Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. a Firms bonds have a maturity of 16 years with a $1000 face value, a 7% semiannual coupon, are callable in 5 years at

1. a Firms bonds have a maturity of 16 years with a $1000 face value, a 7% semiannual coupon, are callable in 5 years at $1090, and currently sell at a price of $1,147. what is their Yield to call (YTC)?

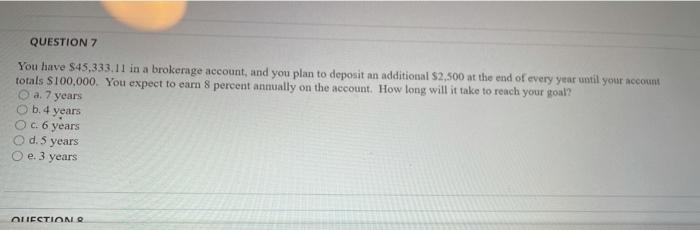

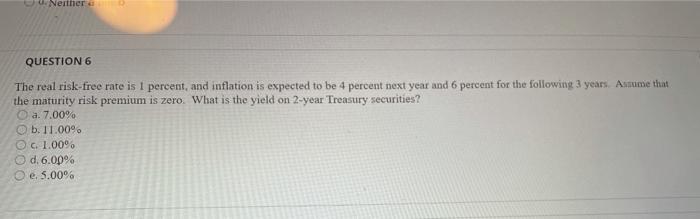

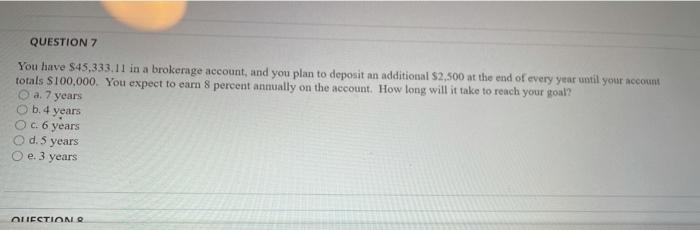

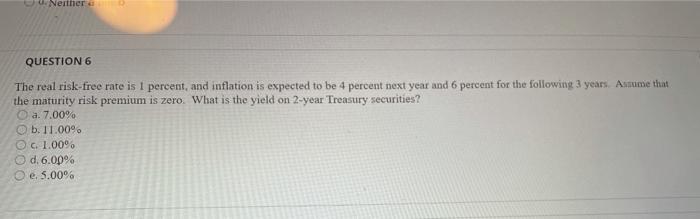

QUESTION 7 You have $45,333.11 in a brokerage account, and you plan to deposit an additional $2,500 at the end of every year until your account totals $100,000. You expect to earn 8 percent annually on the account. How long will it take to reach your goal? a. 7 years Ob. 4 years O c. 6 years O d. 5 years e. 3 years LECTION M. Neither QUESTION 6 The real risk-free rate is 1 percent, and inflation is expected to be 4 percent next year and 6 percent for the following 3 years. Asume that the maturity risk premium is zero. What is the yield on 2-year Treasury securities? a. 7.00% b. 11.00% G 1.00% d. 6.00% e. 5.00% a. 7.00%

b. 5.60%

c. 3.75%

d. 5.91%

e. 5.22%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started