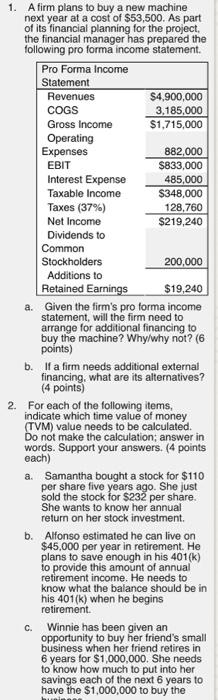

1. A firm plans to buy a new machine next year at a cost of $53,500. As part of its financial planning for the project, the financial manager has prepared the following pro forma income statement. Pro Forma Income Statement Revenues $4,900,000 COGS 3,185,000 Gross Income $1,715,000 Operating Expenses 882,000 EBIT $833,000 Interest Expense 485,000 Taxable income $348,000 Taxes (37%) 128,760 Net Income $219,240 Dividends to Common Stockholders 200,000 Additions to Retained Earnings $19,240 a. Given the firm's pro forma income statement, will the firm need to arrange for additional financing to buy the machine? Why/why not? (6 points) b. If a firm needs additional external financing, what are its alternatives? (4 points) 2. For each of the following items, indicate which time value of money (TVM) value needs to be calculated. Do not make the calculation; answer in words. Support your answers. (4 points each) a. Samantha bought a stock for $110 per share five years ago. She just sold the stock for $232 per share. She wants to know her annual return on her stock investment. b. Alfonso estimated he can live on $45,000 per year in retirement. He plans to save enough in his 401(k) to provide this amount of annual retirement income. He needs to know what the balance should be in his 401(k) when he begins retirement c. Winnie has been given an opportunity to buy her friend's small business when her friend retires in 6 years for $1,000,000. She needs to know how much to put into her savings each of the next 6 years to have the $1,000,000 to buy the 2. For each of the following items, indicate which time value of money (TVM) value needs to be calculated. Do not make the calculation; answer in words. Support your answers. (4 points each) a. Samantha bought a stock for $110 per share five years ago. She just sold the stock for $232 per share. She wants to know her annual return on her stock investment. b. Alfonso estimated he can live on $45,000 per year in retirement. He plans to save enough in his 401(k) to provide this amount of annual retirement income. He needs to know what the balance should be in his 401(k) when he begins retirement c. Winnie has been given an opportunity to buy her friend's small business when her friend retires in 6 years for $1,000,000. She needs to know how much to put into her savings each of the next 6 years to have the $1,000,000 to buy the business. d. Max has read about an investment opportunity that promises to pay investors $500 per year for 10 years. He wants to realize an annual return of 15% per year on any investments he makes. He needs to know the most he should pay to buy the investment today