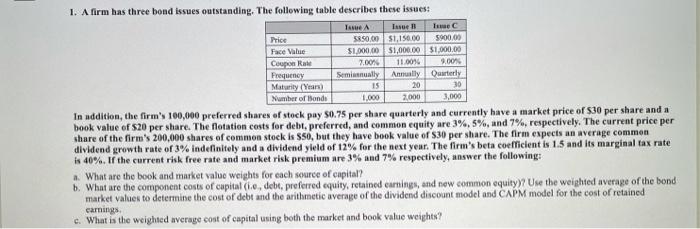

1. A firm has three bond issues outstanding. The following table describes these issues Tase A Issue Twe Price 5850.00 1,150.00 5900.00 Face Value $1,000.00 $1,000.00 $1,000.00 Coupon Rate 7.00% 11.00% 9.00 Frequency Semially AnnuallyDarterly Maturity (Yuan) 15 20 30 Number of Bonde 1.000 2.000 3,000 In addition, the firm's 100,000 preferred shares of stock pay $0.75 per share quarterly and currently have a market price of $30 per share and a book value of $20 per share. The flotation costs for debt, preferred, and common equity are 3%, 5%, and 7%, respectively. The current price per share of the firm's 200,000 shares of common stock is S50, but they have book value of $30 per share. The firm expects an average common dividend growth rate of 3% indefinitely and a dividend yield of 12% for the next year . The firm's beta coefficient is 1.5 and its marginal tax rate is 40%. If the current risk free rate and market risk premium are 3% and 7% respectively, answer the following: a. What are the book and market value weights for each source of capital? b. What are the component costs of capital ie, debt, preferred equity, retained earnings, and new common equity? Use the weighted average of the bond market values to determine the cost of debt and the arithmetic average of the dividend discount model and CAPM model for the cost of retained carnings c. What is the weighted average cost of capital uning both the market and book value weights? 1. A firm has three bond issues outstanding. The following table describes these issues Tase A Issue Twe Price 5850.00 1,150.00 5900.00 Face Value $1,000.00 $1,000.00 $1,000.00 Coupon Rate 7.00% 11.00% 9.00 Frequency Semially AnnuallyDarterly Maturity (Yuan) 15 20 30 Number of Bonde 1.000 2.000 3,000 In addition, the firm's 100,000 preferred shares of stock pay $0.75 per share quarterly and currently have a market price of $30 per share and a book value of $20 per share. The flotation costs for debt, preferred, and common equity are 3%, 5%, and 7%, respectively. The current price per share of the firm's 200,000 shares of common stock is S50, but they have book value of $30 per share. The firm expects an average common dividend growth rate of 3% indefinitely and a dividend yield of 12% for the next year . The firm's beta coefficient is 1.5 and its marginal tax rate is 40%. If the current risk free rate and market risk premium are 3% and 7% respectively, answer the following: a. What are the book and market value weights for each source of capital? b. What are the component costs of capital ie, debt, preferred equity, retained earnings, and new common equity? Use the weighted average of the bond market values to determine the cost of debt and the arithmetic average of the dividend discount model and CAPM model for the cost of retained carnings c. What is the weighted average cost of capital uning both the market and book value weights