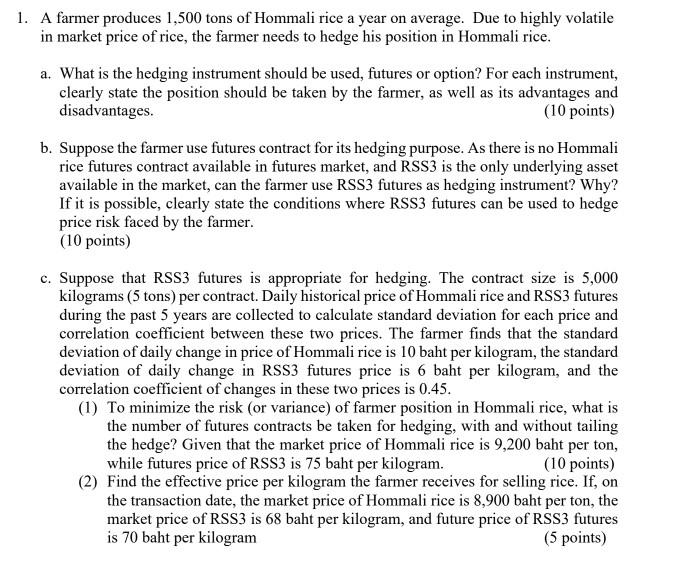

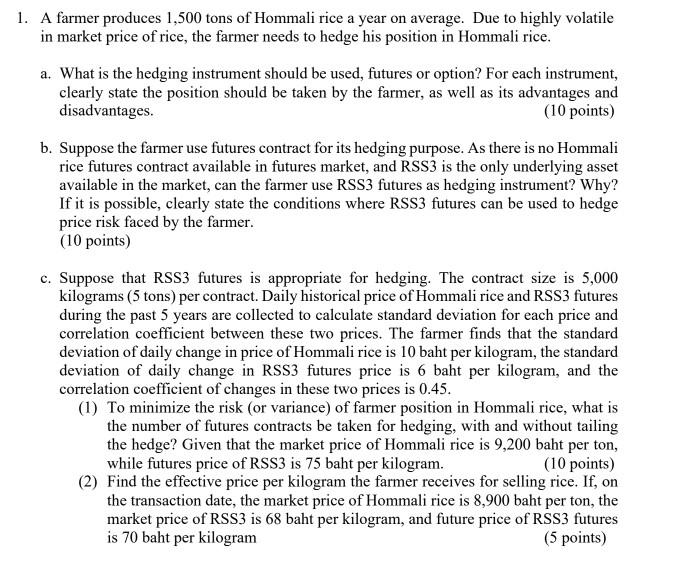

1. A farmer produces 1,500 tons of Hommali rice a year on average. Due to highly volatile in market price of rice, the farmer needs to hedge his position in Hommali rice. a. What is the hedging instrument should be used, futures or option? For each instrument, clearly state the position should be taken by the farmer, as well as its advantages and disadvantages. (10 points) b. Suppose the farmer use futures contract for its hedging purpose. As there is no Hommali rice futures contract available in futures market, and RSS3 is the only underlying asset available in the market, can the farmer use RSS3 futures as hedging instrument? Why? If it is possible, clearly state the conditions where RSS3 futures can be used to hedge price risk faced by the farmer. (10 points) c. Suppose that RSS3 futures is appropriate for hedging. The contract size is 5,000 kilograms (5 tons) per contract. Daily historical price of Hommali rice and RSS3 futures during the past 5 years are collected to calculate standard deviation for each price and correlation coefficient between these two prices. The farmer finds that the standard deviation of daily change in price of Hommali rice is 10 baht per kilogram, the standard deviation of daily change in RSS3 futures price is 6 baht per kilogram, and the correlation coefficient of changes in these two prices is 0.45. (1) To minimize the risk (or variance) of farmer position in Hommali rice, what is the number of futures contracts be taken for hedging, with and without tailing the hedge? Given that the market price of Hommali rice is 9,200 baht per ton, while futures price of RSS3 is 75 baht per kilogram. (10 points) (2) Find the effective price per kilogram the farmer receives for selling rice. If, on the transaction date, the market price of Hommali rice is 8,900 baht per ton, the market price of RSS3 is 68 baht per kilogram, and future price of RSS3 futures is 70 baht per kilogram (5 points) 1. A farmer produces 1,500 tons of Hommali rice a year on average. Due to highly volatile in market price of rice, the farmer needs to hedge his position in Hommali rice. a. What is the hedging instrument should be used, futures or option? For each instrument, clearly state the position should be taken by the farmer, as well as its advantages and disadvantages. (10 points) b. Suppose the farmer use futures contract for its hedging purpose. As there is no Hommali rice futures contract available in futures market, and RSS3 is the only underlying asset available in the market, can the farmer use RSS3 futures as hedging instrument? Why? If it is possible, clearly state the conditions where RSS3 futures can be used to hedge price risk faced by the farmer. (10 points) c. Suppose that RSS3 futures is appropriate for hedging. The contract size is 5,000 kilograms (5 tons) per contract. Daily historical price of Hommali rice and RSS3 futures during the past 5 years are collected to calculate standard deviation for each price and correlation coefficient between these two prices. The farmer finds that the standard deviation of daily change in price of Hommali rice is 10 baht per kilogram, the standard deviation of daily change in RSS3 futures price is 6 baht per kilogram, and the correlation coefficient of changes in these two prices is 0.45. (1) To minimize the risk (or variance) of farmer position in Hommali rice, what is the number of futures contracts be taken for hedging, with and without tailing the hedge? Given that the market price of Hommali rice is 9,200 baht per ton, while futures price of RSS3 is 75 baht per kilogram. (10 points) (2) Find the effective price per kilogram the farmer receives for selling rice. If, on the transaction date, the market price of Hommali rice is 8,900 baht per ton, the market price of RSS3 is 68 baht per kilogram, and future price of RSS3 futures is 70 baht per kilogram (5 points)