Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A favorite marketing ploy of credit card companies is to offer you a large number of frequent flyer miles for applying for a co-branded

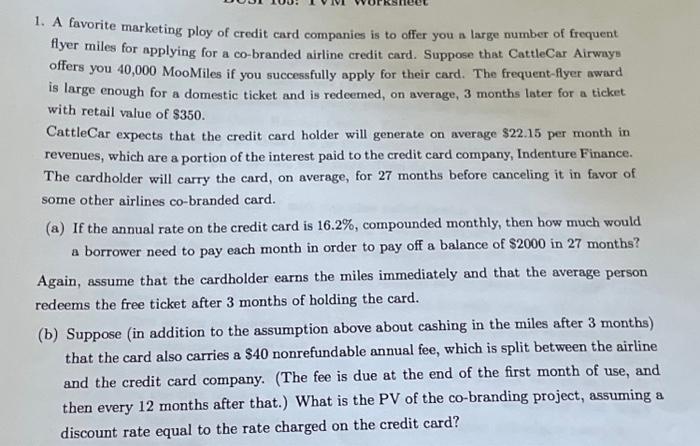

1. A favorite marketing ploy of credit card companies is to offer you a large number of frequent flyer miles for applying for a co-branded airline credit card. Suppose that CattleCar Airways offers you 40,000 MooMiles if you successfully apply for their card. The frequent-flyer award is large enough for a domestic ticket and is redeemed, on average, 3 months later for a ticket. with retail value of $350. CattleCar expects that the credit card holder will generate on average $22.15 per month in revenues, which are a portion of the interest paid to the credit card company, Indenture Finance. The cardholder will carry the card, on average, for 27 months before canceling it in favor of some other airlines co-branded card. (a) If the annual rate on the credit card is 16.2%, compounded monthly, then how much would a borrower need to pay each month in order to pay off a balance of $2000 in 27 months? Again, assume that the cardholder earns the miles immediately and that the average person redeems the free ticket after 3 months of holding the card. (b) Suppose (in addition to the assumption above about cashing in the miles after 3 months) that the card also carries a $40 nonrefundable annual fee, which is split between the airline and the credit card company. (The fee is due at the end of the first month of use, and then every 12 months after that.) What is the PV of the co-branding project, assuming a discount rate equal to the rate charged on the credit card?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started