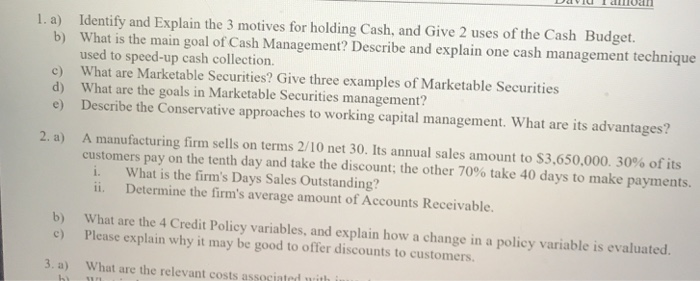

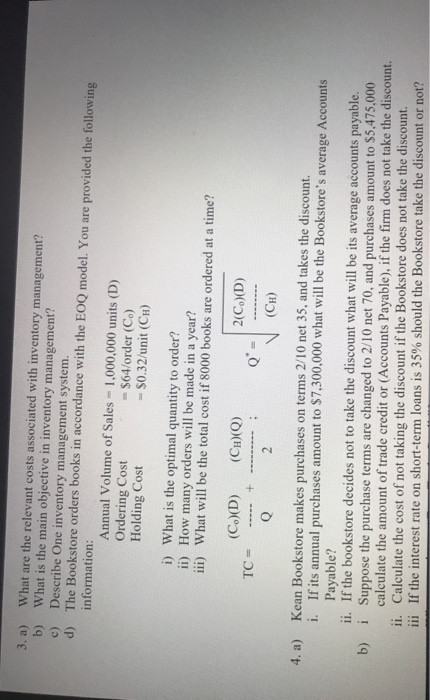

1. a) Identify and Explain the 3 motives for holding Cash, and Give 2 uses of the Cash Budget. b) What is the main goal of Cash Management? Describe and explain one cash management technique used to speed-up cash collection c) What are Marketable Securities? Give three examples of Marketable Securities d) What are the goals in Marketable Securities management? e) Describe the Conservative approaches to working capital management. What are its advantages? 2. a) A manufacturing firm sells on terms 2/10 net 30. Its annual sales amount to $3.650.000. 30% of its customers pay on the tenth day and take the discount; the other 70% take 40 days to make payments. i. What is the firm's Days Sales Outstanding? ii. Determine the firm's average amount of Accounts Receivable. b) c) What are the 4 Credit Policy variables, and explain how a change in a policy variable is evaluated. Please explain why it may be good to offer discounts to customers. 3. a) What are the relevant costs incinted with 3. a) What are the relevant costs associated with inventory management? b) What is the main objective in inventory management? c) Describe One inventory management system. d) The Bookstore orders books in accordance with the EOQ model. You are provided the following information: Annual Volume of Sales = 1,000,000 units (D) Ordering Cost - $64/order (C) Holding Cost - $0.32/unit (CH) i) What is the optimal quantity to order? ii) How many orders will be made in a year? iii) What will be the total cost if 8000 books are ordered at a time? (C.)(D) + TC = (C)(Q) ------- ; 2(C.)(D) Q = (CH) 4. a) b) Kean Bookstore makes purchases on terms 2/10 net 35, and takes the discount. i. If its annual purchases amount to $7,300,000 what will be the Bookstore's average Accounts Payable? ii. If the bookstore decides not to take the discount what will be its average accounts payable. i Suppose the purchase terms are changed to 2/10 net 70, and purchases amount to $5,475,000 calculate the amount of trade credit or (Accounts Payable), if the firm does not take the discount. ii. Calculate the cost of not taking the discount if the Bookstore does not take the discount. iii If the interest rate on short-term loans is 35% should the Bookstore take the discount or not