Question

1. A hotel purchased a new office desk on April 15, 2020 and a new executive style chairs for the office on August 5, 2020.

1. A hotel purchased a new office desk on April 15, 2020 and a new executive style chairs for the office on August 5, 2020. The office desk cost $1,150 and the chairs cost $2,300.

determine the total depreciation amount for 2022 assuming the taxpayer opted out of Sec. 179 and bouns(if available) in the year of purchase. In addition, assume all taxpayers use a calender year tax period and that the property mentioned was the only property purchased in the year of acquisition.

2. An accounting firm bought an office building on October 15, 2017, which cost $750,000.

determine the total depreciation amount for 2022 assuming the taxpayer opted out of Sec. 179 and bouns(if available) in the year of purchase. In addition, assume all taxpayers use a calender year tax period and that the property mentioned was the only property purchased in the year of acquisition.

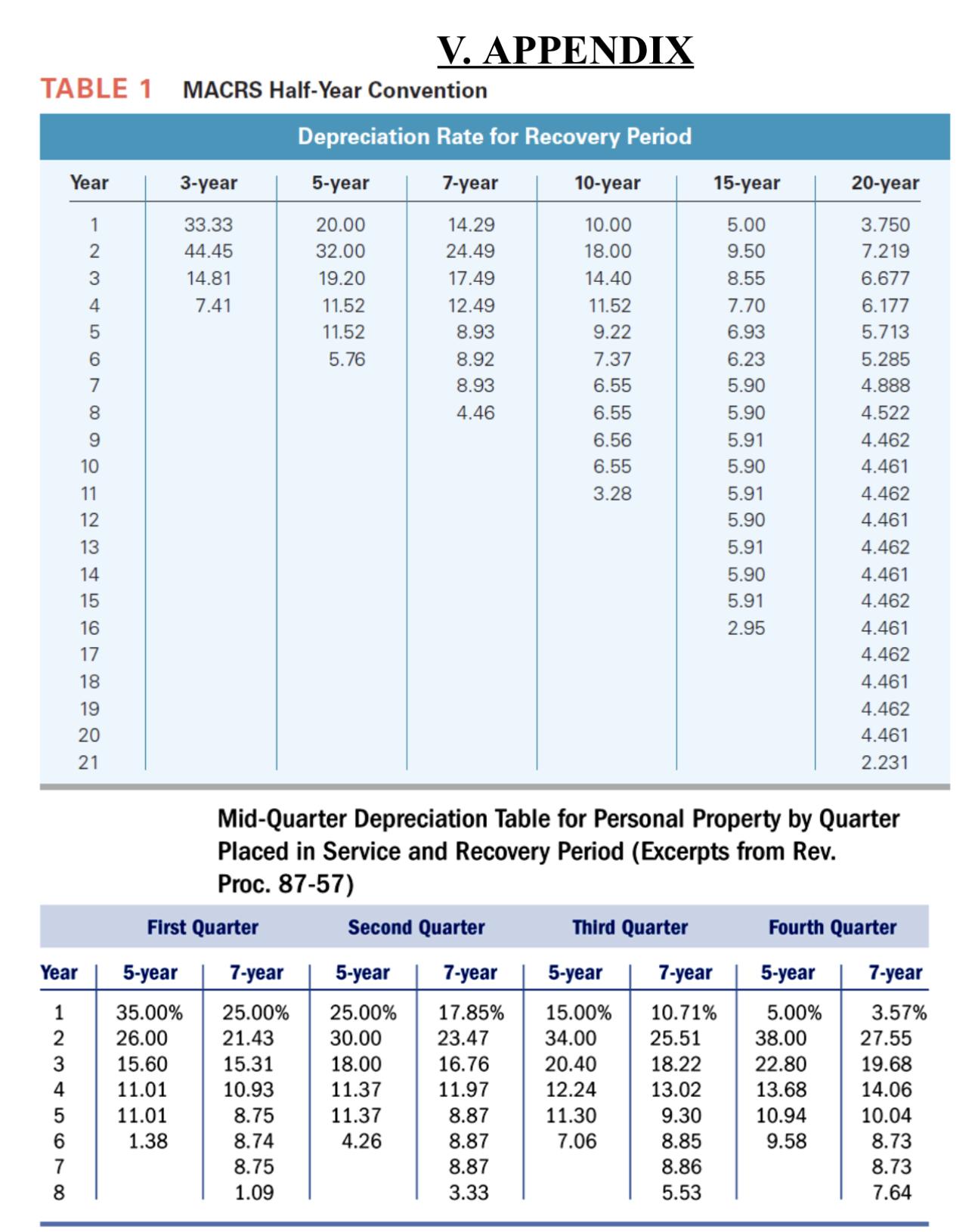

TABLE 1 MACRS Half-Year Convention Year 345678 12345NH76927 Year 1 2 8 10 11 18 20 3-year 33.33 44.45 26.00 15.60 11.01 11.01 1.38 14.81 7.41 First V. APPENDIX Quarter 5-year 35.00% 25.00% 21.43 15.31 10.93 8.75 8.74 8.75 1.09 Depreciation Rate for Recovery Period 7-year 14.29 24.49 17.49 12.49 8.93 5-year 20.00 32.00 19.20 11.52 11.52 5.76 8.92 8.93 4.46 Second Quarter 7-year 5-year 7-year 25.00% 17.85% 30.00 23.47 18.00 16.76 11.37 11.97 11.37 8.87 4.26 8.87 8.87 3.33 10-year 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 Mid-Quarter Depreciation Table for Personal Property by Quarter Placed in Service and Recovery Period (Excerpts from Rev. Proc. 87-57) Third Quarter 15-year 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 5-year 15.00% 34.00 20.40 12.24 11.30 7.06 7-year 10.71% 25.51 18.22 13.02 9.30 8.85 8.86 5.53 20-year 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 38.00 22.80 13.68 10.94 9.58 Fourth Quarter 5-year 5.00% 7-year 3.57% 27.55 19.68 14.06 10.04 8.73 8.73 7.64

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer and Explanation The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started