Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 a . Giants Inc., is a successful firm that uses leverage and has assets valued at $ 2 million. Jets, Inc., is another successful

a Giants Inc., is a successful firm that uses leverage and has assets valued at $ million. Jets, Inc., is another successful firm similar to Giants except that Jets is unlevered. One evening at a party you overhear a shareholder of Giants telling a shareholder of Jets that his firm is better because it uses debt. Use the concept of homemade leverage to convince the Giants shareholder that because the assets of the two firms are identical, he would be equally as well off by investing in Jets, Inc. and borrowing.

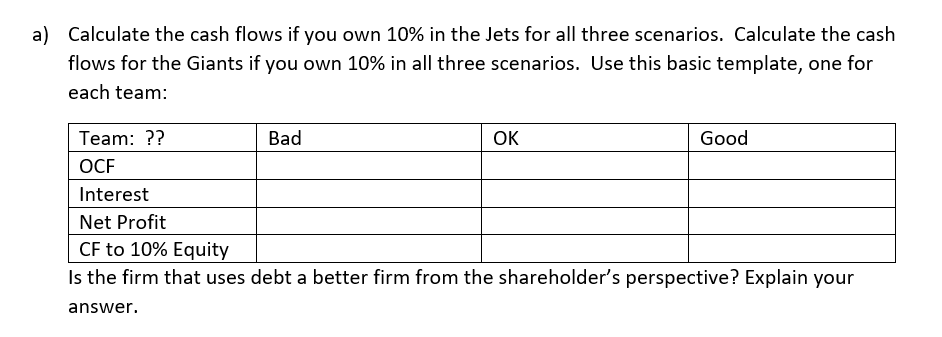

Assume that the Giants, Inc. uses $ in debt at a cost of There are three possible states of the world for cash flows: BAD$ OK$ and GOOD$a Calculate the cash flows if you own in the Jets for all three scenarios. Use this basic template, one for each team: see attached template

Is the firm that uses debt a better firm from the shareholder's perspective? Explain your

answer.

b Now, say you like the Giants cash flows better but you own of the Jets. Show that you can earn the Giants cash flows by owning of the Jets equity and borrowing an amount that is equal to of the debt of the Giants.

c Now, say you like the Jets cash flows better but you own of the Giants. Show that you can earn the Jets cash flows by owning of the Giants equity and lending an amount that is equal to of the bonds of the Giants.

d Show that homemade leverage no longer works if corporate income is taxed at Explain why this is true assume you own the Jets but want the leverage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started