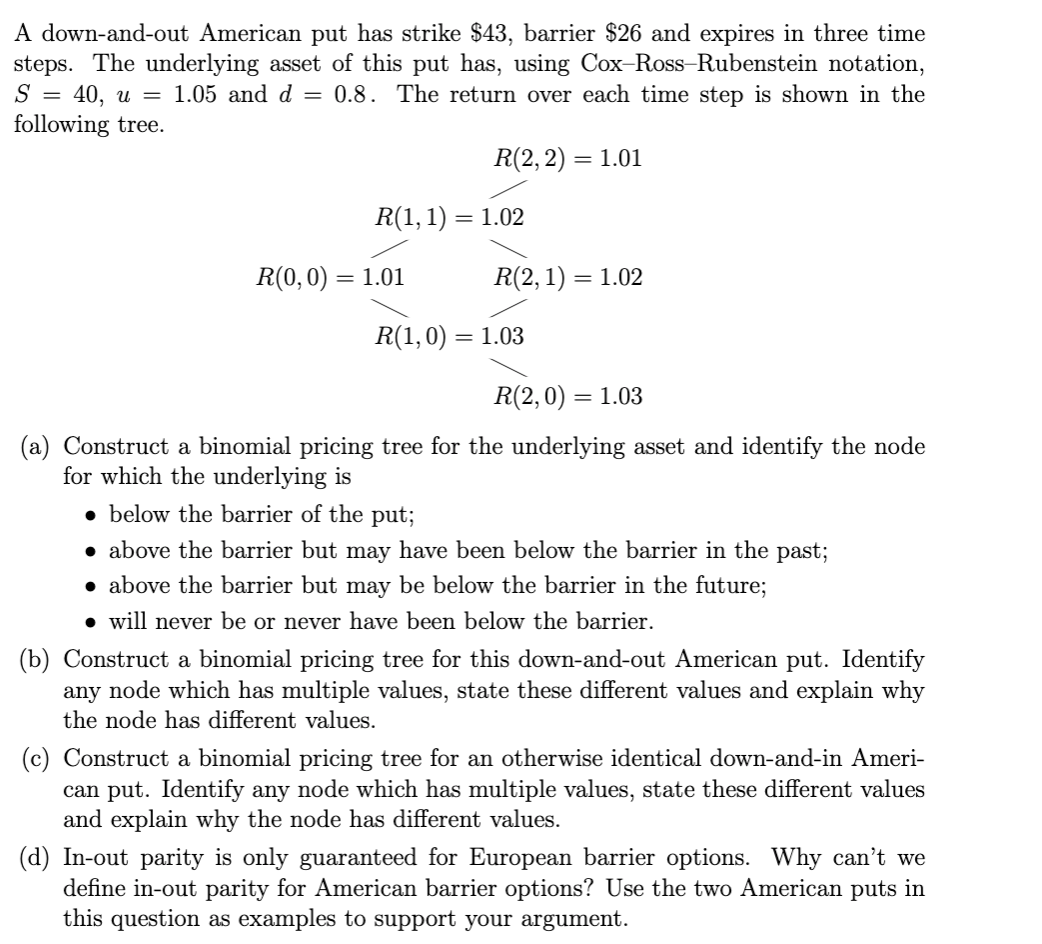

A down-and-out American put has strike $43, barrier $26 and expires in three time steps. The underlying asset of this put has, using Cox-Ross-Rubenstein notation, S = = 40, u = 1.05 and d = 0.8. The return over each time step is shown in the following tree. R(2, 2) = 1.01 R(1,1) = 1.02 R(0,0) = 1.01 R(2,1) = 1.02 R(1,0) = 1.03 R(2,0) = 1.03 (a) Construct a binomial pricing tree for the underlying asset and identify the node for which the underlying is below the barrier of the put; above the barrier but may have been below the barrier in the past; above the barrier but may be below the barrier in the future; will never be or never have been below the barrier. (b) Construct a binomial pricing tree for this down-and-out American put. Identify any node which has multiple values, state these different values and explain why the node has different values. (c) Construct a binomial pricing tree for an otherwise identical down-and-in Ameri- can put. Identify any node which has multiple values, state these different values and explain why the node has different values. (d) In-out parity is only guaranteed for European barrier options. Why can't we define in-out parity for American barrier options? Use the two American puts in this question as examples to support your argument. A down-and-out American put has strike $43, barrier $26 and expires in three time steps. The underlying asset of this put has, using Cox-Ross-Rubenstein notation, S = = 40, u = 1.05 and d = 0.8. The return over each time step is shown in the following tree. R(2, 2) = 1.01 R(1,1) = 1.02 R(0,0) = 1.01 R(2,1) = 1.02 R(1,0) = 1.03 R(2,0) = 1.03 (a) Construct a binomial pricing tree for the underlying asset and identify the node for which the underlying is below the barrier of the put; above the barrier but may have been below the barrier in the past; above the barrier but may be below the barrier in the future; will never be or never have been below the barrier. (b) Construct a binomial pricing tree for this down-and-out American put. Identify any node which has multiple values, state these different values and explain why the node has different values. (c) Construct a binomial pricing tree for an otherwise identical down-and-in Ameri- can put. Identify any node which has multiple values, state these different values and explain why the node has different values. (d) In-out parity is only guaranteed for European barrier options. Why can't we define in-out parity for American barrier options? Use the two American puts in this question as examples to support your argument